CGC ( Corporate Affairs Commission ) - Final 2018 PDF

sector in emerging markets. Working with 2,000 businesses worldwide, IFC uses its six decades of experience to create

opportunity where it is needed most.

Share on Social Networks

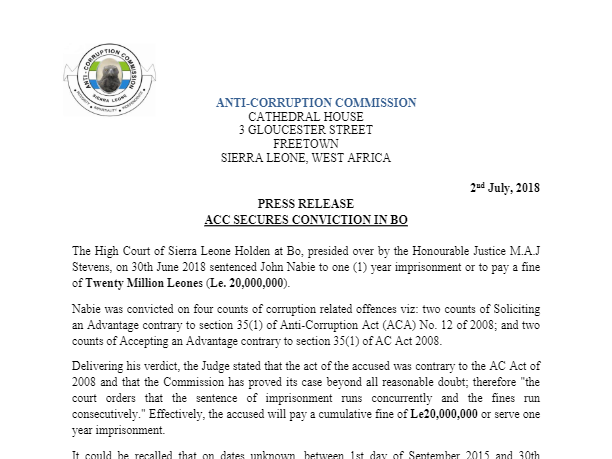

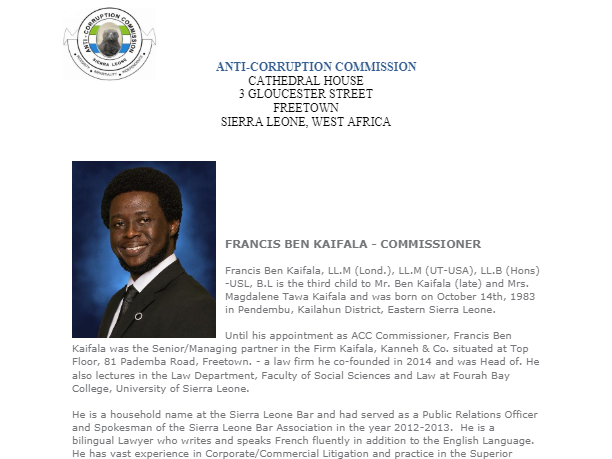

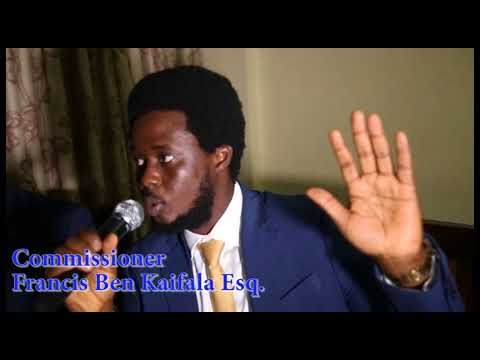

Share Link

Use permanent link to share in social mediaShare with a friend

Please login to send this document by email!

Embed in your website

1.

60. 59 | P a g e In 2013, the Extractive Industries Transparency Initiative (EITI) was agreed whereby all implementing countries should ascertain and disclose publically the beneficial owners of mining and oil and gas companies. This was made concrete in t he 2016 EITI Standard, which sets the rules and aspirations for all EITI implementing countries. According to the 2016 Standard, the EITI Multi - Stakeholder Group in each country must by January 2017 present a Roadmap, detailing the steps it will take to mo ve towards full disclosure of beneficial ownership by 2020. A decision can be made to be consistent in using capital letters for Board and Company. It depends on the context and where the word falls within a sentence.

56. 55 | P a g e IFC Family Governance Handbook: Family Governance Institutions

55. 54 | P a g e situations change. As a result, there could be some uncertainty on the part of external investors and non - family employees. Comment: Also add lack of succession planning. Another major issue is not differentiating the various “hats” that are worn if same person is director, shareholder and manager. Weaknesses in governance systems of family businesses may be most evident in internal controls, internal audit and risk management. Since many family businesses are managed by the founders or their chil dren, the control environment is largely tailored to their needs. The problem: the controls do not grow along with the company, as the business becomes more complex. This gap is a primary area of concern for external investors. Governance challenges only increase as the family and business grow more complex with each succeeding generation.

19. 18 | P a g e Establish Audit, Risk, and Compliance Committees where need be, ensuring that membership of these committees includes non - executiv e directors Boards in SOEs to report to relevant Parliamentary Oversight Committees

25. 24 | P a g e the need to adhere to a confidentiality clause relating to organizational information Organizations shall keep registers of board members.

4. 3 | P a g e Foreword Sierra Leone is reforming, redefining and repositioning itself to occupy respectable positions in important global indexes , attract business, improve on its business environment reputation and realise its full potentials as a country. One unsung hero of such social revolution is the Corporate Affairs Commission; in partnership with its supervising ministry – the Ministry of t rade and other stakeholders. Together, they have recognised the need to ensure greater accountability, ethical conduct and transparency within the corporate and business architecture in line with their statutory mandate. With this new “NATIONAL CORPORATE G OVERNANCE CODE”, the aim is to now move beyond foundational reforms for businesses and establish and enforce corporate structures that invite and assure the world to do business in Sierra Leone with the lure of a transparent, fair and modern standard busin ess environment and corporate governance regime. By so doing, they recognise that the days when business was more about profiteering without much regard to anti - corruption regimes and corporate governance structures are long gone in most countries of the w orld and Sierra Leone has now applaud ably caught up. When serious investors want to invest in an emerging economy like Sierra Leone, one area of interest in terms of due diligence would be the degree to which the legal and regulatory framework in the cou ntry promote transparency, fairness, accountability and ethical behaviour and dealings. This new code, in addition to the efforts of the ACC to curb corruption is Sierra Leone’s answer. The code sets the accountability paradigm within which boards, managem ent and organizations can operate. It also prescribes clear framework and rules that not just limit their ambitions to ethically acceptable adventurism but identify and set the standards that guide them in their quest for business success. It does not only identify what is to be done by boards, management and organizations within ethical boundaries, it also sets a guideline on what is deemed unacceptable conduct or practice. Added to these, it also provides a guide on their dealings with other actors like c ivil society, communities, government, etc. It further gives clear recognition and guide on corporate social responsibility and social accountability which has been needed for so long but remained lacking within our corporate governance legal and regulator y framework and interrelation. Most importantly, a really remarkable part of this code is the carefully set out guidelines, rules, procedures and practice that help mitigate and mediate the moral hazard problems that arise between share (equity) holders an d board of directors on the one hand, and boards and management on the other hand. Without proper code of ethics and rules on how these complex corporate segments interrelate, either may engage in practices that tend to hamper the realization of the full p otentials of companies and even lead to business failures. It is therefore a very welcome reform for these codes to serve as easily referable guides for either side of the corporate relationship so as to protect the profitability of companies, ensure accou ntability of boards and management and protect the business aspirations of companies or similar organisations. This important inclusion in this new code helps emphasise, reinvigorate or clarify weak or ambiguous provisions within the Companies Act 2009 and other laws amplify them for easier understanding, assimilation and use by all. This reform is particularly welcomed because it comes at a time when discussions are on - going for the improvement on our anti - corruption laws to include more seriously, the pri vate sector as an integral part of improving accountability, transparency and ethical behaviour within the public space. This step taken by the Corporate Affairs Commission and its partners sets the stage for the re - direction of transparency and accountabi lity efforts and certainly reduces the gap that hitherto existed while this plan is being worked - out. The Corporate Governance Code is a great addition to the new direction for doing business in Sierra Leone. Francis Ben Kaifala Commissioner, Anti - Corrupt ion Commission

