REVIEW REPORT - GUMA

Share on Social Networks

Share Link

Use permanent link to share in social mediaShare with a friend

Please login to send this document by email!

Embed in your website

3. 1 Scan this QR Code to go to the ACC Website

4. 2 1.0 EXECUTIVE SUMMARY In line with Section 8 (1) of the Anti - Corruption Act (ACA) 2008 as amended in 2019, the Monitoring and Compliance Unit (M&C Unit) of the Anti - Corruption Commission (ACC) has completed a monitoring for compliance with ACC Systems and Processes Review Recommendations (SPRR) at the GUMA Valley Water Company (GUMA) GUMA is the Government body mandated to supply portable water to residents in Fr eetown and its environs between Sussex and Allen Town. In 2 021 , the Systems and Processes of GUMA were reviewed in line with Section 7(2)(f - j ) of the ACA, 2008 as amended in 2019 which mandates the ACC to review practices and procedures in Ministries Dep artments Agencies (MDAs) , Persons, authorities, public bodies, or private sector institutions to identify Corruption vulnerabilities and make recommendations to improve on efficiency and effective service deli very. The report of the Systems and Processes Review (SPR) was presented to GUMA’s Management in March, 2022. In that S PR , Ninety ( 90 ) recommendations were proffered in Ten ( 10 ) thematic areas. To ensure alignment with the current strategic focus of the ACC, which is prevention and compliance with ACC recommendations through SPR, the Monitoring and Compliance Unit gauged the compliance level of GUMA with the aforesaid recommendations in December 2022. Data analyzed showed that GUMA achieved 92 % Compliance Score, by fully implementing 83 out of the 90 recommendations proffered to the Company . Such a compliance score according to the Compliance Management and Sanctions Enforcement Handbook is termed as Full Compliance It is however worth noting that the ACC will keep in view the remaining (7) recommendation to ensure they are fully implemented . We recommend that:

6. 4 conducted by the ACC at GVWC in 2021, in line with Section 7(2)( f - j ) of the ACA as amended in 2019; and a report presented to G VWC management in the second quarter of 2022. SPR is a corruption prevention exercise that is carried out to examine practices and procedures of public bodies to facilitate the discovery of corrupt practices or acts of corruption and to secure the revision of those practices and procedures which in th e opinion of the Commission, may lead to or be conducive to corruption or corrupt practices. Recommendations proffered from SPR are meant to correct actions or lapses whether administrative, financial, operational, functional , or structural which may pos e debilitating effects on the overall output of MDAs. The idea of C ompliance M onitoring is consistent with the saying “ what get measured gets managed ” . This simply means, tracking or examining an activity changes the activity by forcing the one in charge of it to pay attention to it. In other words, Corruption opportunities can be managed and rid of in MDAs if recommendations are implemented and appropriate sanctions in line with the Section 4.3 of ACC Compliance Management and Sanctions Enforcement Handb ook for Systems and Policy Review Recommendations (CMSEHBSPRR) are levied for non - compliance. Against this backdrop, the Commission considers monitoring to ensure compliance and to plug loopholes that are conducive to the occurrence of graft. This report contains analysis of findings on progress made by GUMA in the implementation of ACC recommendation. 3.0 OBJECTIVES The overall aim of this monitoring exercise was to gauge GUMA’s compliance with the ACC SPRR as mandated by section 8(1) of the ACA,2008 as amended in 2019. The key objectives in achieving that aim were:

7. 5 To measure the compliance level of the management of Guma in the implementation of each recommendation proffer ed. To provide expert advice to the management of GUMA during the monitoring exercise on the effective implementation of ACC SPRR. To Identify any barriers/issues, preventing and/or stalling the implementation of the recommendations for possible corrective intervention To produce and present a report on the findings (compliance Level) for these MDAs and the ACC for further action. 4.0 METHODOLOGY The monitoring exercise focused on the implantation of the Ninety (90) validated recommendations proffered by the Systems and Processes Review Report. C orrespondence in respect of an inception meeting was sent to and held with the Management of GUMA to ens ure a common understanding on the objectives, processes, and expected outcome of the monitoring exercise. Key informants were interviewed, and documents examined to triangulate with oral explanations provided that related to the implementation of the recommendations. Data on the implementation or otherwise of the 90 recommendations were collected and recorde d into the Compliance Progress Assessment Matrix (CPAM). Ratings on the implementation or otherwise of each of the recommendations were mostly participatory and based on verified evidence to ensure objectivity. An exit meeting was held with the focal perso n who agreed with the preliminary compliance score of the Company, which was not different from the final score.

5. 3 1. The Letter of commendation be sent to the Management of GUMA for their full compliance. 2. Going forward, all MDAs and other donors example t he Ministry of Finance (MoF) and the Millennium Challenge Corporation (MCC) in this case that have stake and primary responsibility in the implementation o f some recommendations proffered t o the Company , be invited to the presentation of the Systems and Processes Review reports. 3. The management of GUMA expedites the implantation of the remaining 7 recommendations. 2.0 INTRODUCTION/BACKGROUND In line with Section 8 (1) of the Anti - Corruption Act (ACA) 2008 as amended in 2019, which mandates Ministries , Departments and Agencies (MDAs) to comply with ACC instruction within three (3) months of receipts of instructions, the Monitoring and Compliance Unit (M&C Unit) of the A nti - Corruption Commission (ACC) , in December, 2022, undertook a monitoring for compliance with ACC Systems and Processes Review Recommendations (SPRR) at the Guma Valley Water Company (GVWC) to gauge the company’s compliance with ACC instru ctions. Guma Valley Water Company (GVWC) was established by the Guma Valley Water Ordinance in April 1961 as a government - owned entity, with a mandate to supply portable water to residents in Freetown and its environs between Sussex and Allen Town. The ma in source of supply is from the Guma Dam at Mil 13 which accounts for about 95% of the water to Freetown and its environs. Other smaller sources that supplement the supply from Guma Dam are Kongo Dam, Sugar Loaf weir, Chalotte weir, Cemetery Blue weir, Thu nder Hill weir and Whit - water wire (ACC , Systems and Processes Review Report on Guma Valley Water Company, 2021). The instruction s(recommendations ) were the output of a thematic Systems and Processes Review (SPR) focused on Budgetary Allocation and Utilization,

14. 12 The 5.5% holding tax deducted from suppliers are now paid to the National Revenue Authority and on time. However, the Le150,000,000 (one hundred and fifty million Leones) withholding tax for the 2019 financial year in que stion has still not been paid to the National Revenue Authority (NRA) as prescribed by law. Management indicated that “GVWC will pay all current WHTs. The outstanding WHT liability will be included in the Cross - Debt arrangement being planned with Governm ent.” PAYE tax deducted from staff salary are now paid to the National Revenue Authority and on time. However, only Le500,000,000 (5%) of the Le10,478,047,309.46 (ten billion, four hundred and seventy - eighty million and forty - seven thousand three hundred and nine Leones forty - six cents) in question has been paid. Contrary to ACC SPRR, no investigation report was made available to the monitoring team. GVWC management is hopeful to include the outstanding PAYE liability in a Cross - Debt arrangement with the Government. 8.4 Own Source Revenue 100 % of the 1 5 recommendations proffered related to Own Source Revenue were fully complied. For example, as per ACC SPRR, Management investigated and concluded that the drop in revenue was due to a lack of targets and other performance measures. Performance measures were introduced across the company including Revenue Generation in2022. Revenue has now increased from Le 32 billion in 2021 to Le 36 billion as at October 2022. Consistent monthly revenue reports are no w generated and discussed by management.

19. 17 For more details on the compliance status of of each of the 10 thematic areas please reference section 10 of the report. The Compliance Assessment Metrix. 9.0 CONCLUSION GUMA achieved 92 % compliance score. That was a Full Compliance Level. In line with Section 4.3 of the CMSEPHSPRR, the Management of the GUMA should be written a Letter Of commendation and b used by the ACC as an example for other MDAs to follo. . That was a clear indication that, the Management of GUMA took the instructions of the Commission seriously and that it was poised towards improving transparency and accountability as well as improving in its service delivery. 10.0 RECOMMENDATIONS We recommend: 1. A Letter of commendation be sent to the Management of GUMA for their full compliance. 2. Going forward, all MDAs and other donors example the Ministry of Finance (MoF) and the Millennium Challenge Corporation (MCC) in this case tha t have stake and primary responsibility in the implementation of some recommendations proffered to the Company, be invited to the presentation of the Systems and Processes Review reports. 3. The management of GUMA expedites the implantation of the remaining 7 recommendations.

