GUMA VALLEY WATER COMPANY

Share on Social Networks

Share Link

Use permanent link to share in social mediaShare with a friend

Please login to send this document by email!

Embed in your website

101. 100 going for 2018 and 2019 Financial Years.

2. 1

102. 101

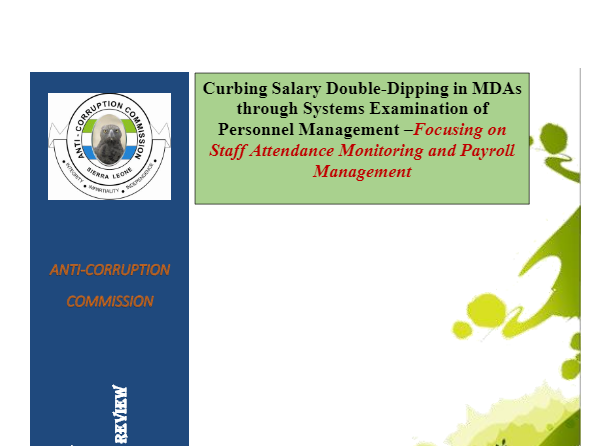

103. 102

5. 4 8.13.1.1 Physical Verification of Deliverables (Compliance Audit) ......................... .. 78 8.13.1.2 AUDIT REPORTS .................................................................................... ... . . 80 8.0 COMPLIANCE MATRIX................................................... ........................... ... 83

80. 79 (f) Review all contracts ensuring effective performance and value for money. Section 11 (2) (c) of the Public Finance Act, 2004 provides that: “...... internal auditors may investigate whether there are adequate measures and procedures for the proper application of sound economic, efficient, and effective management of public funds.” Finding The Internal Audit does not physically verify deliverables, such as contracts agreements, supply of procurement items to stores, fuel allocation, and distribution and so on. These deliverables needed to be audited from initiation to completion to ensure va lue for money. Implication In the absence of physical verification of deliverables, loopholes for corruption and substandard work will not be identified. Recommendation The Internal Audit Unit must physically verify all deliverables from initiation to completion. The Audit Unit should produce a quarterly report on deliverables for sound economic, efficient, and effective management of public funds. Management should ensure the Audit Unit was present and/or aware of deliverable. Management Response The recommendation of ACC is noted and necessary action will be taken.

104. 103 Published by the Anti - Corruption Commission Headquarters: 3, Gloucester Street, Freetown, Sierra Leone, West Africa Tel.No: 223645 Website: http//www@anticorruption.gov.sl Bo Office Address: 45, Kissy Town Road, Bo Email: info@anticorruption.gov.sl Makeni Office Address: Mena Hill Reservation, Makeni Kenema Office Address: Reservation Road, Off Maxwell Khobe Street Kono Office: 37 Masingbe Road, Koidu City Kono Hotline Nos: 077 - 985985 , 077 986 986 , 078 - 394111 515 (All Networks)

35. 34 According to the contractor roughly 70% of work at Mambo was ongoing but upon physical verification at the sites, the team could not determine that 70% of the work completed. The team could not ascertain the formula used by the contractor to reach a 70% conclusion. 8.5. 2.1 The Reservoir Support Water tapped from the weir will be stored at the reservoir, treated and ready for supplies to the community. At the site of the reservoir, the team could only verify the concrete base as the work was ongoing. Figure 5 : Concrete Reservoir Support 8.5.2.2 The “Kiosk The kiosk facility comprises PVC tank, the tank base and water point. The contractor had difficulties in mapping out pipes networks and kiosk locations. This has been resolved with the help of GVWC and NPAA. A total of 16 kiosks were to be constructed and located at different points in the communities. Only 16 kiosks have been erected to roofing while Plumbing, Plastering /Rendering Doors /Windows, tank, Fence, Painting and Picture reference were yet to be completed.

77. 76 The above table tells us that GVWC has achieved 6 out of the 8 metric performance areas stipulated by MCCU. GVWC has a total Earned Payment of USD1,273,254 collections performance just exceeded targ et of USD1, 113,850 with a total percentage of 114% . Implication Failure to achieve all its targets indicates weaknesses in the company’s performance management and this in turn will result to loss of revenue and increase in cost. Recommendations Management should review performance management for the targets not met. Management Response The recommendation of ACC is noted and necessary action will be taken. 8.12 DEBT MANAGEMENT Guma Valley Water Company has an accumulated debt of over sixty seven billion Leones (Le 67bn) from various sectors in the country. The table below shows the various debtors and total accumulated amount accrued.

81. 80 8.13.1.2 AUDIT REPORTS The Internal Auditor’s report supports companies in identifying key risk factors. It allows the company to forestall potential future concerns as well as identifying current weaknesses. It also identifies processes and controls that are not working effectively and enable an opportunity to impro ve on these. Finding We observed that the, 2018 and 2019 external audits were outstanding. At the time of the review, external Auditing was on going for 2018 and 2019 Financial Years. Implication Without regularly auditing weaknesses in the system will go undetected. Recommendation Management should ensure that External Auditing is done annually to mitigate the risk Management Response The recommendation of ACC is noted. With regards to the 2018 & 2019 Financial Reports Audited Financial statement is available for verification.

41. 40 The above table depicts an unfavorable balance of Le1,096,000 (one million and ninety six thousand Leones) from medical claims, which is about 0.44% excess. Some of the medical claims inspected by the team had no signature from the Medical Doctor at PDW to confirm the validity of the claims. We also, noted that the GVWC has no policy on medical claims and / refunds to staff. Implication Misuse / abuse of medical claims leads to a loss in the company’s income. A frequent unchecked medical request claim by staff members was a possible avenue for corruption. Recommendation s ➢ Management should ensure a policy be initiated for medical so as to avoid misuse/abuse. ➢ Management should look into the possibility of allocating an annual fund as medical for staff which should be included in their monthly salary as medical allowance. In addition, Management can also have a medical insurance scheme for staff to cover technic al staff who worked in risk prone areas. Management Response The issues raised have been noted and Management will take necessary steps to put in place measures that will ensure effective and efficient use of Company resources towards medical facility. Prior to the ACC Review,

62. 61 States dollars), which was equivalent to Le1,296,000,000 (One billion two hundred and ninety six million Leones) at an exchange rate of Le9,000 to $1. Upon verification, the team observed that out of the 4 vehicles budgeted for only 3 were procured at the cost of $195,148.80 (One hundred and ninety five thousand one hundred and forty eight united States Dollars eighty Penny) which was equivalent to Le1,8 32,886,316.80 (One billion eight hundred and thirty two million eight hundred and eighty six thousand three hundred and sixteen Leones eighty cents). Evidently there was a deviation from the budget being that only three of the four vehicles were bought and they were bought at an additional cost of Le536,886,316.80 (five hundred and thirty six million eight hundred and eighty six thousand three hundred a nd sixteen Leones eighty cents); an equivalent of $51,148.80 (Fifty one thousand one hundred and forty eight U nited States Dollars eighty Penny). No evidence was provided to the Review Team to show that due process was followed to deviate from the budget. No approved readjusted or supplementary budget was shown to the team with regards the alteration in the procurement plan with respect to the cost, specification and mode of delivery. Implication s ➢ Undertaking a procurement which exceeds the actual cost in the procurement plan affects cost. ➢ Unapproved and unregulated deviations or adjustments of budget will create opportunities for abuse and corruption. Recommendation

73. 72 Thirty Two Million, three hundred and fifteen Leones). This implies that GVWC had spent an excess (adverse) of Le 1,014,349 (One billion and Fourteen million three hundred and forty nine Leones) on transport /Fuel. An increase of 83% of the budget was utilized which could have hit other spending areas. Similarly, the sum of Le88,652 (Eighty eight million six hundred and fifty two thousand Leones) was budgeted for spare parts/ maintenance. An actual spending was Le434,891(Four hundred and thirty four million eight hundred and ninety one Leones) which resu lted to an adverse variance and /or excess spending of Le346,239 (three hundred and forty six million two hundred and thirty nine Leones). Furthermore, the two scenarios indicate that at GWVC the adverse variances/ unfavorable variances often points to the fact that something did not go according to plan, financially. Also, it would have been caused by improper budgeting where the baseline that had been set up had not been reasonably measured against the actual results. Recommendation The Management of GVWC should ensure that budget preparation was more realistic, efficient and effective. 8.10.1 Maintenance Plan Findings The team observed that there was no maintenance plan provided to the team yet maintenance was done on need bases. Also, no policy was provided on maintenance of GWVC fleets and machines. Implication Unplanned and unregulated expenses on maintenance will create room for wastage and misappropriation.