5. 4 | P a g e Statement by the IFC We believe in the power of partnerships and therefore it has been a privilege to work with the Corporate Affairs Commission. A Code of Corporate Governance is in our experience one of the most powerful elements in bui lding sustainable corporations that can actively contribute to building the economy of Sierra Leone. We are pleased with the wide range of organisations (including sector regulators) that have been involved in the development of the Code, and see this as a positive sign that the implementation of the Code will be a success. The IFC, a member of the World Bank Group, is the largest global development institution focused on the private sector in emerging markets. Working with 2,000 businesses worldwide, IF C uses its six decades of experience to create opportunity where it is needed most. Technical assistance was provided by members of the IFC Africa Corporate Governance Programme during the development of the Corporate Governance Code in Sierra Leone. The Corporate Governance Programme is a four - year program with the main objective being to promote the adoption of corporate governance best practices and standards, in alignment with regional priorities. This work aims to help expand markets, attract and ret ain additional investment, and improve firm - level performance for increased economic growth. The IFC Corporate Governance Programme in Sierra Leone works with regulatory bodies, market leaders and private sector organisations to raise awareness and help improve corporate governance practices at all levels. The programme in Sierra Leone, is supported by IFC’s Conflict Affected States in Africa (CASA) Initiative. This initiative, launched in 2008, is helping design and implement integrated strategies speci ally targeted to support economic recovery in conflict - affected countries. The Initiative is supported by the governments of Ireland, the Netherlands, and Norway, and is helping strengthen smaller businesses in Sierra Leone, working with the government and private sector partners to introduce regulatory improvements to the country’s investment climate. The development of a code for corporate governance is a critical step towards these objectives. Our wish is that the development of the code is merely the start of a journey towards a prosperous and thriving corporate community in Sierra Leone. Frank Ajilore Resident Representative IFC Sierra Leone.

47. 46 | P a g e Compliance, Whistleblowing and Fraud The committee shall review the adequacy and security of the company’s arrangements for its employees and contractors to raise concerns, in confidence, about possible wrong doing in financial reporting or other matters. The committee shall ensure that these arrangements allow proportionate and independent investigation of such matters and appropriate follow up action; re view the company’s procedures for detecting fraud;

53. 52 | P a g e Ensure that contractual terms on termination, and any payments made, are fair to th e individual, and the company, that failure is not rewarded and that the duty to mitigate loss is fully recognised. Oversee any major changes in employee benefits structures throughout the company or group. Agree the policy for authorising claims for exp enses from the directors. Work and liaise as necessary with all other board committees

58. 57 | P a g e Operational Reports The Board shall ensure the preparation of quarterly and annual operational reports. Operational reports shall cover the core business of the organization. The report shall indicate the resources n eeded to help achieve maximum results and how these resources shall be acquired in view of financial constraints. Human Resource Management Report The Board shall ensure that approved training programmes for staff are implemented and other approved HR pr ograms submitted to it annually. Procurement. Compliance The work of Public Service organizations, private sector entities and the Board/Council shall be carried out in accordance with their enabling Acts.

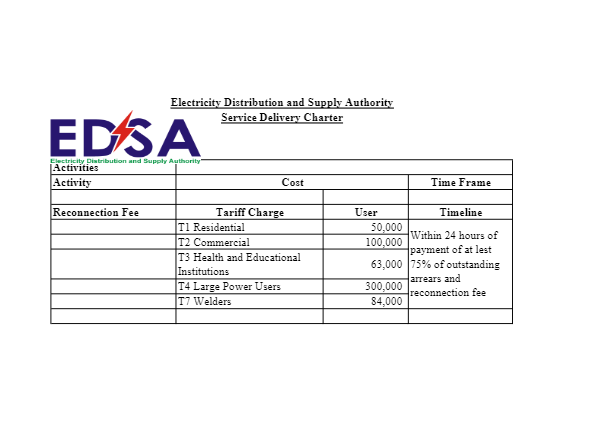

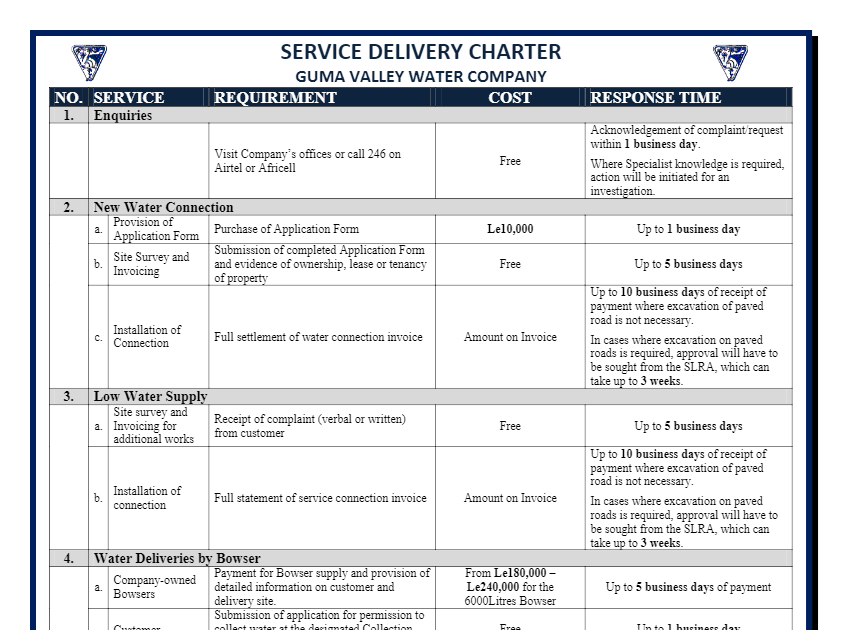

3. 2 | P a g e D.5. – Monitoring and Evaluation ............ ............................................................................................ .40 Appendix 1: Human Resource Man agement, Administration and Legal Committee ............... ... ... . . 43 Appendix 2. Audit Committee: Model Terms of Reference ......................................................... ... ... . 44 Appendix 3: Nominations Committee: Model Terms of Reference .......................................... ...... ... 47 Appendix 4: Remunerations Committee – Model terms of reference ...................................... ... ... . . 48 A ppendix 5: Family - Owned Businesses ..................... ..................................................................... ... . .51 Appendix 6: Financial and Operational Reporting Further Detailed Guidance ....................... ... ... ... 54 Appendix 7: Beneficial Owner Bac kground and Context ............................................................... ... . . 56 Appendix 8; Service Charter List of Contributors

61. 60 | P a g e SUGGESTED CONTEN T OF BOARD OR COMMITTEE CHARTER 1. Introduction 2. Purpose 3. Responsibilities of the Board/Committee 4. Duties of the Board/committee 5. Composition and Structure of the Board/Committee 6. Officers of the Board/Committee 7. Multiple Directorships 8. Other Committees 9. Board/Committee Meetings 10. Quorum 11. Notice of Meetings 12. Board/Committee Appointment 13. Remuneration 14. Performance Evaluation 15. Orientation and Training 16. Conflict of Interest 17. Code of Ethics 18. Tenure and Re - election 19. Independent Advice A u t hori ze d b y on behalf of the Board of Directors : _ ___________________________________ Chairman Board of Directors Dated the ........................day of .......................................20..........