17. 15 There is now a loan policy in the company that guides loan disbursement to staff. All outstanding loans have now been settled. There is now a loan policy in the company that guides loan disbursement to staff. All outstanding loans have now been settle d. There is now a loan policy in the company that guides loan disbursement to staff. All outstanding loans have now been settled. There is now a Staff Welfare Association at the company. The Staff Welfare Association has a separate account where staff mak e their monthly contributions. The company now has a costed manpower recruitment plan team was able examined and verify cost manpower recruitment plan. Monies spent on recruitment processes are now properly accounted for with the necessary supporting docum ents. Only 1 (7 % ) of the 1 4 recommendations related to Human Resource Management that was moderately complied with. Though the Finance and Administration Director has not refunded the responsibility allowance(s) collected for the vacant position of Administrative Manager for the entire period in question , but management in an internal memorandum addressed to the Finance and Administration Director, have notifiedhim of the Refunds and that the deduction for the refund will be effectedfrom his end of March 2023 salary . 8.6 Procurement 5 (83%) of the 6 recommendations proffered related to Procurement were fully complied. For example, as per ACC SPRR,

11. 9 Below are examples of compliance in the various thematic area . 8.1 Strategic Plan: 8 (100 %) of the recommendations proffered related to Strategic Plan were fully complied . For example, a s per ACC SPRR, The 2019 - 2023 (5 years) strategic plan of the company was verified participatorily developed with clear goals and targets was verified. The 2019 - 2023 strategic plan of the company was verified as appropriately popularized. The strategic Plan with specific Targets and reporting templates were shared to all departments , units, and individuals. The budget process was now participatory. There was a budget committee that was made up of the various departmental heads. Activities were aligned with the strategic plan. Budgets are now prepared and approved in time. The 2022 and 2023 budgets were verified as prepared in time (Before the start of the respective years) A Budget Officer has now been recruited. The Budget Officer now full participates and advice Management on budget and budgetary matters in line with the Public Financial Management Act,2016 and Financial and Accounting Management best Pr actices. A budget committee made up of the various departmental heads has been constituted. That budget committee now champions the budgetary process at GUMA. The budget Committee now effectively champions the budgetary process at GUMA. Various meeting min utes of the committee were verified. 8 . 2 Budget Execution: Only 1 (33.3%) of the 3 recommendations preferred to Budget Execution were fully complied.

1. - 0 - MONITORING FOR COMPLIANCE WITH SYSTEMS AND PROCESSESS REVIEW RCOMMENDATIONS AT GUMA VALLEY WATER COMPANY PREPARED BY: CORRUPTION PREVENTION DEPARTMENT MONITORING AND COMPLIANCE UNIT - ACC DECEMBER,2022

9. 7 7.0 SUMMARY OF COMPLIANCE Data analyzed showed that GUMA within three (3) months of receipt of ACC’s Systems and Processes Review recommendations achieved 92 % Compliance Score, by fully implementing 83 out of the 90 recommendations proffered to the Company. Of the 7 (90 - 83) outstanding recommendations, 2 had been significantly (80% - 89%) complied with. While 5 had been moderately (50% - 75%) Complied with. . Such a compliance score according to the Compliance Management and Sanctions Enforcement Handbook FOR Systems and Policies Review Recommendations (CMSEHSPRR), is termed as Full Compliance , which means GUMA should be commended, celebrated, and used as an example by the ACC for other MDAs to emulate. The Management of GUMA has indicated committing in ensuring full compliance with the outstanding 7 representing 8% of the total recommendation s. Figure 2 :GUMA Compliance Score

15. 13 Performance measures are now reviewed by management monthly. Target are now set for revenue collections. Revenue generation is now closely monitored by the Monitoring and Evaluation Unit as well as the Internal Audit Unit. A Customers services protocol and charter guidelines has been developed and now implemented. The billing system has been reviewed by management. Now bills are consistently sent to customers through mobile phone and hard copy monthly. GUMA has a n effective Commercial Policy that provides guidance to both GUMA and its numerous customers on how to engage each other. That Policy has been developed and being fully implemented since 2018 and still aligned with the operations of the Company. Monthly r evenue and bank reconciliations were now prepared. As at December, 2022, reconciliations had been prepared up to october, 2022. GUMA now has a list of all Water Packing Companies. Also, a team of engineers and M&E offices now conduct frequent spot checks t o identify unregistered water packing companies. Revenue Generation Frameworks have been developed and implemented by GUMA. There is now a regulatory framework contract between the company and water packaging companies. There is also Customer policy that guide the relationship between GUMA and its customers. There is now a Monitoring and evaluation unit that now effectively monitors and reports on all the revenue streams and revenue generated by GUMA. Monitoring and Supervision reports on all revenue gene ration were verified. GUMA now has monitors that regularly track machines used by water packing companies. Also, any defaulters are immediately disconnected and are only connected after going through the right procedure of registration. GUMA now has monito rs that regularly track machines used by water packing companies. Also, any defaulters are immediately disconnected and are only connected after going through the right procedure of registration. Bills are now sent regularly (At the end of every month) and on time.

16. 14 The Monitoring Team had confirmed that Family High needs have two factories in Jenner Wright Road (23 and 49 Jenner Wright Road) with two different accounts with the same Owner. After a survey was conducted GUMA, all the water packaging companies in question were immediately debited with the respective amounts assessed as underdeclared and letters “ New/ Updated” statements of accounts in respect of same sent to them. These water packag ing companies are now making payments on account. 8.5 Human Resource Management 13 (93%) of the 14 recommendations proffered related to Human Resource Management were fully complied with . For example, as per ACC SPRR, Now staff proceeding on leave, transferred, or promoted prepare detailed handing over notes to their successors. This amount has been refunded. It was deducted in two instalments from the staff salary. The Financial Accountant was verbally warned by the M anaging Director to desist from such an act . However, the amount has been fully refunded by the staff in question. Regular reconciliations are now conducted between Finance and Human Resource. The payroll is now prepared by HR and payment made by the Fina nce Department. The Finance and Accounting procedure manual has been revised and aligned with the Public Financial Management Act,2016 and best accounting practices. Internal Audits are now conducted on payroll. The inconsistencies have now been regulariz ed.

12. 10 As per ACC SPRR, GUMA currently has a medical scheme for staff. A medical policy has also been drafted and is awaiting approval. However, all medical bills are now signed by medical doctors. The remaining 2 recommendations related to Budget Execution have been significate (80% - 89%) complied with as thus: A medical policy has been drafted but not yet approved to be used as a working document. A medical policy has been drafted but not yet approved to be used as a working document, therefore the monitoring team could not monitor it full implementation. 8.3 Financial Management 1 7 ( 8 9%) of the 19 recommendations proffered related to Financial Management were fully complied with . For example, as per ACC SPRR, Departmental Activities are now aligned with the company’s strategic plan and budget. There is now a revised 2020 finance and accounting policy and Procedure Manu that now guides the financial operations of GUMA. GUMA is now up to date with its External Audit reports. The 2019 and 2020 audits been co nducted, and the unqualified audit opinion verified report was verified by the monitoring team. The 2021 External Audit has also been conducted and the external Audit Management Letter was verified by the Monitoring and Compliance team. All company assets are coded. The Internal Auditor audits or verifies all assets owned by the Company.