65. 64 Finding The review team did not find any evidence that the Procurement Unit communicated, debriefed and /or informed the unsuccessful bidder(s) in writing for procurements completed. Implication Withholding information to unsuccessful bidders as a prerequisite in procurement process raises suspicion. Recommendation For proper accountability and transparency, the Procurement Unit should always communicate in writing to all bidders whether successful or not. Management Response Letters of regrets are always sent to unsuccessful bidders, otherwise, to such bidders, it will be like the procurement process is still on course and there should have been correspondences to the Chairman of the Procurement Committee to that effect. 8.8.5 Requisition Book Finding All goods procured and supplied were being requested for through the requisition books but the Review Team observed that the finance unit does not sign the requisitions as required to ascertain the availability of funds and give approval yet the procuremen ts were undertaken. Implication

28. 27 ➢ The T eam realized that tanks in which water was stored before processing were filthy and looked unhygienic. Water is life but most of the tanks we saw were not clean though we were told they were cleaned on a weekly basis. Figure 3 : An Unhealthy Water Tank Implications ➢ There are weaknesses in revenue mobilization which has resulted to loss of revenue. ➢ There is lack of robust monitoring/supervision and regulation of revenue sources. ➢ There are strong indications that staff of GVWC are colluding with some water packaging companies to defraud the company. ➢ Water packaging companies with multiple production addresses but using single account number may be under declaring hereby not paying for all their production sites. Recommendations ➢ GVWC should set up a mechanism to enhanced revenue mobilization. .

26. 25 ➢ The table also, depicts that, GVWC was losing potential revenue of eleven million two hundred thousand Leones (Le11,200,000) on a monthly basis with respect to the number of machines in use by the various companies stated above. Upon physical verification of the list provided, the team discovered significant discrepancies with the number of machines registered / provided on the list to what was discovered on site. Most companies under declared the number of machines in use. 60% o f the water packaging comp anies checked/visited proved to be under declaring the number of machines they operate in their businesses. ➢ It was mutually agreed by the C ompanies and GVWC that faulty and/ or unused machines should not be in the production room. The picture shows machines which were declared faulty yet there were water sachets hanging on them, showing that they were workable. Clothes and bags were hung or spread all over the machines to make them appear unusable. Figure 2 : Disguised M achines ➢ The table below shows the number of machines unaccounted for as compared to list provided by Guma.

49. 48 In principle, the Finance Director and /or head of Accounts of all organizations have to be knowledgeable and / or aware of the financial transactions of the organization. According to a board document, it was observed that the Director of Finance became a signatory to the account of Guma Valley Water Company effectively on the 3 rd April 2019 upon appointment. Instantly, on the 30 th January 2020, a Board paper was approved by the Board Chair person stating that the Director of Finance should be replaced by the Director of Corporate Services. The operations at Guma with regards the signatory to account was quite complex as such direct ives came from the Board. Implications The Finance Director is the person responsible for all finances; therefore his exclusion from being a signatory will hinder his ability to exert control over finances as withdrawals may be made without his knowledge. Recommendation The Financial Director should be signatory to all accounts in with line best practices and responsibility accounting. Management Response Following the restructuring exercise, the issue of having the Director of Finance as signatory to the account was resolved. 8.6.2.9 Receipts/Supporting Documents Source document was a good internal control measure and provided evidence that a transaction occurred. Findings

56. 55 Le3,583,440,000 more than that budgeted and Le6,563,076,000 more than that reported in the unaudited financial statement for 2019.We could not get any reason(s) for such inconsistencies in the figures. Implication The inconsistencies in reporting amount spent on salaries undermine the credibility of the financial reports of the Company. It shows weak management of financial books and may also be a case of deliberately underreporting of expenditure relating to staffing which may take a huge portion of the Gross revenue of the Company. This will affects management ability to regulate expend iture on salaries. Recommendations ➢ The Finance Department and the Human Resource department should conduct regular reconciliation to identify and address inconsistencies. ➢ The Company should review its accounting procedures and records management to ensure that they give a true and accurate view of the Company’s financial position. Management Response The salary structure has always been reported as Direct and Admin Expenditures. The aggregate of salaries and wages in the 2019 Budget (Direct + Admin) amounted to Le12b, which gives a favorable variance when compared to the amount actual paid as per your Report. 8.7.4 Staff list and Payroll Finding Upon verification, the team observed variances between the payroll and the staff list.

67. 66 Finding The review team observed that bid documents were sold by the Procurement Unit for all procurements advertised as prescribed in the above section but no records of accountability were given to the team with respect to proceeds on sale of bid documents. Implication Non accountability of proceeds on sale of bid documents is a weakness in the procurement proces s inclusive of reconciliation. Recommendation Management should ensure that the company’s bank account numbers are spelt out in all bid documents to which bidders should pay and present bank slips to Finance Department. Bidders should then present the receipt issued by Finance Department to the procur ement Unit and in turn collect the bid document. This would ease accountability and reconciliation. Management Response The fund will be paid to GVWC cashier for special transfer into GVWC bank account 8.8.7 Procurement Committee Section 18 (1) of NPPA 2016 states that ‘a procurement committee shall be established in every procuring entity.. Also, according to S18(8) ‘a procurement committee shall make necessary arrangements to ensure that timely information on the execution, and conclusion of contracts by a Department or Division of a procuring entity, as well as on supplier, contractor or consult ant performance is reported to the procurement committee’.

44. 43 8.6.2.3 Withholding Tax Deduction Finding The 5.5% withholding tax deductions mandated by the Income tax Act 2000 was not deducted from suppliers payments. A large number of transactions examined involving payments to suppliers for the supply of goods, services and works did not indicate such deductions. A total of Le 150,000,000 (one hundred and fifty million Leones) was outstanding for the 2019 financial year. This amount had been deducted from suppliers but never paid to the National Revenue Authority (NRA) as prescribed by law. Implication Failure to submit withholding tax deductions from suppliers to NRA will lead to loss of revenue to government and would amount to an offence under the tax laws of Sierra Leone. This was a breach of Section117 of the Income tax Act of 2000. Recommendation The Accountant should ensure that 5.5% withholding tax deductions from supplier’s payment are payable as prescribed by the law. Management should ensure all outstanding on Withholding tax deductions are paid. 8.6.2.4 PAYE Section116 (1) Income Tax Act, 2000 provides that “An employer shall withhold tax from employment income. Management Response We have noted the ACC’s comments. Prior to the review, the Company was in dialogue with the Ministry of Finance for a cross debt settlement arrangement

36. 35 Figure 6 : Kiosk at Roofing Point 8.5. 2.3 Waterloo Community Reservoir The Waterloo Community is located at the mountain catchment area from which water is to be harvested and sent to the communities. The waterloo weir and Reservoir are far from completion. At the moment only 6 kiosks were under construction out of the total to be constructed. There have been tensions between the contractors and the community as well. The contractors have not been allowed to locate spots for the kiosk as there was resistance from the communities. Figure 7: Construction of the Reservoir at Foundation Level Most terrains where gravity water systems were constructed were rough, but the mambo gravity and the topography was unpredictable. The terrain was rough, poorly planned and not easily accessible. The weir was far away from the main road where vehicles could not pass through.