63. 62 | P a g e Civil Societies Group & other groups 1. Campaign for Good Governance 2. Focus 1000 3. Market Women Association – Sierra Leone 4. Tink - Salone 5. Sierra Leone Institution of Engineers 6. Institute of Chartered Accountants Sierra Leone Law Firm 1. BMT Law Chambers The World Bank Group Sierra Leone - IFC

15. 14 | P a g e A.6. The Rights of Shareholders and Key Ownership Functions The corporate governance framework should protect and facilitate the exercise of shareholders’ rights. The governing body must ensure that shareholder rights as provided for in the Companies Act are honoured. Basic shareholder rights should include the right to share in the profits of the corporation when dividends are declared. a) Capital structu res and arrangements that enable certain shareholders to obtain a degree of control disproportionate to their equity ownership should be disclosed. b) Markets for corporate control should be allowed to function in an efficient and transparent manner. c) The rules and procedures governing the acquisition of corporate control in the capital markets, and extraordinary transactions such as mergers, and sales of substantial portions of corporate assets, should be clearly articulated and disclosed so that investors understand their rights and recourse. Transactions should occur in a transparent manner and under fair conditions that protect the rights of all sha reholders according to their class rights. d) Anti - take - over devices should not be used to shield management and the board from accountability e) The exercise of ownership rights by all shareholders, including institutional investors, should be facilitated. f) Institutional shareholders acting in a fiduciary capacity should disclose their overall corporate governance and voting policies with respect to their investments, including the procedures that they have in place for deciding on the use of their voting rig hts. g) Institutional investors acting in a fiduciary capacity should disclose how they manage material conflicts of interest that may affect the exercise of key ownership rights regarding their investments. h) Shareholders, including institutional sharehold ers, should be allowed to consult with each other on issues concerning their basic shareholder rights as defined in the OECD Principles, subject to exceptions to prevent abuse. i) Payment of dividends should be effected within six months of the dividends bei ng declared

32. 31 | P a g e B.10.2. Appointment of Standing Committee Members o The board shall constitute the membership of the standing committees. o The chairperson of a committee shall be appointed by the board. However, the Board/Commission may also delegate that responsibility to the members themselves. o Non - Board members may be co - opted as members. o General Standing Committe es should not to be chaired by Chairman of the board The Secretary to the Board shall serve as secretary to all standing committees, unless otherwise prescribed by an enabling Act or a decision by the board to the contrary. The Board/Commission shall dete rmine the Terms of Reference of the Standing Committee unless it is explicitly provided in an enabling Act. B.10.3. Conduct and Procedures of Committee Meetings Committees shall observe the same rules of conduct and procedure as the board. Meetings shall be called by the use of notice and agenda. Papers shall be dispatched to members at least one week before each meeting to allow for thorough preparation. Senior Management Staff may be invited to the meetings of the committee to provide technical/professio nal advice as and when necessary. They shall not be eligible to vote on issues requiring decision - making. They may also be excluded from participating in some aspects of the meeting by the committees. Committees shall submit written recommendations to the board for consideration and approval. Committees shall not make decisions, except where they have been specifically authorized by the board to do so. For purposes of carrying out their assignments, standing committees may be authorized to: (a) consider all iss ues within their terms of reference (b) obtain professional advice and opinion; and (c) consult and seek information from employees of the organisation, where necessary The quorum for standing committees meetings shall be spelt out in the TOR of that committee. B .10. 4. Evaluation of the Performance of Standing Committees Committees shall undertake self - review of their operations annually. Report on the review shall be submitted to the board, for consideration and guidance.

50. 49 | P a g e Ensure that on appointment to the board, non - executive directors receive a formal letter of appointment setting out clearly what is expected of them in terms of time commitment, committee service and involvement outside board meetings Revie w the results of the board performance evaluation process that relate to the composition of the board Review annually the time required from non - executive directors. Performance evaluation should be used to assess whether the non - executive directors are s pending enough time to fulfil their duties Work and liaise as necessary with all other board committees. The committee shall also make recommendations to the board concerning formulating plans for succession for both executive and non - executive director s and in particular for the key roles of chairman and chief executive suitable candidates for the role of senior independent director membership of the audit and remuneration committees, and any other board committees as appropriate, in consultation wit h the chairman of those committees the re - appointment of any non - executive director at the conclusion of their specified term of office having given due regard to their performance and ability to continue to contribute to the board in the light of knowled ge, skills and experience required the re - election by shareholders of directors under the annual re - election provisions of the Code or the retirement by rotation provisions in the company’s articles of association, having due regard to their performance a nd ability to continue to contribute to the board in the light of the knowledge, skills and experience required and the need for progressive refreshing of the board (particularly in relation to directors being re - elected for a term beyond six years) any m atters relating to the continuation in office of any director at any time including the suspension or termination of service of an executive director as an employee of the company subject to the provisions of the law and their service contract the appoint ment of any director to an executive or any other office

46. 45 | P a g e . 5. Duties Financial Reporting The committee shall monitor the integrity of the financial statements of the company, including its annual and half - yearly reports, interim management statements, and any other formal announcement relating to its financial performance, reviewing and reporting to the board on significant financial reporting issues and judgements which they contain having regard to matters communicated to it by the auditor. In particular, the committee shall review and challenge where necessary the consistency of, and any changes to, significant accounting policies both on a year on year basis and across the company/group; the methods used to account for significant or unusual transactions where different approaches are possible; whether the company has followed appropriate accounting standards and made appropriate estimates and judgements, taking into account the views of the external auditor; the c larity and completeness of disclosure in the company’s financial reports and the context in which statements are made; and all material information presented with the financial statements, such as the business review and the corporate governance statement s relating to the audit and to risk management. Where the committee is not satisfied with any aspect of the proposed financial reporting by the company, it shall report its views to the board. Narrative Reporting Where requested by the board, the commit tee should review the content of the annual report and accounts and advise the board on whether, taken as a whole, it is fair, balanced and understandable and provides the information necessary for shareholders to assess the company’s performance, business model and strategy. Internal Controls and Risk Management Systems The committee shall keep under review the adequacy and effectiveness of the company’s internal financial controls and internal control and risk management systems and review and approve t he statements to be included in the annual report concerning internal controls and risk management.

59. 58 | P a g e Appendix 7: Beneficial Owner Background and Cont ext The issue of beneficial ownership is of particular relevance to organizations operating in the extractive industry. In this industry, there is a high risk that “new” companies may be set up as a front to carry out extractive related projects in an une thical and sometimes illegal manner e.g. avoiding tax obligations and corruption. Having information about the people who actually own and run such companies is of importance to external stakeholders, including the government, civil society, media and loc al communities, enabling them to require accountability and transparency from these organizations in the spirit of good corporate governance. Beneficial Owners are those who ultimately own or control a company in part or in whole. There is a legal requirem ent under Sierra Leone law for organizations (companies, legal entities) to disclose who the beneficial owners are in relation to the organizations. These organizations are referred to as “reporting companies” and they are required to identify and disclose the names of their “beneficial owners”, or “ultimate beneficial owners” where the ownership structure may be more indirect or complex. This disclosure is required in the “SLEITI 2017 Beneficial Ownership Declaration Form’ The Mines and Minerals Act (2009 ) and in the Petroleum (Exploration and Production) Act (2011), refers to (Ultimate) Beneficial Owners and sets out certain rights and obligations. Using the provisions in those Acts, (Ultimate) Beneficial Owner refers to : A natural person who: i. has, d irectly or indirectly, 5% of shares in the company; ii. or has, directly or indirectly, 5% of voting rights in the company; iii. or has the ability to appoint or remove directors from the board of the company; iv. or has the right to exercise, or actually does exercise , significant influence or control over the company (where 'significant influence of control is defined for the time being as it is in sections 1.20 - 6.7 of the United Kingdom's Statutory Guidance on the same topic (which can be found here: http://bit.ly/2afBOTw) ); v. or exercises such ownership, influence or control indirectly through ownership, influence or control over one or more legal entities (or through a chain of such entities) which in turn exercise such ownership , influence or control over the company. Politically Exposed Persons (PEPs) In addition to the above, any Politically Exposed Persons (PEPs) with any stake in ownership or control of a company (including below 5%), whether held directly or indirectly, mus t also be declared as ultimate beneficial owners. A PEP is defined as a person holding (or who in the past 12 months has held) a prominent public position in any country such as a Head of State or Government, an elected or appointed politician on the nati onal or local level, a Paramount Chief, a senior government, judicial, military or party official on the national or district level, or a senior executive of a state - owned enterprise, or a natural person or other entity identified as having close family ti es (first or second degree) or other personal or business connection to such a person. State Entities In the case where a state, or a national or local government (or a department of such a government), or a multilateral organisation whose members are stat es or their governments, would, if it were a natural person, meet one of the conditions set out above, that state or government or government entity or multilateral institution should be named as an ultimate beneficial owner of the company. EITI Global St andard context