13. 11 All staff are now paid through their vari ous salary bank accounts. All payment to suppliers is now done by cheques or direct transfer to suppliers or contractors accounts d epending on the amounts in questions. All workers have now submitted their bank accounts details and salaries are now paid through their bank accounts. All Petty cash payments are now made after the approval of the petty cash requests by the Managing Director. A Petty Cash Policy is now part of the GUMA’s 2020 Finance and Accounting Policy and procedure Manual and now effectively applied. Petty cash disb ursements are now made to departmental heads on monthly basis. Reimbursements are now made after reconciliation with the relevant supporting documents. A member of Association of Certified and Chartered Accountants (ACCA) has been promoted to Finance Dir ector. The Financial Director is now signatory to all the accounts of the company. 100% of the O L E26,000,000 - salary advance has been repaid by the Finance Director. Thye amount was deducted in two instalments from his salary. All transactions are now s upported with adequate and appropriate documentation. The newly recruited Budget Officer has been assigned to and currently updating and managing the company’s asset register. 2(10) of the 19 - recommendation related to Financial Management have only been moderately complied with as thus:

18. 16 Now all amendments made to the procurement plan are supported by the relevant procumbent committee minutes and supplementary. All files have now been properly packed and shelved. Letters of regret are now sent to unsuccessful bidders. Requisitions are now approved before any procurement is undertaken. Additionally, availability of funds is now confirmed before any procurement is undertaken. Now all proceeds from the sale of bid documents are now paid directly to the Company’s bank account and the receipt is presented to the Finance Department from which receipt are issued. This cannot not be implemented because it is out of the control of GUMA Management. In that, the Public Procurement Act states that the head of the procuring entity should be the head of t he procurement committee. The relevant sections isin support of the argument that the MD (who’s the Vote Controller) should act as the Procurement Committee Chairman. 8.9 Garge And Fuel Management 6 ( 100 %) of the recommendations proffered related to Garage and Fuel Management were fully complied with . For example, as per ACC SPRR, There is now a fleet maintenance policy to be implemented effective January, 2023. All accountability tools related to fuel and fleet management are now maintained. The company has a fuel and fleet policy on the allocation of fuel. All fuel request forms are now attached to the fuel chit. Monthly fuel reconciliation is now done with the fuel dealer. The fuel calibration chart has been developed, adopted, and applied.

39. - 37 - and effective management of public funds. 90 Management should ensure that External Auditing is done annually to mitigate the risk. External Auditing done annually to mitigate the risk. H We observed that the 2018 and 2019 external audits were outstanding. At the time of the review, external Auditing was on going for 2018 and 2019 Financial Years. External Auditing to be done annually to mitigate the risk. External audit reports 100% GUMA is now up to date with its External Audit reports. The 2019 and 2020 audits been conducted, and the unqualified audit opinion verified report was verified by the monitoring team. The 2021 External Audit has also been conducted and the external Audit Manage ment Letter was verified by the Monitoring and Compliance team.

2. - 1 - TABLE OF CONTENTS 1.0 EXECUTIVE SUMMARY ...................................................... ....................................... .. . 2 2.0 INTRODUCTION/BACKGROUND ................................................................................. 3 3.0 OBJECTIVES ................................................................................................................ 4 4.0 METHODOLOGY .......................................................................................................... 5 5.0 COMPLIANCE BAROMETER ......................................................................................... 6 6.0 THE COMPLIANCE RATE (SCORE) .............................................................................. 6 7.0 SUMMARY OF COMPLIANCE ....................................................................................... 7 8.0 DETAILED FINDINGS AND ANALYSIS ........................................................................ 8 8.1 Strategic Plan: ...................................................... .................................................. 9 8.2 Budget Execution: ................................................................................................... 9 8.3 Financial Management: .......................................................................................... 10 8.4 Own Source Revenue ............................................................................................. 12 8.5 Human Resource Management: ............................................................................ 14 8.6 Procurement: ............................................................... .......................................... 15 8.9 Garge And Fuel Management: ............................................................................... 16 9.0 CONCLUSION ............................................................................................................. 17 10.0 RECOMMENDATIONS ................................ ..................... 17 11.0 APPENDIX DATA CAPTURE AND REPORT MATRIX FOR NATIONAL GUMA VALLEY WATER COMPANY ..................................................................................................... - 18 - 3. DON OR FUND / MCC PROJECT MANAGEMENT .................................................22 4. BUDGET EXECUTION ............................................................................................. - 23 - Table of Figures Figure 1:GUMA Compliance S core .................................................................................... 7

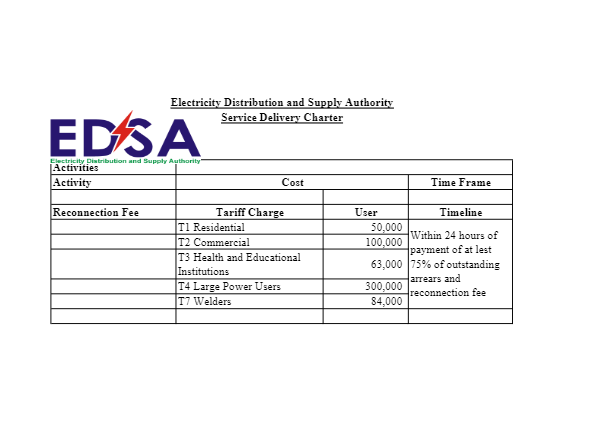

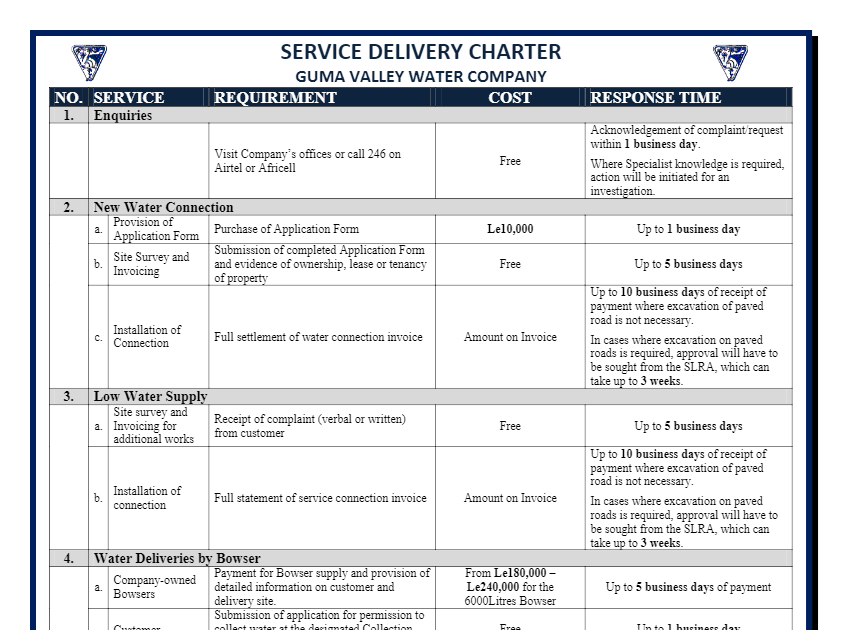

8. 6 0% - 49% No Compliance (Indictment) 90% - 100% Full Compliance Celebrated/Commended 50% - 79% Moderate Compliance ( Warning Letter ) 80% - 89% Significant Compliance (Further Engagement) Figure 1 :The Compliance Barometer The Draft report was emailed to the focal person for the input of GUMA’s Management before the report was finalized. This process served as v alidation of the report prior to finalization, printing, and presentation. 5.0 COMPLIANCE BAROMETER In line with Section 3.4 of the CMSEPH for Systems and Processes Review recommendations, the following compliance Barometer was used to gauge the compliance level of GUMA in a scale of 0% to 100%. Please note the color code and the associated score brackets. 6.0 THE COMPLIANCE RATE (SCORE) The Compliance Score (CS) of the Company is calculated as: Compliance Score = Number of Recommendations Fully Implanted Total Number of Recommendations Proffered 100

35. - 33 - should ensure that the vote controller delegates such responsibility to avoid biasness, independence of the procurement officer/manager and a fair playing ground for suppliers. Vault controller in the procurement committee delegated. an existence of a Procurement Committee and minutes of meetings were presented to the team. As prescribed by the Act the Vote Controller is the chairman of the procurement committee. Vault controller in the procurement committee to be delegated. procurement committee 100% the control of GUMA Management in that, the Public Procurement Act states that the head of the procuring entity should be the head of the procurement committee. The relevant sections in support of the argument that the MD (who’s the Vote Controller) should act as the Procurement Committee Chairman have been highlighted in the Procurement Act and Regulations attached above. All decisions taken by the Procurement Committee should be unanimous, as a result, there is no forcing of members as s tated. Procurement Act 2016, Section 2, Interpretation of context To summarize: Page 4 of the Act above interprets the meaning of the head of Procuring Entity to mean: “head of procuring entity” means the chief executive officer of the entity such as th e Minister of a Ministry or the overall head of a procuring entity; Taken within this context, the overall head of GVWC is the Chairman of the Board of Directors, who is not directly involved in procurement activities, and not the Managing Director. Page 6 of the Act above defines the Vote Controller as follows: “vote controller” means Permanent Secretary of a Government Ministry, Chief Administrator of a local council, Managing Director or a General Manager, Executive Director or other head of a State - owned enterprise, or head of a Government department, agency or commission; This means that the Managing Director of GVWC is the Vote Controller of the procuring entity. Area of Concern 8. STORES MANAGMENT Recommendations Indicator Importance Baseline situation/ Challenges ACC’S Target Means of verification (MOVs) Current Progress Measure Comments