75. 74 ➢ Develop a fuel and fleet management policy that will ensure proper distribution and allocation of fuel. An effective Fuel Management policy ensured the best utilization of resources and allowed reduction of cost to a large extent. ➢ A weekly and/monthly reconciliation should be done on fuel allocation so that management would determine the stock and reorder levels. Management Response The recommendation of ACC is noted and necessary action will be taken. Management has approved a Fuel Management Policy which will be implemented. 8.11 RESULT BASED FINANCING (FRB) RBF is defined as any programe where the principal set financial or other incentives for an agent to deliver predetermined outputs or outcomes and rewards the achievement of these results upon verification (Musgrove 2020). Furthermore, it is a form of funding for project implementation or service provision where the principal, who provides the funding pays the agent who implements the projects or provides the service upon achieving predefined results. On the 28 th of May 2019, the GoSL and the United States of America (USA), through the MCCU entered into a Result Based Financing agreement with Guma valley Water Company (GVWC). MCCU had the responsibility to supervise and manage the implementation of the programme. A payment of an amount not exceeding US$ 1,300,000 (one million three hundred thousand united states dollars) minus an upfront investment cost of US$186,150 (one hundred and eighty six thousand, one hundred and fifty united states dollars) was paid into t he RBF project account at the Sierra Leone

68. 67 Finding We discovered that there is an existence of a Procurement Committee and minutes of meetings were presented to the team. As prescribed by the Act the Vote Controller is the chairman of the procurement committee. Implication Being the head/vote controller of an entity and the same time chairman of a procurement committee, constitute complicit of interest and there is possibility of the chairman uses his veto in the selection process. Recommendation The management of GVWC should ensure that the vote controller delegates such responsibility to avoid biasness, independence of the procurement officer/manager and a fair playing ground for suppliers. Management Responses The recommendation of ACC is noted and necessary action will be taken 8.9 STORES MANAGEMENT Guma V alley Water Company maintained two stores, a general and fittings stores. The store was controlled and managed by a Store Manager, an Acting Storekeeper and a Store Clerk. A Store Supervisor supervised these stores and items were manually recorded. Store management plays a strategic role in the supply chain by enabling inventory distribution, sorting process to meet the growing demand of the market. 8.9.1 AUDITORS VERIFICATION OF ITEMS IN STORE

46. 45 at Regent, Lumley; Wilberforce etc. without bank account details and /or Identification cards. Implication Cash handling by Account Officers can create vulnerabilities for misappropriation. Recommendation All payment should be done by Cheque and/or paid directly to the employees’ bank account. Management should ensure all workers submit bank accounts details for swift accountability. Management Response The payment over the counter relates to contract workers engaged for short period (between 1 to 3 months). The recommendation is however noted and action will be taken to ensure payments are made by cheque or through bank accounts. 8.6.2.6 Petty Cash Findings A petty fund (float) was provided to all departmental heads to undertake transactions involving petty expenses for the upkeep of their departments/Unit on a monthly basis The following were observed by the team: - ➢ The team was informed that all petty cash should be approved by the Managing Director before payment is effected by the Finance Department. Upon verification, it was observed that some petty cash vouchers were not approved by the Managing Director, yet payment was effected. ➢ Furthermore, the team realized that multiple petty cash approvals are made to different directorate on a monthly basis. There is no specify float

48. 47 Petty cash being one of the alternative forms of payment when compared to cheques and bank transfers is usually used to settle or pay for i tems with small monetary value. 8.6.2.7 Qualification of the Director of Finance For someone to become a Director of Finance, he/she should be knowledgeable in accounting practices and procedures and possesses the requisite academic qualifications such as Chartered Accountant (ACCA, CIMA, CIPFA,CPA etc.), a Master’s of Science degree in Finance and Accounting and/or MBA in Finance/Accounting . The team observed that the Director of Fina nce and Administration does not have any such qualifications and as such, the competences in managing such a department are questionable. Implications Finance is the bloodline in any organization and having a non - Accountant to manage the financial affairs of the Company affects the efficiency/diligence of the company Financial Management Recommendations Management should ensure that appropriate action is taken to recruit a qualified person to fill the position of Director of Finance Management Response The recommendation from ACC is noted. Prior to the ACC report, the Board carry out a restructuring and re - deployment of staff to address the issue raised . 8.5.2.8 Signatory to Account

10. 9 The operating budget on the other hand, portrays the Ministry’s recurrent expenses, expected costs, and estimated income, considering the quarterly or the annual performance. The team will then assess the utilization of such approved budgets with reference to activities and/or projects in the Ministry’s Strategic and annual work plans. Budgetary allocations form an integral component to the annual financial plan, or budget, of all MDAs. They indicate the level of resources an MDA is committing to a department or program. Without allocation limits, expenditures can exceed revenues and res ult in financial shortfalls. Anyone working with budgets should understand how they are used and the limitations they provide . The budget preparation process is a powerful tool for coherence. The budget is both an instrument of economic and financial management and an implicit policy statement, as it sets relative levels of spending for different programs and activities. 2.0 OBJECTIVE The essence of the review is to track resource utilization and ensure the Ministries/D epartment /Agencies makes effective use of its resources in line with the budget. The review aims to identify weaknesses in budget process that will create opportunity for corruption and proffer recommendations to address those weaknesses . 3.0 SCOPE The review examined budgets allocated by the Ministry of Finance to the Ministry of Water Resources for financial year 2019. The central focus of the review is on recurrent (operating) budget. However, limited samples of capital expenditures were also examined.

31. 30 Bypassing the Guma registration/system meant a loss of revenue to the company as these companies were not paying bills to GVWC . Recommendations The management of GVWC should ensure that all water packaging companies are registered and updated on the list. Management Response The recommendation is noted and necessary action will be taken to address the situation. 8.4 DONOR FUND/PROJECT MANAGEMENT The Company received support from various donors and international partners, namely 8.4.1 MILLENNIUM CHALLENGE COMPACT (MCC) The Company through the support from Millennium Challenge Compact (MCC) has procured the service of a Consultant for the development of an application for Tariff increase for submission to the Sierra Leone Electricity and Water Regulatory Commission (SLEWR C). The MCC also through Adam Smith International (ASI) is also funding the project to construct of water kiosks at kingtom and Aberdeen. The construction of Water Kiosk and installation of pipes, fittings and meters is almost complete at Aberdeen whilst the construction of Water Kiosk and installation of pipes, fittings and meters at Kingtom is 50% complete. 8.4.1.2 DEPARTMENT FOR INTERNATIONAL DEVELOPMENT (DFID ): As part of its contribution to the CoVID 19 response commissioned the IMATT COMMUNITY WATER SUPPLY PROJECT. The project involved construction of

24. 23 ➢ The Finance Director should ensure that all data collected from various departments are matched up and /or reconciled before the final presentation of the financial statement so as to give a clear picture of the financial position of the Company. Therefore monthly or at least quarterly reconciliatio n be done. ➢ All variances should be properly investigated and addressed. Management Response Commercial Department Reports are generated from the EDAMS Billing Software. The software generates billing and collection reports only. Therefore, payment that do not relate to water sold like GoSL support and Donor grants, proceeds on disposal of assets, dividend received, rent received etc. are not captured in the EDAMS Billing Software. Unlike the Comm ercial Dep artment Reports, t he Finance Dep ar t ment Reports captures the comprehensive income received from various sources including EDAMS. 8.3.2.2 Water Packaging Companies as own R esource R evenue Water packaging companies are major revenue source for Guma. They are billed based on the number of machines they use in production and packaging. GVWC demand charge per machine is Le700,000 and each company is charged Le90,000 as water rate on a monthly basis.

14. 13 The Trogas report shows the expenditure pattern per quarter, revenue received (actual allocation) from Government of Sierra Leone (GoSL) and also gives a reflection of the MDAs cash book. 7 .0 GUMA VALLEY WATER COMPANY (GVWC) Guma Valley Water Company (GVWC) was established by the Guma Valley Water Ordinance in April 1961 as a government - owned entity, with a mandate to supply portable water to residents in Freetown and its environs between Sussex and Allen Town. The main source of supply is from the Guma Dam at Mile 13 which accounts for about 95% of the water to Freetown and its environs. Other smaller sources that supplement the supply from Guma Dam are Kongo Dam, Sugar Loaf weir, Charlotte weir, Cemetery Blue weir, Thunder H ill weir and White - Water weir. The Guma Dam was constructed when the City’s population was less than 500,000 inhabitants. Studies have shown that the demographics of Freetown changed rapidly from the 1990s due to influx of refugees during the years of civil conflict. The population of F reetown is now over 1.5 million people and a good number of them depend on GVWC water for their daily sustenance. Under its 1961 Ordinance and the recently enacted Guma Valley Water Company Act 2017, the Utility has the exclusive mandate to supply /provide access to potable water to both residential and non - residential consumers in the Western Area of Sierra Leone. The coverage area has now been extended to cover communities like Hastings, Kossoh Town, Waterloo, Tombo, and Newton . The Organizational Structure was revisited to reflect the structures set out in the GVWC Act 2017 and a Deputy Managing Director position was established for improved operational efficiency. In line with the GVWC Act 2017, the operations of the Company are run under four Departments which are headed by four Directors.