26. 25 | P a g e B.3. Tenure of office The tenure of office of a Board member shall be determined by the organi zation’s governing document. Board Members must be conversant with the legal instruments establishing their organizations. Issues such as: (a) possible renewal of tenure (b) resignation of membership (c) replacement of a member, where necessary, and circumstances in w hich this may occur shall be provided for in the legislative instrument The tenure of board members shall come to an end when the period for appointment ends as set out in the governing document of the organization, or other relevant governance provision’ or as stipulated in the appointment letter. . A member may resign for various reasons including: a. Personal b. major conflict of interest c. health d. concern over the position of the organization e. serious dissent with other board members. A member who wishes to res ign must submit a written notice of resignation, and may discuss the subject with other members before submitting the resignation letter. Death, naturally ends membership of a board. Removal by the appointing authority. The appointing authority may remove a Board/Council Member. In line with best practice, the member shall be notified of the grounds for his/her removal. B.4. Induction of Board Members Board Members shall go through an induction programme ideally before the first meeting, but as a minimum in the first six months of office. The induction programme shall consist of: (a) Delivery of an induction pack (b) Agreeing on a training programme

48. 47 | P a g e Appendix 3: Nominations Committee: Model Terms of Reference Note: square brackets contain recommendations which are in line with best practice but which may need to be changed to suit the circumstances o f the particular organisation, or excluded where not relevant to the company or if the company has a separate risk committee. 1. Membership The committee shall comprise at least [three] members. A majority of the members of the committee shall be indep endent non - executive directors Only members of the committee have the right to attend committee meetings. However, other individuals such as the chief executive, the head of human resources and external advisers may be invited to attend for all or part of any meeting, as and when appropriate and necessary. Appointments to the committee are made by the board and shall be for a period of up to three years, which may be extended for further periods of up to three - years, provided the director still meets the criteria for membership of the committee. The board shall appoint the committee chairman who should be either the chairman of the board or an independent non - executive director. In the absence of the committee chairman and/or an appointed deputy, the rema ining members present shall elect one of themselves to chair the meeting from those who would qualify under these terms of reference to be appointed to that position by the board. The chairman of the board shall not chair the committee when it is dealing with the matter of succession to the chairmanship. 2. Secretary The company secretary or his or her nominee shall act as the secretary of the committee. 3. Quorum The quorum necessary for the transaction of business shall be [two] members. 4. Frequen cy of meetings The committee shall meet at least [twice] a year and otherwise as required .

49. 48 | P a g e 5. Duties The committee shall: regularly review the structure, size and composition (including the skills, knowledge, experience and diversity) of the board and make recommendations to the board with regard to any changes give full consideration to succession planning for directors and other senior executives in the course of its work, taking into account the challenges and opportunities facing the company, and the skills and expertise needed on the board in the future keep under review the leadership needs of the organisation, both executive and non - executive, with a view to ensuring the continued ability of the organisation to compete effectively in the market place keep up to date and fully informed about strategic issues and commercial changes affecting the company and the market in which it operates be responsible for identifying and nominating for the approval of the board, candidates to fill board vacanci es as and when they arise before any appointment is made by the board, evaluate the balance of skills, knowledge, experience and diversity on the board, and, in the light of this evaluation, prepare a description of the role and capabilities required for a particular appointment. In identifying suitable candidates the committee shall: use open advertising or the services of external advisers to facilitate the search consider candidates from a wide range of backgrounds consider candidates on merit and ag ainst objective criteria and with due regard for the benefits of diversity on the board, including gender, taking care that appointees have enough time available to devote to the position13 For the appointment of a chairman, the committee should prepare a job specification, including the time commitment expected. A proposed chairman’s other significant commitments should be disclosed to the board before appointment and any changes to the chairman’s commitments should be reported to the board as they arise. Prior to the appointment of a director, the proposed appointee should be required to disclose any other business interests that may result in a conflict of interest and be required to report any future business interests that could result in a conflict o f interest16

57. 56 | P a g e Appendix 6: Financial and Operational Reporting: Further Detailed Guidance The responsibilities of Board members with regard to financial reporting, are to: (a) ensure that competent and qualified accounting staff are employed; (b) ensure that organizations prepare financial statements in accordance with approved existing accounting standards; (c) maintain adequat e systems of internal control within the organization; and (d) ensure the integrity and adequacy of the financial statements (e) ensure preparation of an annual budget Financial Statements (unaudited) The report shall be submitted periodically in accordance with the relevant financial reporting laws of Sierra Leone. Internal Audit Reports The board shall require periodic audit reports to be prepared and presented to the board. The reports shall indicate any weaknesses that were detected during the audit. It must contain Management responses on action taken or intended to be taken. Annual Budget The Board shall approve the annual budget of the organization before submission to the sector Minister or relevant body. The Board will monitor the implementation and use of the approved budget. Audited Financial Statements Within the Public Service, the Auditor - General is the statutory auditor. The Auditor General may delegate this function to an auditing firm. Board members shall receive, review and approve the audited financial statements. Board members must call for the Management Letter, which will indicate any weaknesses the statutory auditor came across in the performance of his/her duties. Management must respond to all the issues raised in the Management Letter. The Audit [and risk] Committee is responsible for: reviewing all the reports and make recommendations to the Board/Commission for approval, and liaising with Management to ensure that recommendations are implemented. The Board/Commission shall sanction management for non - implementation of that Committee’s recommendations Strategic Planning The Board/Commission shall ensure the development and the implementation of the Strategic Plan, Business Plan or Annual Work Plan of the Organization; Monitor and eva luate the performance of these plans.

51. 50 | P a g e Appendix 4: Remunerations Committee – Model Terms of Reference Note: square brackets contain recommendations which are in line with best practice but which may need to be changed to suit the circums tances of the particular organisation, or excluded where not relevant to the company or if the company has a separate risk committee. 1. Membership The committee shall comprise at least [three] members, all of whom shall be independent non - executive dire ctors The chairman of the board may also serve on the committee as an additional member if he or she was considered independent on appointment as chairperson Members of the committee shall be appointed by the board, on the recommendation of the nominatio n committee and in consultation with the chairperson of the remuneration committee Only members of the committee have the right to attend committee meetings. However, other individuals such as the chief executive, the head of human resources and external advisers may be invited to attend for all or part of any meeting, as and when appropriate and necessary. Appointments to the committee are made by the board and shall be for a period of up to three years extendable by no more than two additional three - yea r periods, so long as members (other than the chairman of the board, if he or she is a member of the committee) continue to be independent. The board shall appoint the committee chair who should be either the chairperson of the board or an independent non - executive director. In the absence of the committee chair and/or an appointed deputy, the remaining members present shall elect one of themselves to chair the meeting from those who would qualify under these terms of reference to be appointed to that posi tion by the board. The chairperson of the board shall not be the chair of the committee. 2. Secretary The company secretary or his or her nominee shall act as the secretary of the committee and will ensure that the committee receives information and pa pers in a timely manner to enable full and proper consideration to be given to the issues. 3. Quorum The quorum necessary for the transaction of business shall be [two] members. 4. Frequency of meetings The committee shall meet at least [twice] a year and otherwise as required . 5. Duties The committee shall:

