KOIDU NEW SEMBEHUN CITY COUNCIL

Share on Social Networks

Share Link

Use permanent link to share in social mediaShare with a friend

Please login to send this document by email!

Embed in your website

39. 38

2. 1 CONTENTS

1. March 2020

38. 37 It is therefore of utmost important that the managements of the two entities , together with other stakeholders take the necessary actions consistent with recommendations in this report to address these challenges . It is only then that they can actually deliver on their respective mandates.

17. 16 Implication There are strong indications of circumstances for the misappropriation of funds. Recommendation • Procurement laws and policies must be strictly adhered to when procuring services. If contingencies of work cannot permit for a fresh procurement process to be conducted whenever there is need to repair, management should consider a framework contract with due process followed in achieving it. • No repairs or maintenance should be done without SLRTA assessment and approval. 4.6.2 Cash payments to suppliers . Findings • It was discovered that payments to suppliers were not made through bank transactions.

13. 12 verified by the verification team for which the Internal Auditor is part of before the goods /services/works are delivered . • This process is required in order to confirm completeness and value for money . • The verification team should produce a verification report certifying delivery and compliance to specifications for every delivery made and they are to attach the report to the procurement records of that transaction. This report will constitute part of the basis on which Paymen t to suppliers will be made . No payment should be made without the report. 4.4 Area of Focus: Staffing Capacity Section 17 (1) of the National Public Procurement Act (NPPA) 2016 states that “Procurement - related functions shall be carried out by procurement persons, trained, and knowledgeable in accordance with the guidelines, and qualification requirements established by the Authority.” Also, Section 19 (1) of the Public Procurement Act 2016 states that “A Procurement Unit shall be established in each procuring entity, staffed with persons trained and knowledgeable in procurement and charged with carrying out, on a continuous basis, functions related to procurement”.

37. 36 of KNSCC The above table shows receipts issued for completed transactions but not dated. Implication(s) Failure to accurately record transaction makes it difficult to effective account for moneys expended and creates room for corruption. There is strong suspicion that these undated receipts were used to double charge the Council subsequent periods. Recommendation(s) Council and hospital should ensure that all financial documents issued are correct ly dated to reflect the correct period of the transaction. 8 . CONCLUSION The review ha s revealed serious lapses in the management of devolved fund s and procurement processes at the KNSCC and the K GH . These lapses have impacted accountability and transparency negatively hence created an environment that is suitable for corruption to thrive . In such circumstances, these entities will find it difficult to effectively and efficiently provide the service for which they were set up.

20. 19 technical support from the hospital management and pharmacists. Implication Without inputs from the requesting entities on specifications and quality it is difficult to see how effectively the procurement will address the entities needs and ensure value for money. This also undermines transparency and accountability Recommendation • The Hospital management and pharmacist should be involved and consulted on the procurement process of drugs and other supplies to ensure the right specification and quality are achieved. • Representatives from the Hospital should be members of the Procurement Committee and Procurement Evaluation committee for procurement transactions on behalf of the Hospital. 5. STORES MANAGEMENT Store management is concerned with ensuring that all the activities involved in storekeeping and stock control are carried out efficiently and economically by the store personnel. Store keeping is the function of receiving materials, storing

29. 28 • Tracking of the Council assets will be difficult as there are no records to follow. Assets will go missing with no one noticing. Recommendation(s) • A Fixed Asset Register must be maintained for both local purchases and donations so that assets are tracked, recorded for proper reporting and audit purposes. • The assets can also be coded for ease of identification. 7.4 Area of focus: Minimum Wage The then Minister of Labour and Social Security, Dr. Matthew M. Timbo, tabled the statutory instrument No.6 of 2014 on the Regulation of Wages and Industrial Relations Act of 1971 (Act No.18 of 1971). Parliament unanimously adopted the minimum wage statutory instrument for the private sector with respect to an increase in the minimum wage. This instrument, named the National Minimum Rate of Payment for Workers, shall now be Five Hundred Thousand Leones (Le 5 00,000. 00) and would came to effect on the 1st day of January 2015. Finding(s) It was discovered that KNSCC did not comply with the minimum wage payment to its workers as was promulgated by law and this ha d affected 62 workers in the institution since January