32. 31 water intake structures, 500m of pipeline to transmit the water to the storage tank 200cubic of concrete reservoir, 3km of 50mm pipeline with 8 public stand posts that will serve an estimated population of 20,000 persons. World Vision: The GVWC connected 45 community tanks to the distribution network with support from World Vision. 8.4.1.3 The World Bank is funding the Freetown Emergency Recovery Project. The p rocurement of Pipes and fittings for the rehabilitation works on the network is 40% complete. First set of pipes has been delivered on site and Implementation of the FERP was in progress and was expected to complete by mid - November 2020. 8.4.1.4 Freetown Water Supply and Sanitation Master Plan Studies funded by AfDB and D2B Two (2) Consultants have been procured for both the Priority project (Hydrophil & AWSE) and the Master plan studies (CoBA/SMEC). GVWC Website development is in progress and procurement of IT equipment’s is at an advance stage 8.4.1.5 Freetown WASH & Aquatic Environment Revamping Project funded by AfDB, IsDB, Kuwait Fund, EBID, Saudi fund, GCF, GoSL, NEA, & OFID Funding has been confirmed by some of the donors like AfDB, IsDB, Kuwait, OFID and GoSL. Four (4) Vehicles have been procured for the Project Implementation Unit including Technical Assistants. Contracts for Four (4) Technical Assistants have been signed and the procurement processes for the Environmental TA, Sanitary TA are at an advanced stage. The Project Steering Committee has also been inaugurated . 8.5 PROJECT MANAGEMENT

66. 65 Bypassing the finance department to give a fair view with regards available funding before executing the procurement affects financial management process. Recommendation Management should ensure that before a procurement process is undertaken, the requisition book should be filled, signed, approved, by all parties more especially to ascertain the availability of funds by the Finance Department and forwarded to the Procurem ent Unit for action. Management Response At GVWC, the Finance Department does not give approval for procurement to be undertaken but the Vote Controller does. The Finance and Admin Director usually give concurrence for payments to be made and moreover a sign out on cheques and transfers, and in that note, the Finance Department is not by passed. There has been an approved budget out of which the procurement plan is emanated . However, for due diligence as regards to control ‘payables” the requisitions are now submitted to Finance Department for their concurrence on availability of funds. 8.8.6 Bidding Fees Section 48 (1) of NPPA 2016 states that “ An invitation to bid, or an invitation to prequalify, shall be published in the Gazette, national print media of wide circulation and electronic media”. It is a norm that Procurement Units do sell biding document to bidders at a specific fee. This document had detailed information with regards the procurement in question.

53. 52 8.7.1 HANDING OVER NOTE Handover Notes are documents created by staff members who are about to leave their positions, either temporarily or permanently, to assist their successor to carry out their duties. The Purpose was to provide their successor with key knowledge and information regarding the position for smooth transition and continuity. Findings The team observed that most senior staff does not leave handing over note to their successors while proceeding on leave. Likewise the subordinates also failed to provide a detailed handing over note to their superiors upon resumption of duty. Implication Failing to submit a detailed handing over notes will deprive the successor the key knowledge regarding the position. Recommendations Management should ensure that a detailed handover is made so that successors will settle into the position more quickly and easily, and feel more comfortable and confident with the processes of the new job . Management Response It has now become a policy of the Company that senior and Executive staff must prepare a handing over note whenever they are proceeding on annual leave. 8.7.2 ACTING/ RESPONSIBILITY ALLOWANCE Findings

64. 63 procurement contract, or from the date of rejection of all bids or cancellation of the proceeding, as the case may be. Finding The team observed in relation to the above section that proper filing system of procurement documents was not maintained. Procurement files were placed on the floor instead of them being shelved in the office of the Procurement Office. Implication The absence of a proper filing system render audit trail very difficult. Placing files on the floor would lead to document misplacement. Recommendation The Procurement Unit should ensure that all files are shelved accordingly. Management Response There is a new fabricated 8 - sided filling cabinet now in the Procurement Unit that is used to house the procurement documents. 8.8.4 Debriefing |Unsuccessful Bidder Section 27 of the NPPA Act states that procuring entity shall immediately, after a successful bidder has been identified, inform the unsuccessful bidder(s) of the reason for which their respective bids were unsuccessful. By the provisions of Sec 28 (1) , Subject to this Act, documents, notifications, decisions and other communication referred to in this Act to be submitted by the procuring entity to a bidder, or by a bidder to the procuring entity, shall be in writing

43. 42 Management Response s ➢ The audited Financial Statements for 2019 is now available and the audit exercise for the 2020 Financial Statements is in progress. ➢ The review of the Financial and Accounting Policies and Procedures Manual is in progress and to be completed by the end of the year. 8.6.2.2 ASSET REGISTER Finding The team was not provided with a Fixed Asset Register and we noted that most of the company’s assets procured with the exception of those donated by MCCU were not coded. Implication Operating without a valid asset register is a high corruption risk issue as it will be difficult to distinguish between government property and private ones. Recommendation s ➢ Management should ensure that all company’s assets are coded to avoid misuse and to distinguish them from private use. ➢ Also, ensure that the Finance Department should develop a comprehensive assets register. The Internal Auditor should be responsible for the verification of the assets register. Management Response The process of developing a comprehensive fixed asset register is in progress. Inventory of fixed assets and coding have been done.

54. 53 The review team observed that the position of the Administrative Manager had been vacant for a number of years. However, the Director of Finance and Administration had been receiving responsibility allowance for this position even though the job is belo w his status and there was no due process for him to receive that allowance as he was the supervisor or line Manager of the vacant position. Implications Collecting responsibility allowance for a vacant position and/or position below the rank of Director without following due process was an abuse of office and a recipe for corruption. Recommendation ➢ Management should ensure that the Finance and Administration Director refunds such allowance(s) collected for the vacant position of Administrative Manager for the entire period. ➢ Management has to ensure that acting/responsibility allowances are paid to employees who are acting in a senior position rather than the reverse. Management Response The recommendation is and necessary action will be taken. 8.7.3 Leave Allowance Findings The team observed that on the 30 th April 2020 , part of the leave allowance was paid ( cheque number 02428629 ) to the Director of Finance and Administration. However, when the Director of Finance and Administration was proceeding on leave, he was paid in full his annual leave allowance rather than the outstanding leave pay

18. 17 7 .2.3 Budget Committee Findings There was no evidence to show that a Budget Committee existed to guide the budget process. Implication Without a Budget Committee It will be difficult to guide the budget and ensure budgetary controls. Recommendation s ➢ The Company should immediately constitute a Budget Committee comprising of all heads of departments and representative of the Board. ➢ The Committee should be given the free hand to guide and regulate the budget process. Management Responses The comments from the ACC are noted. A Budget committee will be constitut ed as per ACC’s recommendation. 8.3 BUDGET FUNDING The Company’s key funding sources are the government of Sierra Leone, Own Source Revenue (OSR) and Donors. GVWC does not receive subvention from Government to undertake their budgetary activities. Budgetary activities are tied with it revenue generated from its Own Source. Notwithstanding the fact that no subvention allocation is