34. 33 | P a g e Working Papers for Board/Commission Meetings The board shall determine the form, structure and time of receipt of all papers for discussion. To en able the board to work effectively, it must receive the appropriate information from the Chief Executive Officer in a timely manner as per board policy and in the required format. Quorum The number of members constituting a quorum may be found in the legal document (s)establishing the organization. In the absence of such provision, the board shall decide on the quorum for its meetings, which shall not be less than one half (1/2) of the membership. The governing document(s) may state whether the quorum is n eeded to start a meeting or must be maintained throughout the meeting. In the absence of any specific provision the Board/Commission must establish a position by making a suitable rule. Where a quorum is not obtained, the meeting can be automatically adjou rned for some days and members reconvene at a later time when a quorum will be attained. It is a practice when quorum is not obtained for members present to meet and arrive at decisions which are ratified at the next meeting when a quorum is formed. This s hould be an exception. Those who agree to serve on must be committed to the service of the organization and attend meetings. D. Remuneration, Performance and Related Matters The enabling Acts establishing Public Service Organizations and Private Sector En tities may provide for payment of allowances to board members. D.1. Allowances Board members shall be paid allowances determined by the board in accordance with prevailing guidelines issued by the relevant government departmen t e.g. the Minister of Financ e. The following factors must be considered in determining allowances; (a) the responsibilities of a board member; (b) the risk factors involved; (c) ability to pay; and (d) fairness to the organization Basis of categorization must be added as appendix or posted on websit e. Sitting Allowances may be paid when the board meets. Members who do not attend board meetings are not eligible to receive this allowance. There may be a retainer fee payable monthly to all board members in line with the Ministry of Finance or other rele vant guidelines on allowances.

35. 34 | P a g e Accommodation and other related logistics shall be arranged by the relevant personnel within the organization, when members travel to attend meetings outside their domicile. Unless included as part of the allowances, board members should be reimbursed for all direct and reasonable approved expenses in relation with the activities of their organizations. Review of Board Allowances The Board Allowances shall be budgeted for and reviewed periodically in accordance with Ministr y of Finance or other relevant guidelines. The board shall determine appropriate sitting allowances to be paid to board and committee members. The Board Chairperson shall receive an enhanced fee reflecting the extra work and responsibility that the chairp erson shall be called upon to perform. Payment to board members may be by cash, cheque or electronically. The amount paid shall be net of tax. D.2. Evaluation of the Board/Commission Performance Management is a means where boards measure how far they ha ve been able to discharge their responsibilities. The board shall undertake periodic review of its performance, with the aim of improving upon the performance of the individual member and the Board/Council as a whole. D2.1. Benefits of performance managem ent The benefits of Performance Evaluation or Appraisal are many and include the following: (a) serves to clarify the individual and collective roles of members; (b) helps the board to focus on its mandate so as to improve upon its effectiveness; (c) identifies weakne sses of members and assists the board to overcome weaknesses with appropriate remedial measures; and (d) motivates management because of the board’s leadership by example approach. D2.2. Principles The following principles shall be observed in the Performance Evaluation: (e) prior knowledge of criteria by members

40. 39 | P a g e (e) loss of reputation; (f) litigation; (g) loss in brand value; (h) failure/closure of organization; (i) health, safety and environmental challenges; and (j) removal of the Board/Council before the end of their tenure. D.4.3. Well Managed Risk Where risk is well managed, it results in: a) increased stakeholder confidence in achieving desired outcomes; b) the impact of threats is kept to a minimum level; c) opportunities are taken advantage of; d) increased stakeholder confidence in Board/C ouncil and Management; e) enhanced trust; and f) enhanced reputation.

20. 19 | P a g e A.12. Board and Management Where statute does not provide for meetings, quarterly Board meetings should be held wherein management has to report to the Board Information and materials including agenda to be submitted at least 7 days before the meeting All relevant issues to be discussed during Board Meetings. As far as possible these meetings should be open to relevant stakeholders and not seen as “secret” meetings Full a nd frank disclosures to the Board that were either undertaking or initiated or proposed by management that warrant the attention and/or approval of the Board The principle of confidentiality must be one of the hall marks of corporate ethics, and that breac h of confidentiality will lead to summary dismissal Directors to always disclose other interests (e.g. directorships) that are actually or potentially conflicting Boards to introduce Performance Contracts for management to be appraised half yearly and ma nagement to devise a mechanism to appraise the board In the event the organization is in financial crisis or reputational issues attributable to act or omission of the Board and/or Management, the Board must take responsibility The concept of Corporate S ocial Responsibility should be considered by all organizations and the business case for CSR considered by Boards/Councils at strategy setting stages Publication of Financial Statements

31. 30 | P a g e The chairman of the board should, on appointment, meet the independence criteria set out in this provision, but thereafter the test of independence is not appropriate in rela tion to the cha irman. The Chairman should not: o holds cross - directorships or has significant links with other directors through involvement in other organizations or bodies; o represents a significant shareholder; or o have served on the board for more th an nine years from the date of their first election. B.10. Board Committees B.10.1 Standing Committees Standing committees may be formed to facilitate the decision making process of the board. All such committees should have Terms of Reference either s et out by statute, or in their governing documents, or alternatively developed and authorized by the board. While an Act of parliament may prescribe the types of committees that should be formed, the board is at liberty to form any committee that it consi ders necessary for the efficient discharge of its mandate. The benefits inherent in the use of the committee system include the fact that they: a) are smaller in size and are often able to devote more time to the effective discharge of certain assigned tasks; b) can delve into complex often technical issues; c) can act as a liaison between the Board/Commission and Management and thus provide support and assistance to management; and d) facilitate decision - making process of the full Board/Commission. The following are s ome of the key standing committees a board may form based on the provisions made in an enabling Act or other applicable statutory provisions, or as required by the board: a) Human Resource, Administration and Legal Committee b) Finance and Audit [and Risk] Commi ttee c) Nominations Committee d) Remuneration Committee Templates of terms of reference for each of these sub - committees can be found in the appendices to this Code.

22. 21 | P a g e e) The board should fulfil certain key functions, including: 1) Reviewing and guiding corporate strategy, major plans of action, risk policy, a nnual budgets and business plans; setting performance objectives; monitoring implementation and corporate performance; and overseeing major capital expenditures, acquisitions and divestitures. 2) Monitoring the effectiveness of the organization’s governance practices and making changes as needed. 3) Selecting, compensating, monitoring and, when necessary, replacing key executive members and overseeing succession planning. 4) Considering whether, and to what extent, it is appropriate to align key executive and board remuneration with the longer term interests of the organization and any shareholders. 5) Ensuring a formal and transparent board nomination and election process. 6) Monitoring and managing potential conflicts of interest of management, board members an d any shareholders, including misuse of corporate assets and abuse in related party transactions. 7) Ensuring the integrity of the organization’s accounting and financial reporting systems, including the independent audit, and that appropriate systems of co ntrol are in place, with particular reference to systems for risk management, financial and operational control, and compliance with the law and relevant standards. 8) Overseeing the process of disclosure and communications. f) The board should be able to e xercise objective independent judgement on corporate affairs. 1) Boards should consider assigning a sufficient number of non - executive board members capable of exercising independent judgement to tasks where there is a potential for conflict of interest. Ex amples of such key responsibilities are, ensuring the integrity of financial and non - financial reporting, the review of related party transactions, nomination of board members and key executives, and board remuneration. 2) When committees of the board are e stablished, their mandate, composition and working procedures should be well defined and disclosed by the board. 3) Board Members should be able to commit themselves effectively to their responsibilities. g) In order to fulfil their responsibilities, board m embers should have access to accurate, relevant and timely information. h) Strategic Direction: The Board should provide leadership for the attainment of the organization’s vision, mission, values, structure and strategy. It should approve the strategic plan, annual budgets and other relevant documents.