31. - 29 - leave allowance; whilst this was not deducted from his full annual leave allowance when he proceeded on leave. and Administration. However, when the Director of Finance and Administration was proceeding on leave, he was paid in full his annual leave allowance rather than the outstanding leave pay. 57 The Financial Accountant should be queried for failing to comply with principles of basic booking. Queried Financial Accountant for not comply with principles of basic booking. The team observed that on the 30th of April 2020, part of the leave allowance was paid (cheque number 02428629) to the Director of Finance and Administration. However, when the Director of Finance and Administration was proceeding on leave, he was paid in full his annual le ave allowance rather than the outstanding leave pay. Comply with Financial Accountant on principles of basic booking. Query letter 100% The Financial Accountant was verbally warned by the Managing Director to desist from such act. However, the amount has been fully refunded by the staff in question. 58 The Finance Department and the Human Resource department should conduct regular reconciliation to identify and address inconsistencies. Conduct Regular reconciliation There is inconsistency in reporting amount spent on salaries. That is, favorable variance between the budgeted figures for salaries as compared to the Actual figures in 2019. The Review Team’s analysis of the payroll shows actual amount spent on salaries was Le. 9,560,955,000 which is Le.3, 583,440,000 more than that budgeted and Le. 6,563,076,000 more than that reported in the unaudited financial statement for 2019. Regular reconciliation conducted. Verify Reconciliation report. 100% Regular reconciliations are now conducted between Finan ce and Human Resource. The payroll is now prepared by HR and payment made by Finance Department. 59 The Company should review its accounting procedures and records management to ensure that they give a true and accurate view of the Review accounting procedures and records management ensured. There is inconsistency in reporting amount spent on salaries. That is, favorable variance between the budgeted figures for salaries Review account ing procedures and records management ensured. Verify Review reports 100% The Finance and Accounting procedure manual has been revised and aligned with the Public Financial Management Act,2016 and best accounting practices.

32. - 30 - Company’s financial position. as compared to the Actual figures in 2019. The Review Team’s analysis of the payroll shows actual amount spent on salaries was Le. 9,560,955,000 which is Le.3, 583,440,000 more than that budgeted and Le. 6,563,076,000 more than that reported in the unaudited financial statement for 2019. 60 Management should ensure that Internal Audit conducts an audit on the payroll. Internal audit conducted on payroll. The team observed that there is variance between the number of staff on the staff list and payroll and vice versa. Conducted Internal audit payroll. Internal audit report 100% Internal Auditsare now conducted on payroll. 61 The variances or inconsistencies should be regularized to save cost. regularized inconsistencies on variances The team observed that there is variance between the number of staff on the staff list and payroll and vice versa. regularized inconsistencies on variances Staff list Payroll 100% The inconsistencies have now been regularized. 62 Management should ensure a loan portfolio be set aside with a special account for the purpose of the loan. setting aside loan portfolio with special account. The team observed that there is variance between the number of staff on the staff list and payroll and vice versa. The team observed that staff loan was not budgeted for in the budget and most of these loans are outstanding and far exceeded the loan period. setting aside loan portfolio with special account. Special account loan port folio 100% There is now a loan policy in the company that guides loan disbursement to staff. All outstanding loans have now been settled. 63 Interest on loan repayment should be paid into the main Accounts. Interest on loan repayment paid into the main Accounts. The team observed that staff loan was not budgeted for in the budget and most of these loans are outstanding and far exceeded the loan period. The repayment of loan to be strictly enforced. Loan overdue reports 100% There is now a loan policy in the company that guides loan disbursement to staff. All outstanding loans have now been settled. 64 The repayment of loan should be strictly enforced. The repayment of loan strictly The team observed that staff loan was not budgeted for in A staff welfare association to be Formation documents There is now a loan policy in the company th at guides loan disbursement to staff. All outstanding loans have

27. - 25 - revised and updated and procedures. Manual (final draft July 2007) of Guma Valley Water Company, was outdated and yet still a draft. and procedures. procedures. 100% financial operations of GUMA. 38 The financial statements should be audited to ascertain that the actual figures/amounts are stated. Financial statements audited to ascertain actual figures /amounts stated. The actual figures/amounts stated on the Financial Statements were unaudited figures. Audited Financial statements Verify Audited Financial Statement and Report 100% GUMA is now up to date with its External Audi t reports. The 2019 and 2020 audits been conducted and the unqualified audit opinion verified report was verifiedby the monitoring team. The 2021 External Audit has also been conducted and the external Audit Management Letter was verified by the Monitoring and Compliance team. 39 Finance Department should develop comprehensive assets register. Developed comprehensive assets register The team was not provided with a Fixed Asset Register Developed comprehensive assets register. Verify Developed Asset Register 100% The newly recruited BudgetOfficer, has been assigned to and currently updating and managing complete the asset register. 40 Management should ensure that all company’s assets are coded to avoid misuse and to distinguish them from private use. All Company’s assets coded Most of the company’s assets procured except for those donated by MCCU were not coded. 100% Company Asset Coded. Verify Asset Register, Physical verification of Asset. 100% All company assets are coded. 41 The Internal Auditor should be responsible for the verification of the assets register. Asset register verified by the Internal Audit. The Internal Audit are not verifying the asset register. 100% Verification of Asset Register Verify Asset Register. 100% The Internal Auditor audits or verifies all assets owned by the Company. 42 The accountant should ensure that 5.5% withholding tax deductions from supplier’s payment are payable as prescribed by the law. % of 5.5% withholding tax deductions payment. A total of Le 150,000,000 (one hundred and fifty million Leones) for the 2019 financial year had been deducted from suppliers but never paid to the National Revenue Authority (NRA) as prescribed by law. 100% 5.5% withholding tax deductions payment Verify payment of withholding tax 50% 5.5% holding tax deducted from suppliers are now paid to the National Revenue Authority and on time. However, the Le 150,000,000 (one hundred and fifty million Leones) withholding tax for the 2019 financial year in questio n has still not been paid to the National Revenue Authority (NRA) as prescribed by law. Management indicated that “GVWC will pay all current WHTs. The outstanding WHT liability will be included in the Cross - Debt arrangement being planned with Government.”

24. - 22 - packing companies are registered and updated on the list registered GUMA with GUMA are immediately disconnected and are only connected after going through the right procedure of registratio n. 23 Bills to clients are sent on time and regularly Sent bills to client regularly. Bills to client are not sent on time and regularly Timely distribution of bills to clients Verify waybook and client database. 100% Bills are now sent regularly (At the end of every month) and on time. Area of Concern 3. DONOR FUND / MCC PROJECT MANAGEMENT Recommendations Indicator Importance Baseline situation/ Challenges ACC’S Target Means of verification (MOVs) Current Progress Measure Comments 24 The Company should establish an effective project management and monitoring mechanism for all its projects Established effective project management and monitoring mechanism L There were weak project management and monitoring mechanism in place Effective project management and monitoring mechanism Verify project reports 100% An effective Project Management mechanism has been established. There is now a Monitoring and Evaluation Unit that monitors the implementation of all projects. There is a monthly and weekly update of project to both the mayor and the minister of water resources. 25 Donor should provide funds on time % of funds disbursed There were delayed in the approval of funds for some of the projects All funds provided on time Verify Bank statement, project monitoring report. 100% The Freetown WASH and Aquatic Environment Revamping Project, the current major project, for example, has good project management & monitoring procedures put in place to ensure properexecution of the project. And project activities and deliverables are being monitored by the African Development Bank. The procedures are attached above. Funds are now provide as planned. 26 Implementation of projects should be within projects time frame Timely implementation of project Delayed in Project implementation All project implemented on time Verify project implementation matrix 100% The Freetown WASH and Aquatic Environment Revamping Project, the current major project, for example, has good project management &monitor ing procedures put in place to ensure proper execution of the project. And project activities and deliverables are being monitored by the African Development Bank. The procedures are attached above. Funds are now provide as planned. 27 All projects should have proper accounting Proper accounting documents in all There were challenges in accounting for the projects. Proper accounting mechanism for all Verify project accounting 100% All projects are now properly accounted for separately.