9. 8 Finding(s) • The review team did not access any procurement plan for both the Council and the Hospital for the period under review as prescribed in S29 (2) above. • All that was provided to the team was procurement activities completed in 2015 - 2018. • The procurement activities conducted were unguided and were based on the discretion of few individuals without addressing the strategic needs of the Councils and the Hospital. Implication(s) The absence of a Procurement Plan w ould prevent the Council from prioritizing its procurement needs and achieving value for money. Recommendation(s) The Procurement Officer should ensure that standardize d procurement plan s for both the Council and the hospital as prescribed by the Act are prepared . The procurement plan for the hospital should be based on the budget prepared by the Hospital management and should be done in consultation with the hospital management. The Procurement Plan should be strictly followed and no procurement should be made if not in the plan. The Audit Committee constituted should ensure strict adherence to the

26. 25 Findings NASSIT contributions are deducted from staff earnings, but are not paid to NASSIT. The following are the accrued debt owed by K NSCC on behalf of staff NaSSIT contributions. PERIOD FOR WHICH PAYMENT WERE NOT MADE FOR CORE STAFF Year 2015 2017(July) 2018 (Aug – Dec) The figures for such outstanding NaSSIT contributions were not provided as such deductions were done by the Local Government Finance Department (10%) while the 5% were to be paid by Council. For the support staff, the following years were outstanding : Support staff Years 2015 2016 2017 (June - December) 2018 2019 (January – December) As at 3 rd July 2019, Council is indebted to the Trust: Le .

18. 17 • Cheques were drawn in the names of Council Staff who withdrew cash and then pa id the contractors/suppliers in cash . Implications This raise d serious concerns over the credibility of the procurement processes and collusion to misappropriate funds. Recommendations • All payments to suppliers should be by bank transactions. Cheques should be drawn on the suppliers name and not Council staff. • Any subsequent cash payments to suppliers should be investigated. Responsible officers should be held culpable for breach of the financial laws of Sierra Leone. 4.6.3 Verification of Suppliers Findings • Attempts were made to verify the existence of suppliers. This proved fruitless for majority of suppliers that were part of the sample chosen for verification. • Their offices could not be located nor contact persons reached.

34. 33 7.6 Area of focus: Cheques written in the names of staff members The team ascertained that cheques which were supposed to be written in the name s of suppliers were written in the name of a member of the F inance U nit. Implication(s) This clearly raises doubt as whether the suppliers actually received the payments. It creates conducive environment for corrupt practice. Recommendation(s) • All payments to suppliers should be by cheques drawn in the name of the business entity. If for some reasons this cannot be done, cheques should be done in name of the proprietor or head of the entity with special clearance from the Chief Administrator of the Council. • No cheque should ever be drawn in the name of a staff of the procuring entity that is: Council and Hospital. • All suppliers should be encouraged to open business account. If they fail to do so, Council should look for alternatives. 7.7 Area of focus: Failure to Authorize and / or sign Documents

21. 20 and distribut ing them to the various departments in order to maintain demand and supply. Stores should be under the control of a storekeeper. 5.1 Area of Focus: Storage and Distribution Findings • It was observed that there was no storage facility, no proper methods of storage and distribution of goods procured as they were packed in the corridors and o ffices of staff in the C ouncil. • The Hospital has a store for drugs. However drugs and other items procured by the Council for the Hospital do not go through the store s ; items were supplied directly to end users with no proper inventory taken . • For the period 2016 to 2019 only one batch of items procured went thr ough the store s although a high number of procurements were made. Implication(s) • Proper storage and inventory controls ensure that goods are maintained and their movement are tracked and accounted for. Goods could be easily stolen when left outside the corridors and offices of staff of the Council.

22. 21 • Failure to supply goods procured to store s for proper stock taking and verification before distribution will distort the audit trail and makes it difficult for accountability to prevail. • It creates a conducive environment for fraudulent procurement activities to occur. Recommendation(s) • It is recommended that a storage facility is provided. • It is also strongly recommended that items procured are supplied directly to stores for proper stock taking and verifications before stores distributed them to the end users. 5.2 Area of Focus: Storekeeper Findings T he team realized that in the absence of a storage facility, Council has not got a storekeeper to compliment the procurement process. Implications Without a store keeper to manage stores items and drugs procured will be difficult to be accounted for. Recommendation s

24. 23 • Pre and post A udit (internal controls) Implications The non - existence of the I nternal Audit Unit and/or Auditor has created and shown the weaknesses and loopholes in the entire systems. Recommendations • With immediate effect, an I nternal A udit U nit/ Auditors should be recruited followed by the composition of an A udit C ommittee. • A two years audit should be conducted as soon as the A udit U nit has been constituted to minimize and or control the weaknesses in the internal controls. 7. FINANCIAL MANAGEMENT 7.1 Area of Focus: Receipt /Supporting Documents Findings • Examination of financial records revealed that the Council and Hospital have consistently failed to properly account for fund s expended. • The team discovered that 60% of the documents verified, and examined were without receipts and other relevant documents to complete the transactions with suppliers.