45. 44 of debt owed by MDAs to GVWC and GVWC’s debt to NRA with regards to PAYE and WHT. Finding During the review, the team observed the non - payment of PAYE totaling Le 10,478,047,309.46 (ten billion, four hundred and seventy eight million and forty seven thousand three hundred and nine Leones forty six cents) was deducted from staff salary at source as Pay As You Earn Tax (PAYE) but never paid to the regulatory authority. Implication Failure to fulfill tax obligations does not only deprive the State of much needed revenue, but it is also a violation of tax laws. Recommendation s ➢ All PAYE taxes must be paid promptly and Management should ensure mechanisms are put in place to regularize outstanding PAYE. ➢ Management and Anti - Corruption Commission should investigate the amount deducted but not paid to National Revenue Authority (NRA). Management Response We have noted the ACC’s comments. Prior to the review, the Company was in dialogue with the Ministry of Finance for a cross debt settlement arrangement of debt owed by MDAs to GVWC and GVWC’s debt to NRA with regards to PAYE and WHT. 8.6.2.5 Cash Handling Finding It was also discovered that huge cash was handled and paid over the counter by the Account Clerk to various workers. The payment was made to 200 staff

17. 16 Implications ➢ Without the participation of departmental staff, the budgets tend to be less accurate and closer to the actual situation on the ground therefore making the public budget less equitable and ineffective. ➢ Late preparation of budget will render spending unguided and vulnerable to misappropriation. Recommendations ➢ We recommend that the budget process be highly participatory. That is, the budgeting process starts at the departmental level and moves up to higher levels. Every department within the institution will be required to prepare plans for its proposed activiti es for the next budget period and estimate the costs it will incur. These individual budgets are combined to get a master budget. ➢ Annual budget should be prepared and approved before the start of every financial year . Management Responses ➢ Preceding the processing of the annual Budget, budget circularization is sent to all Directorates and Heads of Unit for their various inputs into the Budget process. ➢ The vacant position of a Budget Officer was advertised and recruitment process is in progress. Once completed, all management accounting functions will be undertaken by the Budget Officer ➢ The position of Management Accountant will be considered once the cash flow situation improves. ➢ GVWC Management has however noted the comments regarding the submission of activity plans for preparation of subsequent Budget.

47. 46 given on a petty cash request per month as there is no policy on petty cash disbursement. ➢ Also, it was observed that there were no receipt and/ or supporting documents on most of the petty cash retirement submitted to support their claims. Implication s ➢ Collecting petty cash funds on multiple occasions within a month shows waste of resources. ➢ Bypassing the Managing Director (Vote Controller) is a breach of procedure and raises concerns regarding unapproved cash disbursements and spending. ➢ Disbursing funds for petty cash without a float and policy will lead to abuse of company’s financial resources. ➢ Replenishing petty cash with supporting document is poor accounting and reporting procedures. Recommendations ➢ The Financial Accountant should ensure that all petty cash requests are approved by the Managing Director before payments were effected. ➢ Management should ensure that a petty cash policy should be developed and properly regulated with clearly indication of the float to be issued per month per department. Also, petty cash disbursement should be made on a monthly basis to departmental heads and reimbursed after reconciliation with the relevant support ing documents. Management Response The Company’s Petty Cash Policy allows a Directorate with more than one Unit under his/her control to maintain more than one petty cash floats.

1. 0 REPORT ON THE REVIEW OF BUDGET ALLOCATIONS AND UTILIZATION IN THE WATER SECTOR: GUMA VALLEY WATER COMPANY 2021 ANTI - CORRUPTION COMMISSION

16. 15 A 5 years Strategic Plan exist and can be made available. 7 .2.2 Participation in budget Preparation Section 44.9 of the Financial and Accounting Policies and Procedures Manual (final draft July 2007) of Guma Valley Water Company states that “all Senior Managers and Area Managers are expected to manage their affairs within the approved budget. Once budgets have been approved at head office level, mechanisms sho uld be in force to allocate these figures to areas and departments. Finance Managers will satisfy that appropriate arrangements are in place.” Finding s ➢ The T eam found that the Board requested the expertise of the Director of Corporate Services (a Chartered Accountant) to prepare the Company’s 2019 and 2020 budget. ➢ Furthermore, the budget preparation process was fully handled by the Finance Unit as the post of Management Accountant was vacant. There was also no Budget Officer. The budget preparatory process was not fully participatory. ➢ The budget is not prepared prior to the commencement of the financial year. It was mostly prepared in August whilst the financial year run from January to December. ➢ It is stated in the Financial M anual that budget must have a supporting schedule. The T eam did not see such schedule and could not set eyes on any departmental activity plan and/or proposal in line with the budget with regards budget implementation. The budget did not allocate any resources to the various management levels linked with depart mental objectives and strategic priorities. In essence, the budget is not participatory.

22. 21 From the data it is clear to see that some revenue sources are not providing enough as one will anticipate. For example one will expect high revenue from domestic clients taking into consideration the high number of dwelling houses. There is no strategy in place to investigate the poor performance of these revenue sources. There are accusations that domestic bills are written off/adjusted without any proper guidelines or procedures. Implication The low revenue from some revenue streams gives an indication that the revenue collection drive is weak or that revenue generation is been underreported. Recommendation s ➢ The Company should conduct annual review of the performance of its revenue streams in a bid to investigate poor performance and device strategies to enhance revenue generation. ➢ Targets should be set for each revenue stream and any shortfall investigated. ➢ There should be regular audits of revenue generated to ensure leakages are plugged. ➢ The B illing S ystem and its related matters should be reviewed. ➢ A clear policy or guide should be developed on how customers can challenge bill and how bill can be adjusted, waived or settled. Management Response The recommendations are noted. Prior to this Report, Management engaged the services of 12 Enumerators for house - to - house field verification and update of the database. Furthermore, close attention was given to the valve regulation

37. 36 Figure 8 : Terrain leading to the Weir at Mambo Forest reserved areas surrounding the weir situated at Mambo was seriously experiencing deforestation, coal mining, timber and/wood harvesting. These activities adversely affected the water flow to the dam. Figure 9 1 : Deforestation of reserved land Figure 10 : Coal M ining Site after T imber L ogging

33. 32 8.5.1 THE 45 INDUSTRIAL BOREHOLES PROJECT (MAMBO / HAMILTON / WATERLOO GRAVITY WATER PROJECT) The 45 Industrial Boreholes Project was used by the Review Team as a sample to examine how projects are managed by the Company. The 45 Industrial boreholes project came into existence after the major water supply challenge that hit Freetown in the dry season of 2016. This project was identified as a medium term project by the end of 2016. The project got cabinet approval in 2017 un der the leadership of Hon. MomoduMaligi. The project was spear headed from its inception by the Ministry of Water Resources. A total of 15 reservoirs (3 units to 1 system) were incorporated into the project. The industrial borehole was estimated to deliver at least 10m³/h each. This means that every reservoir would have been supplied with 240m³/day of water complementing the c urrent water supply. This would have benefitted a total population of around 30,000 people. The cost of the project was US$9.9 million which was equivalent to Le78 Billion as at October 2017 when the project was approved by cabinet. 8.5.1.2 THE NEW SCOPE OF THE PROJECT GVWC initiated the idea of changing the scope to gravity systems because of the uncertainties with boreholes. Until a proper study was carried out to clearly determine well fields locations, it was opined that the existing scope will not meet the value for money. The Ministry decided to engage the contractors to look at this possibility and if it was not already too late. The contractors agreed to a scope change and requested to visit all the sites before any action was taken. A site visit to all the locati ons were carried out and Bills of Quantities & drawings were generated by GVWC and SALWACO engineers. The scope (attached with this summary note) included; i. development of gravity water supply systems in Waterloo and Hamilton; procurement of 20km of distribution pipelines of various sizes;

60. 59 There is no dedicated expenditure code for recruitment process. Expenditures on recruitment process are charged to their various account codes; e.g., advertisement will be charged to communications, snacks and drinks during the interview will be charged to communications. The budget was however making provisions for personnel cost for the increase in staff due to recruitment . 8.8 PROCUREMENT MANAGEMENT 8.8.1 PROCUREMENT PLAN According to Section 29 (1) of the NPPA 2016, all procuring entities shall undertake procurement planning, with a view to achieving maximum value for public expenditures and the other objects of this Act. Finding There was a procurement plan but the review team noted that the procurement plan was inclusive of non - procurement items which were already taken care of in the budget. Items such as Salaries and wages, Nassit payments etc. Implication Including non - procurement items such are salaries and wages is not in line with Section 29 (1) of the NPPA 2016. Recommendation The Procurement Unit should ensure that procurement plans are inclusive of procurement items rather than the inclusion of non - procurement items.