16. 15 | P a g e A7. The Equitable Treatment of Shareholders The corporate governance framework should ensure the equitable treatment of all shareholders, including minority and foreign shareholders. All shareholders should have the opportunity to obtain e ffective redress for violation of their rights. 1. . Minority shareholders should be protected from abusive actions by, or in the interest of, controlling shareholders acting either directly or indirectly, and should have effective means of redress. 2. All s hareholder rights shall be recognized, respected and protected. Basic shareholder rights include: To obtain company information as required by statute on the corporation and notices for meetings on a timely and regular basis; To convey or transfer shares; To participate and vote in general shareholder meetings; To vote on the election or re - election of members of the Board, appointment of auditors and approval of accounts etc. 3. All shares shall attract the same value notwithstanding the classes of shares. Within any series of a class, all shares should carry the same rights. All investors should be able to obtain information about the rights attached to all series and classes of shares before they purchase. Any changes in voting rights should be subject to approval by those classes of shares which are negatively affected. 4. Shareholders should have the right to require and obtain full and frank disclosures from other shareholders, management and Board relating to assets and liabilities (as well as the finan cial status of the company), transactions including transaction for sale of the company, including the right to object to any transaction; and 5. Shareholders should have the right to share in the distributable profits of the company. If any of the above o r any other rights ascribed by law is infringed upon or actually threatened, the minority shareholder may have recourse to legal redress in accordance with the laws of Sierra Leone. 6. Votes should be cast by custodians or nominees in a manner agreed upon wi th the beneficial owner of the shares. 7. Impediments to cross border voting should be eliminated. 8. Processes and procedures for general shareholder meetings should allow for equitable treatment of all shareholders. Company procedures should not make it un duly difficult or expensive to cast votes. 9. Insider trading and abusive self - dealing should be prohibited. 10. Members of the board and key executive members should be required to disclose to the board whether they, directly, indirectly or on behalf of thi rd parties, have an interest in any transaction or matter directly affecting the corporation, as soon as possible when that matter first arises.

28. 27 | P a g e B.8. Disclosure of Interest Bo ard Members shall declare their interest and abstain from an issue under deliberation by the board. Failure to disclose one’s interest may lead to a member losing membership of the board All board members shall declare their assets and liabilities in accor dance with the relevant governing document. In the event that the organization suffers financial loss as a result of a board member’s failure to disclose any such interest, the relevant board member in addition to possible loss of membership, may be requir ed to compensate the organization for the loss suffered. B.9. Board Composition B9.1 The Chairperson The responsibilities of a board chairperson may include: a) determination of agenda, venue and date of board meetings in consultation with the Chief Executi ve and the Secretary b) convening board meetings c) presiding over the meetings of the board and ensuring smooth functioning of the board in line with good corporate governance d) providing overall leadership to the board without limiting the principle of collecti ve responsibility e) acting as the main link between the Board and Sector Minister, and also between the Board and the Chief Executive Officer f) leading the board in the determination of the organisation’s strategy and in monitoring the achievement of its goal s g) ensuring that board committees are properly established and composed with clearly defined terms of reference h) projecting a positive image for the organization i) Leading in evaluating and monitoring the compliance with organisational policies and governanc e processes. j) The right to a casting vote in situations where the votes of members do not result in a majority decision

52. 51 | P a g e Have responsibility for setting the remuneration policy for all executive directors and the company’s chairman, including pension rights and any compensation payments. The board itself or, where required by the Articles of Association, the shareholders should determine the remuneration of the non - executive directors within the limits set in the Articles of Association. No director or senior manager shall be involved in any decisions as to their own remuneration. Recommend and monitor the level and structure of remuneration for senior management. In determining such policy, take into account all factors which it deems necessary including relevant legal and regulatory requirements, the provisions and recommendations of the Code and associated guidance. The objective of such policy shall be to attract, retain and motivate executive management of the quality required to run the company successfully without paying more than is necessary, having regar d to views of shareholders and other stakeholders. The remuneration policy should have regard to the risk appetite of the company and alignment to the company’s long strategic term goals. A significant proportion of remuneration should be structured so as to link rewards to corporate and individual performance and designed to promote the long - term success of the company. When setting remuneration policy for directors, review and have regard to pay and employment conditions across the company or group, espe cially when determining annual salary increases. Review the on - going appropriateness and relevance of the remuneration policy. Within the terms of the agreed policy and in consultation with the chairman and/or chief executive, as appropriate, determine t he total individual remuneration package of each executive director, the company chairman and other designated senior executives including bonuses, incentive payments and share options or other share awards. Obtain reliable, up - to - date information about r emuneration in other companies of comparable scale and complexity. To help it fulfil its obligations the committee shall have full authority to appoint remuneration consultants and to commission or purchase any reports, surveys or information which it dee ms necessary at the expense of the company but within any budgetary restraints imposed by the board. Be exclusively responsible for establishing the selection criteria, selecting, appointing and setting the terms of reference for any remuneration consult ants who advise the committee. Approve the design of, and determine targets for, any performance - related pay schemes operated by the company and approve the total annual payments made under such schemes Review the design of all share incentive plans for approval by the board and shareholders. For any such plans, determine each year whether awards will be made, and if so, the overall amount of such awards, the individual awards to executive directors, company secretary and other designated senior executive s and the performance targets to be used. Determine the policy for, and scope of, pension arrangements for each executive director and other designated senior executives.

45. 44 | P a g e Appendix 2. Audit Committee: Model Terms of Reference Note: square brackets contain recommendations which are in line with best practice but which may need to be changed to suit the circumstances of the particular organisation, or excluded where not relevant to the company or if the company has a separate risk committee. 1. Membership The committee shall comprise at least [three] members. Members of the committee shall be appointed by the board, on the recommendation of the nomination committee in consultation with the chairman of the audit committee. All members of the committee shall be independent non - executive directors at least one of whom shall have recent and relevant financial experience ideally with a professional qualification from one of the professional accountancy bodies. The chairman of the board shall not be a member of the committee Only members of the committee have the right to attend committee meetings. However, the external auditor and finance director will be invited to attend meetings of the committee on a regular basis and other non - members may be invited to attend all or part of any meeting as and when appropriate and necessary. Appointments to the committee shall be for a period of up to three year s, extendable by no more than two additional three - year periods, so long as members continue to be independent. The board shall appoint the committee chairman. In the absence of the committee chairman and/or an appointed deputy, the remaining members pre sent shall elect one of themselves to chair the meeting. 2. Secretary The company secretary, or his or her nominee, shall act as the secretary of the committee and will ensure that the committee receives information and papers in a timely manner to enable full and proper consideration to be given to issues 3. Quorum The quorum necessary for the transaction of business shall be [two] members. 4. Frequency of meetings The committee shall meet at least [three] times a year at appropriate intervals in the fi nancial reporting and audit cycle and otherwise as required. Outside of the formal meeting programme, the committee chairman will maintain a dialogue with key individuals involved in the company’s governance, including the board chairman, the chief executi ve, the finance director, the external audit lead partner and the head of internal audit.