25. 24 • Training workshops organized by the hospital amounting to tens of millions of Leones were not properly accounted for: signed attendance lists, signed allowance payment lists etc. were not seen. Implication(s) Incomplete documentation will affect an audit process and show s that the due process es were not followed . This was a clear example of corruption vulnerability. Recommendation(s) • All transactions should have supporting documents, including receipts, to finalize transactions for audit purpose. • The due process must be observed in expending funds. 7.2 Area of Focus: Withholding Tax, PAYE and NASSIT • Section 117 of the Income Tax Act 2018 mandates a 5.5% Withholding Tax Payments to contractors/ or suppliers to be deducted at source of income. • Section 25 (1&2) of the NASSIT Act of 2001 stipulates that the employer deducts 5 % from the employee's earnings and pays another 10 % on behalf of the employee, giving a total contribution of 15%. • Section 25(3) says that such payment should be paid within fifteen (15) days after the end of each month to the T rust.

8. 7 4. PROCUREMENT MANAGEMENT The P rocurement M anagement is the way the procurement is carried out and the planning of the process that w ould ensure th at things run smoothly. All procurements of drugs, goods and services for K GH are done by the Procurement Officer of the N KSCC . The process involves the Hospital Management submitting procurement needs to the Council and the Procurement Officer conducting the procurement activities. Payments for the goods and services procured are made by the Council on behalf of the hospital. 4.1 Area of Focus: Procurement Plan Procurement planning is the process of identifying and consolidating requirements and determining the timeframe for procurement with the aim of having them as and when they are required. A good procurement plan will describe the process in the identification and selection of suppliers /contractors/consultants. According to Section 29 (1) of the NPPA Act 2016, all procuring entities shall undertake procurement planning, with a view to achieving maximum value for public expenditures and the other objects of this Act.

27. 26 • Contribution Arrears (Jan 15 to M ar 19) 200,528,670 • Interest for delayed payment 88,916,898.99 • Penalty Charged 28,944,556.90 Total Amount due 316,390,125.89 A total of three hundred and sixteen million, three hundred and ninety thousand, one hundred and twenty five Leones eighty - nine cents (Le 316,390,125.89) is the amount owed. The team was not provided the current amount due on NaSSIT contributions as at September 2019. It is obvious that the said amount has increased base d on the fact that payments are still not been made to N a SSIT with respect to staff contributions. With regards Withholding Tax , the team could not find any Withholding Tax schedule for NRA payment though some NRA receipts were produced as evidence of payment but there were some transactions where Withholding Taxes w ere not deducted. Implication(s) • Failure to pay taxes deducted from suppliers to NRA is in contravention of the tax law and has a ripple effect on the state economy. • Equally so, reneging on the payments of NASSIT contributions on behalf of employees can have a long time effect on employees retirement. Furthermore, without deducting withholding tax on the supply of goods causes loss of revenue to the Council.

6. 5 However, the most intriguing thing is that proper accountability and compliance to procurement procedures as en shrined in the National Public Procurement Act 2016 has always been a problem as Financial, Procurement and Stores management has always been ridden with corruption, misappropriation and mismanagement. This has been of utmost concern to the government, donor partners and also the ACC. 2. OBJECTIVES OF THE REVIEW 1. To enhance and ensure the judicious use of devolved funds allocated for the procurement of goods , services and works to the KGH . 2. To examine the various structures such as Financial, Procurement and Stores management of the KNSCC and the KGH with a view to identifying and assessing their levels of vulnerability and proffering appropriate alternative to make them more efficient. 3. To identify and review policy gaps in the ir systems. 4. To document recommendations that will serve as working document for the institution.

16. 15 • All items purchased should be delivered directly to the stores for proper inventory to be taken before distribution to end users. • The Procurement Officer should desist from distributing purchased items and conducting keeping duties. The re must be complete separation of personnel and duty between the P rocurement U nit and store keeping. 4.6.1 Area of Focus: Irregularity in Procurement Procedures and Documentation Finding Procurement of services for the repair and maintenance of vehicle • It was discovered that the C ouncil spent tens of millions of Leones on regular vehicle and generator repairs and maintenance for the Hospital. No procurement procedures were followed to acquire these services in complete breach of procurement laws. • The frequency of repairs and maintenance were alarming. Despite the fact that two of the ambulances were fairly new, repairs were done almost every two weeks. • No assessments were made by Sierra Leone Road Transport Authority (SLRTA) as required by law to give clearance for repairs.