30. - 28 - complete supporting documents, including receipts, to finalize transactions. transactions are completely supported. verified and examined were without receipts and other relevant documents to ascertain the completeness of the transactions with the suppliers. supporting documents documents. 100% Area of Focus: 6.HUMAN RESOURCE MANAGEMENT Recommendations Indicator Importance Baseline situation/ Challenges ACC’S Target Means of verification (MOVs) Current Progress Measure Comments 54 Management should ensure that a detailed handover is made so that successors will settle into the position more quickly and easily and feel more comfortable and confident with the processes of the new job. Detailed handover to be made available for succession. The team observed that most senior staff does not leave handing over note to their successors whil e proceeding on leave. Likewise, the subordinates also failed to provide a detailed handing over note to their superiors upon resumption of duty. Detailed handover to be made available for succession. - Verify handover notes. 100% Now staff proceeding on leave, transferred or promoted prepare detailed handing over notes to their successors. 55 Management should ensure that the Finance and Administration Director refunds such allowance(s) collected for the vacant position of Administrative Manager for the entire period. % Of Allowance(s) collected by the Finance and Administration Director for the vacant position of Administrative Manager refunded for the period The review team observed that the position of the Administrative Manager had been vacant for several years. However, the Director of Finance and Administration had been receiving responsibility allowance for this position even though the job is below his status and there was no due process for him to receive that allowance as he was the supervisor or line Manager of the vacant position. All Allowance(s) collected by the Finance and Administration Director for the vacant position of Administrative Manager for the entire period to be refunded. Payment receipt. bank statements Payment voucher. 50% In an internal memorandum by management, the Finance and Administration Director has been notified of the. Refunds. The deduction for the refund will be effected e nd of March 2023. 56 Management should ensure that the Director of Finance and Administration refunds the advance payment that was made to him for his % of advance payment refunds made. The team observed that on the 30th of April 2020, part of the leave allowance was paid (cheque number 02428629) to the Director of Finance 100% payment of refunds Verify payment receipt. Bank Statement Payment voucher. 100% This amount has been refunded. It was deducted in two instalments from the staff salary.

34. - 32 - 69 The Procurement Unit should ensure that all files are shelved accordingly. Procurement files shelved accordingly. The team observed in relation to the above section that proper filing system of procurement documents was not maintained. Procurement files were placed on the floor instead of them being shelved in the office of the Procurement Office. Procurement files t o be shelved accordingly. Verify Procurement files 100% All files have now been properly packed and shelved. 70 For proper accountability and transparency, the Procurement Unit should always communicate in writing to all bidders whether successful or not. # of bidders Procurement Unit communicated in writing whether successful or not. The review team did not find any evidence that the Procurement Unit communicated, debriefed and /or informed the unsuccessful bidder(s) in writing for procurement completed. All bidders should be written. List of Bidders Correspondences 100% Letters of regret are now sent to unsuccessful bidders 71 Management should ensure that before a procurement process is undertaken, the requisition book should be filled, signed, approved, by all parties more specially to ascertain the availability of funds by the Finance Department and forwarded to the Procurement Unit for action. Requisition book filled, signed, approved, by all parties before undertaking procurement process. the Review Team observed that the finance unit does not sign the requisitions as required to ascertain the availability of funds and give approval, yet the procurement was undertaken. Requisition book to be filled, signed, approved, by all parties before undertaking procurement process. requisition book 100% Requisitions are now appro ved before any procurement is undertaken. Additionally, availability of funds is now confirmed before any procurement is undertaken. 72 Management should ensure that the company’s bank account numbers are spelt out in all bid documents to which bidders should pay and present bank slips to Finance Department. Bidders should then present the receipt issued by Finance Department to the procurement Unit and in turn collect the bid document. Company’s bank account numbers spelt out in all bid documents to wh ich bidders should pay and present bank slips to Finance Department. H The review team observed that bid documents were sold by the Procurement Unit for all procurement advertised as prescribed in the above section, but no records of accountability were given to the team with respect to proceeds on sale of bid documents. Com pany’s bank account numbers to be spelt out in all bid documents to which bidders should pay and present bank slips to Finance Department. Bidder payment slips Bank statement 100% Now all proceeds from the sale of bid documents are now paid directly to th e Company’s bank account and receipt presented to the Finance Department from which receipt are issued. 73 The management of GVWC The function of the H We discovered that there is The function of the Composition of the This cannot not be implemented bec ause it is out of

33. - 31 - enforced. the budget and most of these loans are outstanding and far exceeded the loan period. formed. 100% now been settled. 65 Alternatively, A Staff Welfare Association should be formed where an agreed amount should be deducted from staff salaries and paid into the staff welfare account. Loans can be paid to staff members from this account and process and procedures can be develo ped for this payment. A staff welfare association formed. A staff welfare association to be formed. Formation documents 100% There is now a Staff Welfare Association at the company. The Staff Welfare Association has a separate account where staff make their monthly contributions. 66 Management through the Human Resources Unit should certify that a costed manpower recruitment plan be included in the budget separate from salary amount. Separate salary amount to costed manpower recruitment plan included in the budget. The team observed that this amount was reported as part of salaries and wages for proposed staff to be recruited but in an interview with officers of the HR unit it was st ated that the above amount was cost associated with the recruitment process. Separate salary and manpower recruited Verify Costed manpower recruitment plan. 100% The company now has a costed manpower recruitment plan team was able examined and verify c ost manpower recruitment plan. 67 Monies spent on recruitment processes should be accounted for with the necessary supporting documents. % of money spent on recruitment process. The company Recruited a total of 21 staff in 2019 but no evidence of cost associated to the recruitment process provided to the team. 100% of monies spent on recruitment process accounted Verify payment slip Bank Statement Payment voucher 100% Monies spent on recruitment processes are now properly accounted for with the necessary supporting documents. Area of Focus: 7. PROCUREMENT Recommendations Indicator Importance Baseline situation/ Challenges ACC’S Target Means of verification (MOVs) Current Progress Measure Comments 68 Management should ensure any adaptation to the procurement plan has to be followed by a supplementary budget stating the adjustment to the existing procurement. Adaptation to the procurement plan followed by flex budget. No approved readjusted or supplementary budget was shown to the team with regards the alteration in the procurement plan with respect to the cost, specification, and mode of delivery Adaptation to the procurement plan to be followed by supplement ary budget stating the adjustment to the existing procurement. Adaptations Supplementary budget 100% Now all amendments made to the procurement plan are supported by the relevant procumbent committee minutes and supplementary.

20. - 18 - 11.0 APPENDIX DATA CAPTURE AND REPORT MATRIX FOR NATIONAL GUMA VALLEY WATER COMPANY YEAR OF REVIEW - 2021 COMPLIANCE PROGRESSASSESSMENT MATRIX Description of Progress No Compliance Moderate Compliance Significant Compliance Full Compliance Score Range (0% - 49%) (50% - 79%) (80% - 89%) (90 - 100% ) Color Code Area of Focus 1. STRATEGIC PLAN Institute transparency and accountability principles in the management of public funds Recommendations Indicator Impor tance Baseline situation/ Challenges ACC’S Target Means of verification (MOVs) Current Progress Measure comments 1 It is recommended that the institution should develop a strategic plan that is participatory and clearly states the targets and goals for the institution. Developed strategic plan in line with budget No Strategic Plan was presented to the Review Team which would have been the key guide for the budget preparation. Approved strategic plan Verify strategic plan, 100% The 2019 - 2023 (5 years) strategic plan of the company that was participatory developed with clear goals and targets was verified. 2 The Ministry should popularize the strategic plan to all departments, in a view that all department identifies its mandate in pursuing the overall mandate of the institution Popularize strategic plan to all departments. Glow High There was no Strategic Plan presented to the Review Team. I nclusive input of all departments in the strategic plan Verify approved strategic plan, inputs of all Departments and Units 100% The 2019 - 2023 strategic plan of the company was verified as appropriately popularized. The strategic Plan with specific Targets and reporting templates were shared to all department, units, and individuals. 3 We recommend that the budget should be aligned to achieve the goals set out in the Strategic Plan. Aligned budget with activities in the strategic plan The budget is not strictly aligned on activities geared towards achieving the goals set out in the Strategic Plan. aliened budget with activities in the strategic plan Verify Budget and activities in the strategic plan 100% Activities are now aligned to the strategic plan. 4 We recommend that the budget process be highly participatory. Annual budget should be prepared and approved before the start of every year. Participatory and inclusive budget process. H No evidence to show that the budget process was participated. The budget is not prepared prior to the commencement of the financial year. Participatory and Inclusive Annual Budget prepare at the start of the financial year. Verify Inputs of Department and Unit budget submitted. 100% The budget process in now participatory. There was a budget committee and up of the various departmental heads. 5 Annual Budget should be prepared and approved before the start of every financial year Prepared annual budget before the start of every Financial Year Budget is not prepared prior to the commencement of every financial year. Approved annual budget prepared before the start of the FY. Verify annual budget and date of approval 100% Budgets are now prepared and approved in time. The 2022 an d 2023 budgets were verified as prepared in time (Before the start of the respective years)