34. 33 ii. development of gravity water supply systems in Daru, Bendu, Yawei, Tongo and rehabilitation of borehole water supply system in Daru hospital. iii. The Ministry has completed the contract amendment process and the contracts have been signed by all the contractors and the Ministry of Water Resources. i v . The Mambo/Hamilton community water project was developed to help improve the safe drinking water situation along the peninsula. Since these communities were situated along Guma W ater C ompany transmission route, they depended mainly on its supplies just as many other communities along the peninsula. This in return reduced immensely the water supplies to the capital. 8.5.2 THE MAMBO RESERVOIR (WEIR) The weir is one of the foremost components of this project but the Review Team observed that it was still under construction. The T eam was concerned about its timely completion since we are now in the period for rains . Figure 4 : M a mbo Weir

71. 70 Figure 11 : Procured Equipm e nt not used Implication There were wastages of the Company’s resources all as a result of improper procurement planning. Recommendation Management should make sure that procurement of items are of the correct specifications and needs. Management Response Considering the age of GVWC Pipe network system, Management is aware of the non - availability of some of these items in the market. However, these items are procured in the event of emergencies or major breakdown of our network system. Therefore, these items are not wastage of company resources. 8.9.4 Store Environment The Store is not tidily kept though spacious as it is located in a disaster prone area and it floods during the rains.

69. 68 Findings Most items procured were taken directly to site without going through stores verification. The storekeepers only do post charge after the goods were delivered or used. Neither the storekeeper nor the Internal Auditor or both do witness the supplies of thes e goods. Implication Direct delivery of goods to sites without any verification by the storekeeper and the Internal Auditor might cause the goods supplied that did not meet the required specification . Recommendation Storekeepers should be allowed to take goods on charge before distribution to sites. Also, the Internal Audit Unit should have a representative to witness and/or verify all supplies. Management Response The recommendation of ACC is noted and necessary action has already been taken. Management has approved a Stores Policy and Procedure Manual which will be implemented. 8.9.2 RECORDS MANAGEMENT The T eam observed that stores records were poorly managed by the store custodians. Bin cards were not up to date and they were not shelved alongside the respective items. Also, upon physical verification, the review team observed the following inconsistencies on the bin cards: ITEM BID CARD BALANCE PHYSICAL BALANCE 2” Gasket 7 8

23. 22 system in a bid to increase access to water particularly for areas experiencing low pressure. The outcome of these activities will impact positively on revenue generation. 8.3.2.1 Revenue Generation R eporting The T eam collected data from the Finance and Commercial Departments on revenue generated. Upon verification of documents, we discovered that the revenue figures reported by the two departments were not consistent with each other. There was no evidence to show that the two departments conduct regular reconciliation to identify, investigate and address variances and as a result the accuracy of the figures reported for generated revenue become doubtful. The table below shows figures of inconsistency. The table above shows inconsistencies in figures presented to the team with regards revenue generation from the two departments. There is a variance of Le7,133,295,000 (Seven Billion one hundred and thirty three million two hundred and ninety five thousand Leones) between the two figures presented. Implication Failure to accurately report on revenue generated creates the risk of revenue being unaccountable and vulnerable to corruption. Recommendation s FINANCE DAPARTMENT LE’000 COMMERCIAL DEPARTMENT LE’000 29,042,743 21,909,448

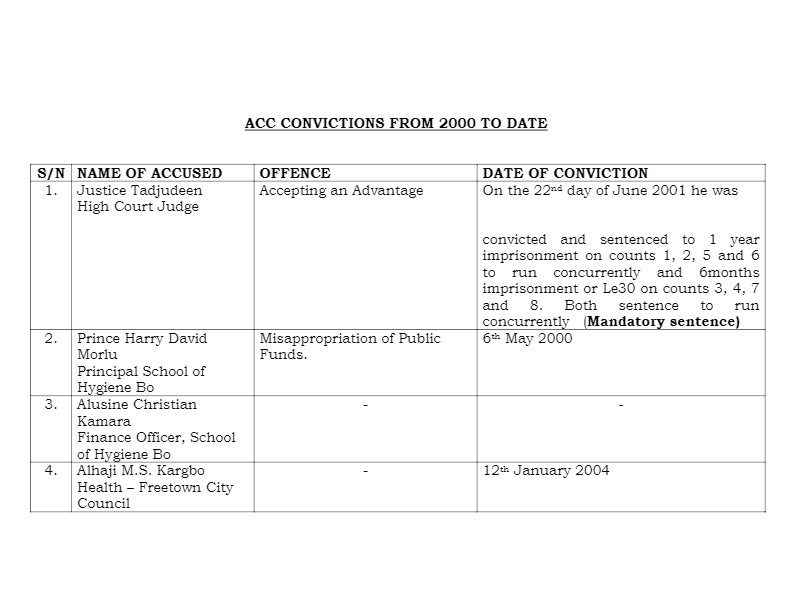

9. 8 1.0 BACKGROUND INTRODUCTION The Anti - Corruption Commission (ACC) was established with the primary aim to prevent, investigate and prosecute corrupt offenders and to also provide accurate information to the general public on the dangers of corruption in our society. The preventive asp ect of the ACC is provided for in Section 7 and 8 of the Anti - Corruption Act of 2008 as amended. The ACC has benefited from Funds from the OSIWA to enhance the effectiveness and efficiency of the Prevention Department. Part of the fund is meant to conduct Thematic Review of the Ministry of Water Resources on budgetary allocation and Utilization inclusive of its agencies (except Sierra Leone Electricity and Water Regulatory Agency (SLEWRA) • Sierra Leone Water Company (SALWACO) • Guma Valley Water Company (GUMA) • National Water Resources Management Agency (NWRMA) When it comes to budgeting, identifying areas of weakness helps the government to allocate resources in a useful and sustainable manner. It’s important for the government to ensure that funds reach where it’s required the most. Therefore using past data to identify sections of the society in need of eco nomic welfare policies and implementing those policies helps the government demonstrate efficient governance and achieve economic stability in the country. The Ministry of Finance is a key player in the Budget allocation to Ministries Department and Agencies (MDAs), therefore, our work required the cooperation and collaboration with the Ministry. Capital expenditures refer to funds that are used by the Ministry for the procurement, improvement, or maintenance of long - term assets (projects) to improve the efficiency or capacity of the Ministry.

79. 78 ➢ Management of GVWC should establish and execute a strategy for managing the debt in order to raise the required amount of revenue at the lowest possible cost over the medium to long term, consistent with a prudent degree of risk. ➢ Furthermore, a debt management policy should be instituted for all debtors and lastly, a robust debt collection team has to be constituted. Management Response The recommendation of ACC is noted and necessary action will be taken. 8.13 BUDGET CONTROL In practice it meant regularly comparing actual income or expenditure to planned income or expenditure to identify whether or not corrective actions are required. 8.13.1 INTERNAL AUDIT According to the Institute of Internal Auditor (IIA), "Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes." 8.13.1.1 Physical Verification of Deliverables (Compliance Audit) Section 6(4) of the GBAA 2005 states that the Internal Auditor has the following duties in the performance of its functions: Ensure strict adherence to all control procedures introduced to safeguard the assets and records of Government; and

74. 73 Recommendation The Management of GVWC had the responsibility to ensure that there is a detailed policy on maintenance which should be followed by an annual maintenance schedule/plan. Management Response The recommendation of ACC is noted and necessary action will be taken. 8.10.2 Fuel Management Finding s ➢ There was no proper accountability in the area of fuel management and fuel was distributed at the discretion of the Store Manager and the Head of Garage. ➢ There was no policy on fuel distribution and allocation as fuel was distributed to vehicles that were not in working order. ➢ With respect to fuel request procedures, it was observed that no technical knowledge was used to determine the quantum of fuel a vehicle or motorbike can consume per kilometer covered. In some transactions, fuel request forms were not attached to the fuel chit; ➢ Unavailability of fuel reconciliation reports with fu el suppliers on fuel allocation. Implication This was a clear indication of abuse of office and wastage of Company’s resources. Fraudulent fuel skimming can occur when drivers or thieves replace card readers at gas stations with a skimmer that captures cardholder data. Recommendation s