6. 5 | P a g e Abbreviation/ Definition Section CBOs: Community Base Organisations IFC: International Finance Corporation INGOs: International Non - Government Organisations NGOs: Non - Government Organisations OECD: Organization for Economic Co - operation and Development PEPs: Politically Exposed Persons SOEs: State Owned Enterprises Acceptable/Appropriate Gifts : gifts that are of a form and value that is proportionate to the circumstances offered openly with legitimate intent and no specific expectation of return. Such gifts would not be the subject of concern if published in the public domain. Often organizations put a maximum value to such gifts e.g. below $50. Board of Directors/Board: a group of individuals that are elected as, or elected to act as, representatives of the shareholders of an organization (company) to establish corporate management related pol icies and to make decisions on major company issues. Reference to “Board” in this document also covers “Council” or “Commission” which may be the terminology used by public sector establishments that are covered by this Code Charter/Board Charter: a writ ten policy document that clearly sets out the respective roles, responsibilities and authorities of the board of directors (both individually and collectively) and management in setting the direction, the management and the control of the organisation. Co nflict of interest: a situation in which a person is in a position to derive personal benefit from actions or decisions made in their official capacity. Refers to a situation in which a person or organization is involved in multiple interests, financial o r otherwise, whereby that other interest might cloud their ability to make objective decisions in relation to a specific organization(s) in which they have responsibilities such as in the role of Board director. Corporate Social Responsibility: represent s a concern with the needs and goals of society which goes beyond the mere economic. So corporates have concerns that are wider than profit or financial rewards. Examples of CSR concerns include employment of minority groups, reduction of pollution, basic health and community rights. Cross border voting : the exercise of voting rights from a country outside of the company’s main jurisdiction (Sierra Leone). This is usually made possible by electronic means Entity: refers to an organization, institution, establishment or body operating in any sector (Public, Private or Not For Profit) in Sierra Leone

9. 8 | P a g e It is recognized that some aspects of the Code exist in certain statutes and other legal regulations in the country. Where this is the case, reference is made to the relevant statute or regulation. This Code should be read together with relevant legislation. Where there are conflicts between this Code and legislation, the legislation prevails. In instances where the Code is providing guidance not enshrined in law, then the expectation is that users of the C ode will comply or explain ; where the relevant provisions are part of the laws of Sierra Leone then the expectation is that provisions will apply on a comply or else basis. A.2 The Concept of Corporate Governance The Organisation for Economic Cooperation and Development (OECD) defines Corporate Governance as the “procedures and processes according to which an organisation is directed and controlled. The corporate governance structure specifies the distribution of rights and responsibilities among the diff erent participants in the organisation – such as the board, managers, shareholders and other stakeholders – and lays down the rules and procedures for decision - making. The governing body is the focal point of governance and carries ultimate responsibility and accountability to all stakeholders including members of the public and others with an interest in, or affected by the entity’s activities. Corporate governance systems in Sierra Leone will be based on the principles of ethical and effective leadership” . This definition covers organizations across sectors, and is therefore the definition that is adopted by the Sierra Leone Corporate Governance Code. Different sectors may also apply identical definitions on a sector specific basis. The International Fin ance Corporation (IFC) in its work with private sector players defines corporate governance as “the structures and processes by which companies are directed and controlled.” Good corporate governance helps organizations [companies] operate more efficiently , improve access to capital, mitigate risk, and safeguard against mismanagement. It makes organizations [companies] more accountable and transparent to stakeholders, including investors and gives them the tools to respond to stakeholder concerns. Corporate governance also contributes to development; increased access to capital encourages new investments, boosts economic growth, and provides employment opportunities. A.3. Corporate Governance Principles The OECD sets out six core Corporate Governance princi ples. These have been used (with adaptation) as organising principles for the drafting of this Code as follows: Ethics as Basis for an Effective Corporate Governance Framework The Rights and Equitable Treatment of Shareholders The Role of Stakeholders in Corporate Governance Disclosure and Transparency The Responsibilities of the Board Board Composition, Board Committees and Meeting Proceedings

23. 22 | P a g e i) The board should ensure that statutory and other periodic reports are submitted to the appropriate authority as required by law j) The board should also formulate organizational policies and monitor their imple mentation k) Board Members should understand the risks that the organization faces and set acceptable thresholds for these risks. l) The Board should ensure that there are effective arrangements for governance, risk management and internal control for the whol e organisation. m) The Board should ensure that effective management oversight mechanisms are in place to implement the organization’s strategy, promote sustainable and cost - efficient activities of the organization and maintain the objectives, business and i ntegrity of the organization. n) The Board shall ensure the appointment of the Chief Executive Officer and other management staff in accordance with the organisation’s constitution. o) The Board shall ensure that where appropriate regular internal/external auditing of the business transactions and financial statements of the organization take place, and that audit recommendations are implemented promptly. p) The Board shall ensure the development of appropriate Human Resource Management systems, policies, proc edures and practices to promote high productivity. q) The Board shall ensure that the organization discharges all contractual obligations in line with the Public Procurement Act 2015.and exercise all the powers under their mandate subject to the limitations contained in the Constitution, Acts of Parliament and to any other lawful directives. B2. Appointment The governing document of the organization should set out the criteria for appointment of Board Directors. The Board should ensure that the laid down cr iteria are complied with in all instances. In addition, the Board as part of its policies and practices should set out relevant skills, experiences and appropriate qualifications that it considers necessary to enable the Board to maximise its effectivenes s. The laid down policies and practices should be reviewed from time to time to ensure that they reflect the current stage of development of the organisation and take into account relevant national and international standards. The Board recruitment process should be used as an opportunity to determine any skill gaps on the Board, and thus focus on identifying potential board members that can fill the identified skill gaps. B2.1. Personal Attributes The following attributes shall be taken into consideration in appointing Board Members. Strategic competence – a major function of a Board deals with strategy. The Board/Council shall constitute a “think - tank” that provides strategic direction of the organization. a) Financial literacy – it is the responsibility of Boards to review and approve financial statements prepared by management. The Members must possess analytical skills and be able to interpret financial statements and

33. 32 | P a g e Board Proceedings C.1. Meetings Meet ings shall be convened in accordance with the provisions in an enabling Act. Generally, requisitioning of a Board/Commission meeting shall be the responsibility of the board chairperson in consultation with the CEO. Various laws of organizations shall give further directives on the subject. Notice of a board meeting shall indicate proposed date, time, venue and agenda. The frequency of board meetings shall be indicated in the laws establishing the organizations or in the relevant governing documents. In the absence of such provision, the board shall meet quarterly. The board shall establish an annual meetings schedule which should be made available to all relevant parties (board members and senior staff) at the beginning of each year. Effective meeting is ch aracterized by: (a) appropriate agenda for the meeting (b) high attendance by members beyond quorum; (c) punctuality at meetings; (d) receipt of board papers at least one week before the date of the meeting by members; (e) thorough preparation by members; (f) effective control an d conduct of meeting by the chairperson; (g) open and frank discussions by members; (h) decisions made and not postponed; (i) proceedings/minutes duly recorded and signed; (j) follow - up on action taken on decisions to ensure that all decisions are implemented. The duratio n of board meetings shall be determined by the agenda to be discussed and the frequency of meetings held by the Board/Commission. Duration shall also be influenced by board culture, effective use of time, effective committee work and dispatch of documents to members in good time. Agenda of Meetings The Chairperson and the Secretary shall draw up the agenda of the meeting in consultation with the Chief Executive Officer and other board members. The agenda shall contain the list of items of business to be di scussed at any particular meeting, including: (a) confirmation of previous minutes; (b) matters arising from decisions taken at the previous meeting; (c) formal approval of matters requiring limited discussions; (d) reports from management staff: CEO, finance director, et c.; (e) reports from standing committees; (f) operational policy issues; (g) strategic issues; and (h) any other business.