26. - 24 - medical to avoid misuse/ abuse. and ninety - six thousand Leones) from medical claims, which is about 0.44% excess. medical. 80% docume nt. 33 Alternatively. Management should investigate the possibility of allocating an annual fund as medical for staff which should be included in their monthly salary as medical allowance. Propositional funds for staff medical included in their monthly salary as medical allowance Some of the medical claims inspected by the team had no signature from the Medical Doctor at PDW to confirm the validity of the claims. We also noted that the GVWC has no policy on medical claims and / refunds to staff. We als o, noted that the GVWC has no policy on medical claims and / refunds to staff. Annual fund for staff medical included in their monthly salary as medical allowance investigated. Verify Annual Budget 80% A medical policy has been drafted but not yet approve d to be used as a working document. Management indicated that the draft medical policy will be reviewed and adopted this year. 34 Management can also have a medical insurance scheme for staff to cover technical staff who worked in risk prone areas Medical insurance scheme for staff to cover technical staff We also noted that the GVWC has no policy on medical claims and / refunds to staff. videos Medical insurance scheme for staff to cover technical staff who worked in risk prone areas established. Verify Medical Insurance scheme. 100% GUMA currently has a medical scheme for staff. A medical policy has also been drafted and awaiting approval. However, all medical bills are now signed by medical doctors. Area of Concern 5. FINANCIAL MANAGEMENT Recommendations Indicator Importance Baseline situation/ Challenges ACC’S Target Means of verification (MOVs) Current Progress Measure Comments 35 The vacant management accountant position should be occupied to affect the budgetary process. Recruit to occupy the vacant account position The Management Accountant Position is vacant till to the time of the conclusion of our review. One vacant management accountant position Verify appointment letter, advert, interview score sheet. 100% A budge t officer has been recruited to serve in this capacity. The Newly appointed Budget Officer and the Appointment Letter were verified.The Management of GUMA indicated that the position of Management Account is not needed now. 36 Departmental activity plan is prepared in line with the budget. Prepared budget in line with Departmental activity plan The Departmental activity plan are not prepared in line with budget. Departmental activity plan in line with the budget. Verify departmental plan and budget. 100% Departmental Activities are now aligned with the company’s strategic plan and budget. 37 The Accounting Policies and Procedure Manual be Updated Accounting policies The Financial and Accounting Policies and Procedures Updated Accounting policies Verify Updated Accounting Policy and There i s now a revised 2020 financeand accounting policy and Procedure Manu that now guides the

37. - 35 - Medicare to close all weep holes and reinforce the fence. This will prevent any water entering the compound and subsequently prevent the stores from flooding. The request for such works has been submitted to the Finance Department awaiting availability of funds. GVCW management has made this work a priority and shoul d be completed before May 15th, 2023. 79 The Management of GVWC should ensure that budget preparation was more realistic, efficient, and effective. A more realistic, efficient, and effective budget preparation is ensured. Budget preparation was full of adverse variance, unrealistic, inefficient, and ineffective. A more realistic, efficient, and effective budget preparation is ensured. Budget 100% A budget and Finance Committee has been established that now champions the budget and budgetary process at G UMA to ensure the preparation of a more realistic budget. Area of Concern 9. GARAGE AND FUEL MANAGEMENT Recommendations Indicator Importance Baseline situation/ Challenges ACC’S Target Means of verification (MOVs) Current Progress Measure Comments 80 The Management of GVWC had the responsibility to ensure that there is a detailed policy on maintenance which should be followed by an annual maintenance schedule/plan. Crafted detailed policy on maintenance H The team observed that there was no maintenance plan provided to the team, yet maintenance was done on need bases. Also, no policy was provided on maintenance of GWVC fleets and machines. Crafted detailed policy on maintenance Approved and functional Policy document verify 100% The re is now a fleet maintenance policy to be implemented effective January ,2023. 81 Accountability tools such as ledger, chit, request form etc in the management and distribution of fuel should be developed and effectively used. Development Fuel utilization accountability tools H There was no proper accountability in the area of fuel management and fuel was distributed at the discretion of the Store Manager and the Head of Garage. Developed functional Fuel utilization and accountability tools Verify Accountability tools 100% All accountability tools related to fuel and fleet management are now maintained. 82 Develop a fuel and fleet management policy that will ensure proper distribution and allocation of fuel. A fuel and fleet management policy developed. H There was no policy on fuel distribution and allocation as fuel was distributed to vehicles that were not in working order. A fuel and fleet management policy developed. Approved fuel and fleet management Policy document 100% The company has a fuel and fleet policy on the allocation of fuel. 83 Fuel calibration chat should be used to determine the quantum of fuel a vehicle or motorbike can consume per kilometre covered. The use of fuel calibration chart ensured. H With respect to fuel request procedures, it was observed that no technical knowledge was used to determine the quantum of fuel a vehicle or The use of fuel calibration chart ensured. Traveling requests Fuel chits etc 100% The fuel calibration chart has been developed, adopted, and being applied.

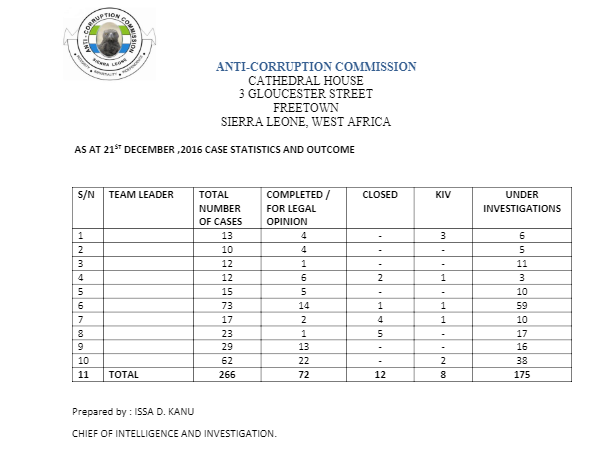

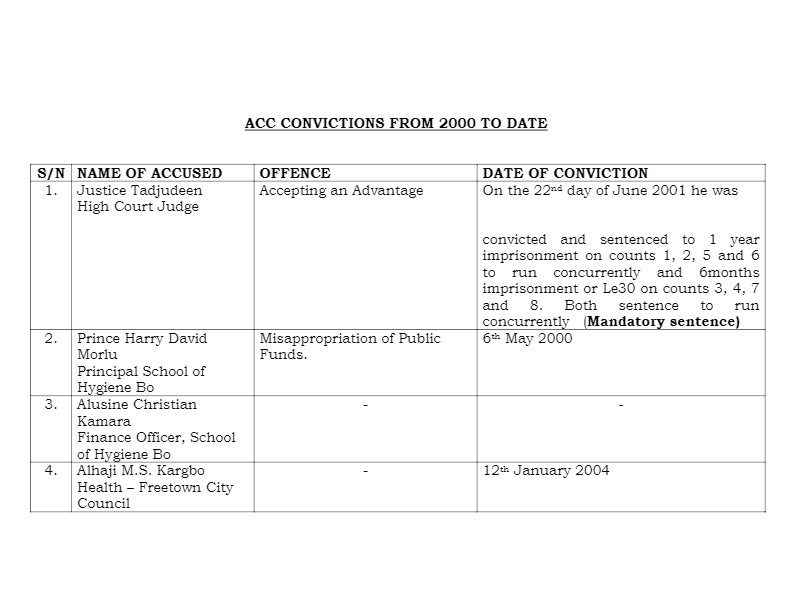

10. 8 8.0 DETAILED FINDINGS AND ANALYSIS Table 1 above showed that a total of Ninety ( 90) validated recommendations from ten (10) thematic areas were proffered and monitored for compliance. The monitoring for compliance intervention revealed that 83 ( 92 %) of the 90 validated recommendations were fully implemented, thereby leaving 7 as outstanding recommendations. 2 of those outstanding recommendations had been significantly (80% - 89%) complied with. While 5 had been moderately (50% - 75%) Complied with. # Thematic Area # Recommen dations proffered # Fully Complied with # Significa ntly Complied with # Moderately Complied with # NotComp lied with 1. Strategic Plan 8 8 - - - 2. Own Source Revenue 15 1 5 - - - 3. Donor Fund/MCC Project 8 8 - - - 4. Budget Execution 3 1 2 - - 5. Financial Management 19 1 7 - 2 - 6. Human Resource Management 14 13 - 1 - 7. Procurement 6 6 - - - 8. Stores Management 6 5 - 1 - 9. Garage & Fuel Management 6 6 - - - 10. Result Based Financing 5 4 - 1 - Total 90 83 2 5 - % Compliance 92 % 2 % 6 % 0 % GUMA Compliance Score 92 % (90% - 100% = Full Compliance )