13. 12 Section 64 (1)PFM Act of 2016 states that “ A payment voucher for making payments to expenditures of a budgetary agency shall be certified by the vote controller of the budgetary agency or other public officer authorized by him ”. Section 18(1) of the Performance Financial Management - Regulation (PFM - R) 2018 stipulates that “ the budget call circular shall require every vote controller to submit within a specified time and in a prescribed manner a medium - term budget framework for his budget entity, including - (a) a medium - term strategy and target outcomes in line with national and sectoral strategies, and key performance indicators for assessing the achievement of the outcomes; (b) detailed work plans for the implementation of the strategy and the anticipated revenue and recurrent and capital expenditure for the following three years within the financial ceilings prescribed by the Minister; (c) a procurement plan showing details of the estimated amount of continuing contracts and each contract to be entered into in the following year, item to be purchased, estimated timing and amount of payments, and the modality of each contract; and (d) revised estimates of revenue and expenditure for the current year . Additionally , Section 18( 2 ) of the Performance Financial Management - Regulation (PFM - R) 2018 “ A vote controller shall, in preparing draft estimates of revenue and expenditure, convene a budget committee meeting to review and ensure that the estimates are realistic and accurate in all respects and are prepared with the involvement of all relevant di visional or programme officers, procurement officers, internal auditors and other relevant officials of the budgetary agency in accordance with any other instruc tion or guideline given by the minister.” In order for the Ministry of Finance to approve and disburse funds for a quarter, Ministry Departments and Agencies (MDAs) have to prepare and submit a Trogas Report for previous allocation disbursed by the Ministry (actual allocation).

61. 60 Management Response s ➢ The meaning of non - Procurement is expenditures that the company will incur, without a procurement method or not having to go through the P rocurement U nit. ➢ Regulation 28.(1) Procuring entities shall prepare a procurement plan for each fiscal year, containing the information required by Regulation29 using the template provided by the Authority.1 ➢ Annual procurement planning shall be fully integrated with applicable budget processes and circulars issued by the Authority and instructions of the Ministry of Finance. ➢ The Procurement Plan template that is in use is issued by the National Public Procurement Authority, until unless otherwise advised by the Authority as stated above in Regulation 28(1) . ➢ A Procurement Plan must be in balance with the company`s budgeted expenditure. All Procurement activities/items are also emanated from the budget or taken care of in the budget. ➢ The budget is the intention of how the company wants to spend. However, Procurement Plan is the implementation. ➢ The meaning of non - Procurement is expenditures that the company will incur, without a procurement method or not having to go through the P rocurement U nit. 8.8.2 PROCUREMENT OF VEHICLES Both the procurement plan and the budget stated that 4 vehicles were to be bought at total cost of $144,000 (one hundred and forty four thousand United

42. 41 8.6.2 FINANCIAL MANAGEMENT 8.6.2.1 FINANCIAL STATEMENT Findings ➢ We discovered that the actual figures/amounts stated on the Financial Statements were unaudited figures. ➢ The Financial and Accounting Policies and Procedures Manual (final draft July 2007) of Guma Valley Water Company, was out dated and yet still a draft. ➢ The Management Accountant Position is vacant till to the time of the conclusion of our review. Implications ➢ Without the financial statements being audited, it leaves the accuracy and authenticity of the figures unverified thereby casting doubt whether the financial statements represent the true state of affairs of the company. ➢ Lack of approved and updated Financial Manual creates challenges in applied modern trends in financial regulations and standards. ➢ Management accountant plays an important role the stewardship of financial management. For example they design the frame work of cost and financial accounts and prepare reports for routine financial and operational decision making. Therefore a lack of one will create challenges in managing the finances of the Company Recommendations Management should ensure that: ➢ The vacant management accountant position is occupied to affect the budgetary process. ➢ Departmental activity plan are prepared in line with the budget ➢ The Accounting Policies and Procedure Manual be revised and updated

59. 58 Management Response A loan portfolio with a dedicated account was established at the SLCB in 2 020 and currently in operations 8.7.6 Recruitment Processes Findings ➢ A total of Le429,868,356.77 (four hundred and twenty - nine million eight hundred and sixty - eight thousand three hundred and fifty - six Leones Seventy - seven Cents) was budgeted for on recruitment process. The team observed that this amount was reported as part of salaries and wages for proposed staff to be recruited but in an interview with officers of the HR unit it was stated that the above amount was cost associated with the recruitment process . ➢ The C ompany Recruited a total of 21 staff in 2019 but no evidence of cost associated to the recruitment process provided to the team. Implication Failure to effectively allocate amount to actual cost centers and heading will distort the financial report of the Company. Recommendation s ➢ Management through the Human Resources Unit, should certify that a coasted manpower recruitment plan be included in the budget separate from salary amount. ➢ All monies spent on recruitment processes should be accounted for with the necessary supporting documents. Management Response

38. 37 Findings ➢ The Review Team observed the following across the various projects assessed: ➢ There were weak project management and monitoring mechanism in place. No project document was presented to the Review Team to determine the project phases/benchmarks and timelines. This makes it very difficult for progress of the project to be monitored and necessary actions taken. Also it is difficult to determine the basis or justification on which payment to contractors have b een made so far. ➢ No project specifications were made available to the Review Team ➢ There were marked delays in the approval of funds from some of the donors. ➢ There were also delays in the implementation of projects ➢ There were challenges in accounting for the projects. Report on project funding and expenses were hard to come by. ➢ There were weak monitoring systems of the projects. No monitoring reports by Guma besides the copy of project update submitted by the contractor. ➢ There are strong indications that proper planning and consultation were not done with the communities and as a result the project in some areas lacks vital community support. Stakeholders analysis was not done. ➢ The Company is failing to take necessary actions to protect the investments. Some project sites are experiencing deforestation which will affect vital supply to these sites. Implications ➢ Delay in funding will result to delay in project completion and increase in cost due to inflation etc. ➢ Without proper accounting and monitoring systems in place, it will be difficult to identify or detect project deviations and misappropriations.

40. 39 ➢ A clear formula/metric should be used to assess work done. Milestones should be set for various activities Management Response This is correct. Please note the comment above. This is correct. The Contractor was stopped from carrying out any further works by the Military as the location falls within their training area. The CDS was engaged and the issue has been resolved. 8.6 BUDGET A RY ITEMS The T eam conducted a random sample of some budget items and compared same with the actual (unaudited financial statements) to determine the variance (if any). 8.6.1. MEDICAL EXPENSES/CLAIMS GVWC has a medical facility at the Public Works Department (PWD) with a Doctor who worked on a 2hrs daily basis. The facility has stationed nurses. Staff is beneficiaries to medical facility and they can make claims when seeking medical attention from hospitals depen ding on the medical conditions of persons concerned. Medical bills are forwarded to the Human Resources Manager for actions to be taken on the refund of such medical claims. Ideally, for a claim to be honored by the company, it has to be vetted by the Doctor at PWD before HR starts the process for payment or refund. The table below shows the budgeted amount as against Actual amount for staff medical for the period under review. BUDGET LE’000 ACTUAL LE,000 VARIANCE LE,000 244,560 245,656 1,096

39. 38 ➢ Deforestation decreased the capacity of soil infiltration of water , increases soil erosion, and decreases the quality of water at the source. The loss of trees and other vegetation can cause climate change, desertification, soil erosion, fewer crops, flooding, increased greenhouse gases in the atmosphere, and a host of problems for indigenous people. ➢ Owing to the distance covered from the main road to the site, it was highly likely that the work will not be completed on time because transporting the materials to site on a difficult terrine involved more labour and hence had has cost implications. Recommendations ➢ The Company should establish an effective project management and monitoring mechanisms for all its projects. ➢ The donor should ensure that funds are provided on time. ➢ Implementation should be within projects timeframe. ➢ All projects should have proper accounting mechanism in place. ➢ There should be effective monitoring systems ➢ The ACC should conduct investigations into all projects. ➢ GVWC/Contractor should have community engagement with the stakeholders of the community to identify land/locations for the kiosks to be erected. ➢ Protection and restoration of forests were included among the targets required to achieve the United Nations Sustainable Development Goals (SDG 6: Clean Water and Sanitation). SDG 15 explicitly indicates the value of forests with reference to the attainmen t of clean drinking water. ➢ The Management of GVWC should work with the Freetown City Council (FCC), and the Ministry of Agriculture and Forestry (MAF) to organize tree planting in the said areas and also work with NPAA to station Forest Guards in the area to ensure that these activi ties are put under control. Also, the Ministry of Lands and Country Planning to ensure the areas are protected from land grabbers.