12. 11 | P a g e Gifts Board Members must not solicit and/or accept gifts, tangible or intangible, directly or indirectly from perso ns with whom they come into contact in relation to official duties. Board Members must take note of any guidance provided by their organizations or regulatory bodies explaining what amounts to “acceptable gifts”. Conflict of Interest Conflict of interest may arise in several forms including: (a) using for his/her own advantage any money or property of the organization; (b) using for his/her personal advantage, confidential information or special knowledge obtained by him/her in his/her capacity as a Board Member; (c) being interested directly or indirectly in any business which competes with that of the organization; and (d) being interested directly or indirectly in any contract or other transactions entered into by the organization. Addressing Conflict of Interest Meas ures to address conflict of interest shall include the following: (e) disclosure of interest – a member who has an interest in a matter being dealt with by the Board shall as soon as is possible/ at the first opportunity disclose in writing to the Board the na ture of that interest; (f) the Board Member shall not participate in any discussion or vote concerning the matter in which he has an interest; (g) where conflict of interest issues are delegated to a committee, the member - in - conflict shall refrain from influenci ng members of the committee, either through covert or overt means; (h) conflict of interest shall be resolved by members who are not in conflict; where a conflict has been disclosed the proposed transaction must be referred to an external body (auditor, techni cal expert, financial advisor, regulator) for review before the transaction can be approved. (i) A transaction approved where a conflict of interest was disclosed has to be made know to the regulator, the public and any other interested within 72 hours of t he transaction being approved (j) members with persistent conflict of interest must resign or shall have their directorship terminated from the Board after having followed due process. Penalty

30. 29 | P a g e e) preparing meeting agenda in consultation with the chairman and other members; f) maintaining statutory registers; g) providing input for the preparation of board work plan (calendar of a ctivities); h) coordinating management reports for consideration by the board i) organizing induction programmes for board members. A good, working relationship between the secretary and the Board/Commission Chairman is critical to the effective r unning of the B oard/Commission. B.9.4. Independent Directors The board should identify in the organisation’s annual report each non - executive director it considers to be independent. The board should ensure that these directors meet the test of “independence” as laid down in the organization’s governing document. T his test would include criteria relating to current and previous personal and professional relationships or circumstances which are likely to affect the director’s judgement. The board should state its rea sons if it determines that a director is independent notwithstanding the existence of relationships or circumstances which may appear relevant to its determination, including if the director: o has been an employee of the organization or group within the l ast five years; o has, or has had within the last three years, a material business relationship with the organization either directly, or as a partner, shareholder, director or senior employee of a body that has such a relationship with the organization; o has received or receives additional remuneration from the organization apart from a director’s fee, participates in the organization’s share option or a performance related pay scheme, or is a member of that organization’s pension scheme; o has close famil y ties with any of the organization’s advisers, directors or senior employees;

39. 38 | P a g e D.3.3. Outcome of Review The review may result in the following outcomes: (a) CEO accepting the decision of the board (b) Improved governance processes (c) Improvement in Board – CEO re lationship. (d) Board members gain a better understanding of the challenging role of the CEO. (e) General improvement in the performance of the CEO because his/her efforts are recognized and rewarded/sanctioned. D.3.4. Appeal against Result of Assessment Where t he CEO disagrees with the results of the assessment, he/she may take the following actions: appeal to the Public Services Commission for redress; appeal to the President if dissatisfied with the PSC’s decision. D.3.5. Review of Criteria The evaluation cri teria shall be reviewed every two years, where necessary. D.4. Risk Management D.4.1. Risk Assessment Public Service Organizations exist for a purpose and to achieve determined objectives; private sector organizations are similarly set up for specific re asons, usually to make a profit through trading in goods or services. Achieving these objectives is surrounded by much uncertainty which poses threats to success and at the same time offers opportunities for increasing success provided the risks are proper ly managed. The board shall ensure that risks of the organization are identified and measures taken to manage them. D.4.2. Consequences of Poor Risk Management include the following: (a) unclear operational procedures/guidelines (b) poor/lack of management contro l (c) adverse publicity; (d) mounting stakeholder pressure;

17. 16 | P a g e A.8. The Role of Stakeholders in Corporate Governance a) Material stakeholders and their rights, needs, inte rests and expectations should be identified. b) The rights of stakeholders that are established by law or through mutual agreements are to be respected. c) Performance - enhancing mechanisms for employee participation should be permitted. These could include emp loyee representation on Boards, employee stock ownership or other mechanism for employee profit sharing. d) Where stakeholders participate in providing information for organizations’ decision - making purposes, these stakeholders should have access to relevant, sufficient and reliable information on a timely and regular basis. e) Stakeholders, including individual employees and their representative bodies, should be able to freely communicate their concerns about illegal or unethical practices to the board and the ir rights should not be compromised for doing this. A.9. Disclosure and Transparency The corporate governance framework should ensure that timely and accurate disclosure is made on all material matters regarding the organization, including the financial situation, performance, ownership, and governance of that entity. a) Disclosure should include, but not be limited to, material information on: 1) The financial and operating results of the organization. 2) The organization’s objectives, vision and mandate and performance against these. 3) The organization’s ownership structure and associated voting rights. 4) Remuneration policy for members of the board and key executives, and information about board members, including their qualifications, the selection process, other directorships held and whether they are regarded as independent by the board. 5) Related party transactions. 6) Foreseeable risk factors. 7) Issues regarding employees and other stakeholders. 8) How stakeholders affect and are affected by operations. 9) Governa nce structures and policies, in particular, the content of any corporate governance code or policy and the process by which it is implemented. b) Information should be prepared and disclosed in accordance with International Accounting Standards (IAS) and fi nancial and non - financial disclosure. c) An annual audit should be conducted by an independent, competent and certified auditor in order to provide an external and objective assurance to the board and shareholders that the financial statements fairly represe nt the financial position and performance of the organization in all material respects. d) External auditors should be accountable to the shareholders and owe a duty to the organization to exercise due professional care in the conduct of the audit. e) Channe ls for disseminating information should provide for equal, timely and cost efficient access to relevant information by users.

42. 41 | P a g e Risk analysi s involves: a) risk identification; and b) risk evaluation Risk control comprises all activities aimed at: a) avoiding risk; b) eliminating risk; or c) reducing the likelihood of the occurrence of a loss or limiting the severity of the loss when and where they occur. R isk financing is about financing the residual risk after applying all the relevant risk control measures. It may be considered in terms of: a) Non - insurance risk financing; and b) Insurance as a risk financing tool. D.4.6. Exposures Risk assessment should addre ss the organization’s exposure to the following: (a) Physical and operational risk; (b) Human Resource risk; (c) Financial risk; (d) Compliance and non - compliance risks; (e) Liquidity risks; (f) Business Continuity and Disaster risk; and (g) Environmental risk It must always be note d that the board is responsible for the total process of risk management policy. Management is accountable to the board for implementation of risk policies.

44. 43 | P a g e Appendix 1: Human Resource Management, Administration and Legal Committee The role of this comm ittee is to assist the board/commission to oversee activities and programmes related to human resource management, administration and legal issues. The Committee shall be responsible for the following: 1. Human Resource Management a. The committee shall ensure the organization has appropriate human resource policies for recruitment, capacity development, career and succession planning, compensation and reward systems b. monitor implementation of such policies; c. review conditions of service of management and employee s and make appropriate recommendations to the board/commission; 2. Governance a. oversee all arrangements for the induction of new board/commission members; b. coordinate board/commission evaluation and provide feedback to the board/commission; c. ensure the organiza tion adopts best practice in every aspect of the operations of the board/commission; d. report to the board/commission on developments in corporate governance e. recommend strategic direction of the organization; f. formulate policies that will improve upon board/c ommission - Management relations; g. ensure that there is a succession plan in place for all management positions; 3. Legal a. recommend to the board/commission amendments to the legislative document; b. ensure that the organization complies with all legal issues perta ining to their area of operation; c. advise on legal issues. 4. Ethics a. review and recommend to the board/commission all matters pertaining to professional standards and practice. b. ensure that there is a code of conduct in place for board/commission members, mana gement and employees and monitor its implementation. 5. Remuneration: Specific Responsibilities include: (a) monitor compliance by management with regard to their terms and conditions of contract; and (b) recommend appropriate guidelines for staff performance approv al, rewards and sanctions.