36. - 34 - 74 Storekeepers should be allowed to take goods on charge before distribution to sites. Storekeepers took goods on charge before distribution to sites. Most items procured were taken directly to site without going through stores verification. The storekeepers only do post charge after the goods were delivered or used. Neither the storekeepe r nor the Internal Auditor or both do witness the supplies of these goods. Storekeepers taking goods on charge before distribution to sites. - Sores ledger - Distribution list 100% All goods procure are now taken on charge before distributed. 75 The Internal Audit Unit should have a representative to witness and/or verify all supplies. The Internal Audit Unit had representative that witness and/or verify all supplies. Most items procured were taken directly to site without going through stores verification. The storekeepers only do post charge after the goods were delivered or used. Neither the storekeeper nor the Internal Auditor or both do witness the supplies of thes e goods. The Internal Audit Unit to have representative that witness and/or verify all supplies. Verification reports 100% Representatives from both Internal Audit Unit and Monitoring and Compliance Unit now verify goods procured before they are taken to store, distributed or used depending on the nature of the goods. 76 Stores Manager should ensure that bin cards are updated on a daily basis and weekly reconciliation report should be submitted to MD as a way to keep him abreast of stock balances. Bin cards updated daily, and weekly reconciliation report submitted to MD to keep him abreast of stock balances. The team observed that stores records were poorly managed by the store custodians. Bin cards were not up to date, and they were not shelved alongside the respective items. Bin cards to be updated daily and weekly reconciliation report submitted to MD to keep him abreast of stock balances. Bin cards Reconciliation reports 100% Store records are now properly maintained. Bin cards are now UpTo Date. 77 Management should make sure that procurement of items is of the correct specifications and needs. Management made sure that procurement of items is of the correct specifications and needs. The team observed that items were procured (such as, 2 non return valves from India DN 500, 8 valves of different sizes and 2 Butterfly valves DN 600) which had no use to GVWC, and they were packed in the store area unattended. Management to make sure that procurement of items is of the correct specificatio ns and needs. Procurement list Procured items 100% Now all goods procured and delivered are of the right specification. 78 Management should relocate the stores to a tidier location, Stores relocated to a tidier location. The Store is not tidily kept though spacious as it is in a disaster - prone area, and it floods during the rains. Stores to be relocated to a tidier location. Relocated stores 50% After careful consideration, the Engineering team has come up with another solution that will fix th is problem permanently. The team has therefore designed and recommended to relocate the main entrance of the compound at the beginning of the fence. Some minor works will also be done close the

23. - 21 - 17 GVWC should conduct researchers/Surveys to effectively identify and capture all water packing Companies List of 100% of water packing companies identified Physical verification of the list provided; the team discovered significant discrepancies with the number of machines registered / provided. Identify and capture all revenue streams. Verify List of revenue streams 100% GUMA now has a list of all Water Packing Companies. Also, a team of engineers and M&E offices now conduct frequent spot checks to identify unregistered water packing companies 18 A regulatory framework should be developed for all revenue streams with stipulated sanctions for breach of the framework Developed regulatory framework & sanction for all revenue streams There was no regulatory framework to regulate the water packing companies. Leading to these water companies acting in their own selfish interest. Developed functional regulatory framework Verify framework 100% Revenue Generation Frameworks have been developed and impl emented by GUMA. There is now a regulatory framework contract between the company andwater packaging companies. There is also Customer policy that guide the relationship between GUMA and its customers. 19 There must be an effective monitoring and supervision mechanism for all revenue streams. # of Monitoring and supervision mechanism conducted No monitoring and supervision in the processing and filtering of water tanks. Effective monitoring of all revenue generation. Verify Monitoring Report 100% There is now a Monitoring and evaluation unit that now effectively monitors and reports on all the revenue streams and revenue generated by GUMA.Monitoring and Supervision reports on all revenue generation were verified 20 GVWC should ensure that all monies embezzled by the water packaging companies are paid. % of monies embezzled paid to the company The team discovered that a particular company ‘Family High need” used a single account number for two different addresses. It was also discovered that other outlets which operated under the same business name operated with a different account number. Under declaration of the number of machines in operation claiming to be faulty and other wise amounting fifty - five million three hundred thousand Leones mon thly. 100% pay of all monies embezzled Verify bank statement, payment of receipt. 100% Family High needs have two factories in Jenner Wright Road (23 Jenner Wright Road 49 Jenner Wright Road) with two different accounts with the same Owner. After a survey was conducted GUMA, all the water packaging companies in question were immediately debited with the respective amounts assessed as underdeclared and letters and “New/ Updated” statements of accounts in respect of samesent to them. These water packaging co mpanies are now makingpayments on account. 21 Guma is encouraged to do a full bill computation as result of under deceleration Developed a computation bill No computation bill thus led to under declaration Developed a Functional full bill computation. Verify the bill computation 100% GUMA now has monitors that regularly track machines used by water packing companies. Also, any defaulters are immediately disconnected and are only connected after going through the right procedure of registration. 22 The management of GVWC should ensure that all water # of water packing companies Water packing companies were not registered with All water packing company registered Verify list of water packing company. 100% GUMA now has monitors that regularly track machines used by water packing companies. Also, any defaulters

25. - 23 - mechanism in place projects Report on project funding and expenses were hard to come by. projects mechanism 28 GVWC/Contractor should have community engagement with the stakeholders of the community to identify land/locations for the kiosks to be erected. Engagement of community stakeholders to identify project site There are strong indications that proper planning and consultation were not done with the communities and as a result the project in some areas lacks vital community support. GVWC/Contractor to engage community stakeholders Verify stakeholders’ engagemen t report, meetings, attendance list. 100% Stakeholders are now engaged on all projects implemented by GUMA. Stakeholders action plan and minutes of stakeholder’s engagements meetings were verified. 29 The Management of GVWC should work with the Freetown City Council (FCC), Ministry of Lands and Country Planning, and the Ministry of Agriculture and Forestry (MAF) for the Protection and restoration of forests Conduct joint activity with FCC, Lands & MAF in protecting and restoring forest There are strong indications that proper planning and consultation were not done with the communities and as a result the project in some areas lacks vital community support. The Management of GVWC to work with the Freetown City Council (FCC), Ministry o f Lands and Country Planning, and the Ministry of Agriculture and Forestry (MAF) for the Protection and restoration of forests - Minute of Water Sector coordination meeting. - Correspondences. 100% Stakeholders are now engaged on all projects implemented by GUMA. Stakeholders action plan and minutes of stakeholder’s engagements meetings were verified. 30 NPAA to station Forest Guards in the area to ensure that these activities are put under control. # of forest guards stationed in the area. There are strong indications that proper planning and consultation were not done with the communities and as a result the project in some areas lacks vital community support. Stationed Forest Guards in all activity area Verify List of forest guard deploye d and the areas of activity 100% Forest Guards have not been deployed. However, security guards employed by GUMA are always deployed at the dam on shift basis to protect the dam and the forest around the dam. 31 A clear formula/metric should be used to assess work done with milestones set for various activities. Used formula to assess work done with milestones set for various activities. No formula/metric used to assess work done with milestones set for various activities. Use formula to assess work done with milestone Verify formula use 100% There is now a project log framework. Area of Concern 4. BUDGET EXECUTION Recommendations Indicator Importance Baseline situation/ Challenges ACC’S Target Means of verification (MOVs) Current Progress Measure Comments 32 Management should ensure a policy be initiated for Developed policy for medical. A n unfavorable balance of Le 1,096,000 (one million Developed a functional policy for Verify functional policy A Medical Policy has been drafted but not yet approved by the Board to be used as a working