12. 11 a unit to be known as the Budget Bureau which shall, under the supervision of the Financial Secretary, be responsible for the preparation and monitoring of the budget in collaboration with the budgetary agencies ”. Section 20(2) of the Government Budget and Accountability Act (GBAA) of 2002 states that “ each budgetary agency shall establish a budget committee comprising the vote controller, the professional head, if any, programme managers and provincial and district managers, to be responsible for preparing the strategic plans and annual estimates of the agency, apportioning quarterly allocations and monitoring expenditure and results.” Section 53 (1) (GBAA) of 2002 provides that “ the vote controller of a budgetary agency shall, within ten days after the end of each month, submit to the Financial Secretary, in the prescribed form, information on actual revenue and expenditure for the preceding month and the amounts anticipated to be collecte d or expended for that month .” Section 56 (1) of the Public Financial Management (PFM) Act of 2016 states that “ At the beginning of a financial year, the Minister may require a head of a budgetary agency to submit to him for his approval monthly forecasts under the Estimates for such period of time as specified by the Minister ”. Also, S ection 56 (2) of PFM Act of 2016 stipulates that, “ An appropriation allotment shall be prepared and submitted in such form and manner and by such date as may be prescribed by the Minister”. Furthermore, Section 56 (3 ) of PFM Act of 2016 “ notwithstanding subsection (1) and (2), the Minister may by himself determine and vary an appropriation allotment of a budgetary agency” . Section 15(2) of the Performance Financial Management - Regulation (PFM - R) 2018 states that “ A budget call circular shall give budgetary agencies and sub - vented agencies at least a six week - period for preparation of their budget proposal.”

63. 62 Management should ensure any adaptation to the procurement plan has to be followed by a supplementary budget stating the adjustment to the existing procurement. Management Response s ➢ Budget is a projection of expenditure in a future period based on certain assumptions. ➢ A Procurement Plan is projection of acquisitions to be made in a future period, based on certain assumptions. ➢ Since both instruments are planning tools, therefore they are not static or cast - in - stones. It is inevitable that there will always be variances and not deviations. ➢ To accommodate budget variances, budgeted lines and figures are mostly re - adjusted rather than involving in an extra budgetary process, meaning budgeting again for new streams of income. ➢ In a procurement Plan, there are fields for Plan and Actuals, therefore the procurement Plan will be updated to show the plan vs. actuals. ➢ Change in quantity is as a result of observations made in the prevailing market conditions as regards change the market prices at the time of acquisition process. ➢ GVWC is not a GoSL sub - vented Agency, therefore extra budgetary process is not usually applied in its case. 8.8.3 Records Management (Filing System ) Section 32 (1) of NPPA 2016 states that the procuring entity shall preserve all documentation relating to the procurement processes, in accordance with applicable rules concerning archiving of government documentation, but at a minimum for a period of six years following the date of final completion of the

20. 19 ➢ Having two different figures (actual) for revenue generation makes it difficult to ascertain the correct figure in making judgment. Recommendation s ➢ GVWC to investigate and determine the factors responsible for the drop in revenue and take necessary action to improve on revenue. ➢ Management should ensure, there is consistency in reporting figures so as to give a correct picture of the company’s finances. Management Response The reasons for the unfavorable variance in revenue generation was identified and it was partly due to non - approval of tariff, non - installation of meters, lack of adequate funds to undertake a comprehensive replacement of spaghetti connections with sub mains i n the areas listed in the activity plans. The budgeted was based on the implementation of the mentioned activities. 8.3.2 REVENUE STREAMS The Commercial Services Department is the hub of revenue generation of the GVWC. Revenues / income generations are derived from various sources including the following: ➢ Government/public Offices ➢ Bowser Water Deliveries ➢ Domestic Metered Supply ➢ Community Service ➢ Commercial/Business enterprises ➢ Residential ➢ Other Income

11. 10 4.0 METHODOLOGY The M ethodology for this study involved both quantitative and qualitative research. The team conducted interviews with key staff especially “those who bear the greatest responsibilities in the performance of their duties,” in line with the review objectives. The review process was initiated by an inception meeting with Management of the Ministry of Water Resources and its Agencies. The team examined information on: • Approved budgeted activities for the years under review • Actual allocations and/or notification of disbursement • Actual expenditure, utilization and accountability of allocation for years under review (actual) • Actual expenditure for periods under review • Balance of annual budget remaining • Variances • Bank statements • supporting documents of utilized budget • Returns per quarter and /or per annum • Physical verifications on projects and capital expenditures 5.0 LIMITATIONS OF THE REVIEW The Ministry of Finance did not provide information requested by the Review Team; as a result the review was based only on information provided by the Ministry of Water Resources and its Agencies. 6.0 THE BUDGET PROCESS Section 20 (1) of the Government Budget and Accountability Act (GBAA)of 2005 states that “ There shall continue to exist within the Ministry,

15. 14 Since there had been numerous allegations both in the print and electronic media about challenges faced in the management of water in this sector, the ACC through its Prevention Department, intervened to identify weakness and proffered recommendations in o rder to improve on service delivery. 7 .1 FINDINGS AND RECOMMENDATIONS 7 .2 BUDGET PREPARATION 7 .2.1 Strategic Plan Findings No Strategic Plan was presented to the Review Team which would have been the key guide for the budget preparation. Implications The strategic pl an lays out the direction and goals of the business and guidelines for actions to achieve those goals, while the budget looks at the money needed to support achieving those goals. Therefore if the budget is not aligned to strategic plan, the institution will struggle to fulfill its mandate and will result to wastages of resources. Recommendations ➢ We recommend that a S trategic P lan be developed in a participatory manner and clearly states the targets and goals of the I nstitution. ➢ This strategy should be popularized to all departments with a view that each department identifies its mandate and path in pursuing the overall goals. ➢ We recommend that the budget be aligned to achieving the goals set out in the Strategic Plan Management Responses

52. 51 It is evident from the illustration above that Director of Finance and Admin had collected a sum totaling Le26,000,000 (T wenty Six Million Leones) as salary advance from various dates. This amount was never deducted from his salary drawback and in essence the Finance Director still owes the Company Le26,000,000. The T eam went further to verify the payment transfer documents and noticed that Director of Finance and Admin transfers were not on file and could not be traced among other documents. All other payment slips for the other Directors were seen except that of the Director of Finance and Admin. Implication The salary advance collected by the Director of Finance without deduction from his salary payment is an act of corruption. Recommendations ➢ Management should ensure that Director of Finance and Admin refunds the excess of Le26,000,000 ( twenty - Six Million Leones) immediately or instruct payroll to deduct the said amount from his subsequent salaries. ➢ Evidence of deductions should be forwarded to the Anti - Corruption Commission Management Response The recommendation of ACC is noted and necessary action will be taken. 8.7 HUMAN RESOURCES MANAGEMENT 02 nd May 2019 5,000,000 21 st May 2019 6,000,000 Total 26,000,000

72. 71 Figure 12 : Store’s Environment Implication Due to the flooding, materials procured became rusty and caused loss of revenue to the company. Recommendation Management should relocate the stores to a more tidy location Management Response The recommendation of ACC is noted and necessary action will be taken. 8.10 GARAGE AND FUEL MANAGEMENT The budget of GVWC allocated a huge sum of money to engineering and fuel/transport and spare parts/maintenance. The table below shows analysis of the budgeted, actual and variances of amount utilized. The above analysis shows that a total of Le1,217,966(One Billion two hundred and seventeen million Leones) was budgeted for fuel with an expenditure (as provided in the trial balance) was Le2,232,315 (Two Billion Two hundred and Items Budget Le,000 Actual Le,000 Variance Le’000 Transport &Fuel 1, 217,966 2,232,315 (1,014,349) Spare parts/Maintenance 88,652 434,891 (346,239)