21. - 19 - 6 The Company should recruit a budget officer. Recruit a Budget officer No budget officer in the company that will ensure effective coordination of budgetary activities. Assigned One Budget Officer Verify appointment letter or correspondence of designation of Budget office, Job description roles and responsibility. 100% The recruitment of a Budget Officer was underway. Significant steps have been taken as pote ntial candidates have been interviewed and management now awaits Boards approval of the selected candidate for the position. 7 The Company should immediately constitute a Budget Committee Comprising of all Heads of Departments of the board with the free hand to guide the budget process. Establishment of approved budget committee H There is no evidence to show that a Budget Committee exists to guide the budget process Approved and functional Budget Committee. Verify List of Budget Committee, updated Minutes of the committee, resolution, and Budget work plan 100% A budget committee made up of the various departmental heads has been constituted. That budget committee, now champions the budgetary process at GUMA. 8 The committee should be given the free hand to guide and regulate the budget process. Independent of the budget committee to guide the budget process No independent budget committee to guide and regulate the budget process. Approved and functional independent budget committee Verify budget committee, minutes of budget committee. 100% The budget Committee now effectively champions the budgetary process at GUMA. Various meeting minutes of the committee were verified. 6 The Company should recruit a budget officer. Recruit a Budget officer No budget officer in the company that will ensure effective coordination of budgetary activities. Assigned One Budget Officer Verify appointment letter or correspondence of designation of Budget office, Job description roles and responsibility. 1 00% A budget Officer has been recruited, orientated, and has started working. 7 The Company should immediately constitute a Budget Committee Comprising of all Heads of Departments of the board with the free hand to guide the budget process. Establishment of approved budget committee H There is no evidence to show that a Budget Committee exists to guide the budget process Approved and functional Budget Committee. Verify List of Budget Committee, updated Minutes of the committee, resolution, and Budget work plan 100% A budget committee made up of the various departmental heads has been constituted. That budget committee, now champions the budgetary process at GUMA. 8 The committee should be given the free hand to guide and regulate the budget process. Independent of the budget committee to guide the budget process No independent budget committee to guide and regulate the budget process. Approved and functional independent budget committee Verify budget committee, minutes of budget committee. 100% The b udget Committee now effectively champions the budgetary process at GUMA. Various meeting minutes of the committee were verified. Area Of Focus: 2. OWN SOURCE REVENUE Institute transparency and accountability principles in the management of public funds Recommendations Indicator Impor tance Baseline situation/ Challenges ACC’S Target Means of verification (MOVs) Current Progress comments

22. - 20 - Measure 9 GVWC to spend time finding out what factors causes the drop in revenue and take necessary action to improve on revenue Identify factors led to the drop in revenue L There is an unfavorable budget variance of 5,308,458 (Five Billion three hundred and eight million four hundred and fifty - eight thousand leones) In revenue generated. An increase in revenue generation Verify revenue mobilization report and the increase in revenue 100% Management concluded that the drop in revenue was due to a lack of targets and other performance measures. Performance measures were introduced across the company including Revenue Generation in2022. Revenue has now increased from Le 32 billion in 2021 to Le 36 billion as at October 2022. 10 Management should ensure, there is consistency in reporting figures to give a correct picture of the company’s finances. Consistency in reporting revenue generated figures No consistency in reporting of revenue generated figures. Consistent and clear reporting of company revenue. Verify revenue generated reports 100% Consistent monthly revenue reports are now generated and discussed by management. 11 The Company should conduct annual review of the performance of its revenue streams. Conduct annual revenue on the performance of revenue stream. There is no strategy in place to investigate the poor performance of these revenue sources. Annual review on the performance of revenue stream to be conducted Verify annual review report 100% Performance measures are now reviewed by management monthly. 12 Targets should be set for each revenue stream and any shortfall investigated. # of revenue stream own by the company. There is no target set for each revenue stream in the company Established set targets for all revenue stream Verify target set for revenue stream. 100% Target are now set for revenue collections. 13 There should be regular audits of revenue generated to ensure leakages are plugged. # of audit conducted on revenue generated No regular audits of revenue generated conducted. Quarterly audit of revenue conducted Verify quarterly revenue audit report. 100% Revenue generation is now closely monitored by the Monitoring and Evaluation Unit as well as the Internal Audit Unit. A Customers services protocol and charter guidelines has been developed and now implemented. 14 The billing system and its related matters should be reviewed. The billing system and its related matters reviewed. The billing system and its related matters is not e reviewed. The billing system and its related matters to be reviewed. Review report 100% The billing system has been reviewed by management. Now bills are consistently sent to customer through mobile phone and hard copy monthly. 15 A clear policy or guide should be developed on how customers can challenge bill and how bill can be adjusted, waived, or settled. Developed policy on customer bill adjustment/waiver or settlement. No clear policy to guide customers Approved and functional policy Verify customer bill or policy. 100% GUMA has an effective Commercial Policy that provides guidance to both GUMA and its numerous customers on how to engage each other. That Policy has been developed and being fully implemented since 2018 and still aligned with the operations of the Company. 16 Monthly or at least quarterly reconciliation be done. Conduct monthly reconciliation No reconciliation conducted Monthly Reconciliation Verify Monthly Reconciliation. 100% Monthly revenue and bank reconciliations were now prepared. As at December,2022, reconciliations had been prepared up to october,2022.

29. - 27 - affected. support their claims. 48 Management should ensure that a petty cash policy should be developed and properly regulated with clearly indication of the float to be issued per month per department. Developed petty cash policy with proper regulated and clear indication of float to issue per month and per department The team observed that the Director of Finance and Administration does not have any such qualifications and as such, the competences in managing such a department are questionable. Developed functional petty cash policy Verify Petty cash policy 100% A Petty Cash Policy is now part of the GUMA’s 2020 Finance and Accounting Policy and procedure Manual and now effectively applied. 49 Petty cash disbursement should be made monthly to departmental heads and reimbursed after reconciliation with the relevant supporting documents. Petty cash disbursement made monthly to departmental heads and reimbursed after reconciliation with the relevant supporting documents. The Director of Finance was replaced by the Director of Corporate Services as signatory to the company’s accounts as approved by the Board Chairperson. Petty cash disbursement to be made monthly to departmental heads and reimbursed after reconciliation with the relevant supporting documents. Petty cash disbursement Reconciliation report. Supporting document 100% Petty cash disbursements are now made todepartmental heads on monthly basis. Reimbursements are now made after reconciliation with the relevant supporting documents. 50 Management should ensure that appropriate action is taken to recruit a qualified person to fill the position of Director of Finance. A qualified Director of Finance recruited. The team observed that some of the documents verified and examined were without receipts and other relevant documents to ascertain the completeness of the transactions with the suppliers. A qualified Director of Finance to be recruited. Advert... Appointment letter 100% A member of Association of Certified and Chartered Accountants (ACCA) has been promoted to Finance Director. 51 The Financial Director should be signatory to all accounts in with line best practices and responsibility accounting. Financial Director made signatory to all accounts. The review team observed that the Financial Director was not signatory to the various accounts of the Company. The Financial Director to be made signatory to all accounts. Accounts Correspondences 100% The Financial Director is now signatory to all the accounts of the company. 52 The Director of Finance to immediately repay the Le 26,000,000 (Twenty - six million Leones) salary advance paid to him % of the Le 26,000,000 repaid by the Finance Director The team observed that Director of Finance and Admin had collected salary advance totaling Le 26,000,000 (Twenty - six million Leones) which was never recorded in the computations of salary advance or repaid. 100% of the Le 26,000,000 repaid by the Finance Director Verify, salary voucher /payment slip / bank statements 100% 100% of the Le 26,000,000 salary advance has been repaid by the Finance Director. Thye amount was deducted in two instalments from his salary. 53 Management should ensure that all transactions have Management ensured The team observed that some of the documents All transactions completed with Verify sampled of financial Supporting All transactions are now supported with adequate and appropriate documentation.