28. 27 Recommendation(s) • Tax obligations should be honored by the institution as stipulated by law. • Also N a SSIT contributions should be paid in order to protect the future interest of employees. 7.3 Area of Focus: Fixed Assets Register Fixed Assets Register contains the list of all fixed assets of a company. It keeps track of book value of assets, date of acquisition, and depreciation . It can be used to track all assets of a company. Finding(s) • The team identified that KNSCC and the K GH do not maintain a fixed Assets Register. • No records exist to give to number of worth of assets owned by the hospital and KNSCC despite th e fact that huge amount of moneys have been spent o n the procurement of assets. • The Hospital cannot even account for assets donated by donor organizations. Implication(s) • The Accountant will be unable to estimate the value of the assets of the Council.

10. 9 procurement; any virement should be properly authorized and documented. 4.2 Area of Focus: Records and filing system Section 32 (1) of NPPA Act 2016 states “that the procuring entity shall preserve all documentation relating to the procurement processes, in accordance with applicable rules concerning archiving of government documentation, but at a minimum for a period of six years following the date of final completion of the procurement contract, or from the date of rejection of all bids or cancellation of the proceeding, as the case may be”. Finding(s) • The team discovered that proper records and filing systems of procurement documents w ere not maintained with respect to Goods, Works and S ervices procured. • Records of the procurement processes were mostly incomplete and unavailable . • Delivery N otes which general ly are proof of delivery o f drugs and other items purchased were hard to come by. • For the records of over 50(fifty) transactions that were examined, 85% were without D elivery N otes. • Procurement records are non - existent at the hos pital. The hospital management claimed details or records of

33. 32 With immediate effect the Council should commence the minimum wage payment to its workers and backlog payments to be made to the affected staff. 7.5 Area of focus: Cash Handling Findings • The team discovered that core staff received salaries over the counter instead of the modern banking practice. • We also, observed that staff members signed and received for and on behalf of others without any L etter of A uthority. Implication(s) • Cash payments of salaries create room for corruption as cash payments can be easily manipulated making it very difficult to establish whether the actual employee received the money and the actual amount received. • With bank payment if there is a dispute whether an employee was paid and for how much, either party can use bank statement to verify. Recommendation(s) • We recommend that all salaries be paid through banks or by cheques for better accountability and transparency. • It should be a policy that no employ ee collect s salary cheque on behalf of another unless with proper ly documented authorization and should not be consistent ly done.

7. 6 3. REVIEW METHODOLOGY AND SCOPE The methodology w as wide and varied. Firstly, it involved the administration of questionnaires to the following set of people; 1. The Director of Local Government Finance Department 2. The K NSCC 3. The K GH Secondly, a desk - based review of relevant documents and internet search of similar reviews carried out in other Municipalities was done . Thirdly, t he team conduct ed interviews with persons who possess ed the desired information in line with the research objectives of reviewing practices and procedures. Fourthly, structured and semi - structured interviews were conducted to authenticate the information gathered from the questionnaire. The methodology furthermore covered pieces of Literature on service delivery, systems, practices and procedures associated with the conduct of the K GH in the Country. Finally, assessing transparency and accountability in the areas of Financial Management, Procurement and Stores Management, and so on, formed the crux of our intervention. The review was for the period (2015 - 2018) inclusive.

4. 3 EXECUTIVE SUMMARY 1. INTRODUCTION In March 2014, the Investigations Department of the Anti - Corruption Commission (ACC) conducted an investigation into an alleged case of misappropriation of public funds for the repair of hospital ambulances and generator at the Koidu Government Ho spital (KGH) . The allegation was that the Finance Officer of the Hospital conspired with some suppliers of spare parts for vehicles and generators to misappropriate the sum L e30,000,000 (thirty million Leones). The investigation s concluded that the Finance Officer of the Hospital failed to follow th e procurement procedures . However it was impracticable for the matter to be prosecuted as the said Finance Officer died before th e investigations were concluded . Furthermore no action could be brought against officials of the Koidu New Sembehun City Council (KNSCC) which supervis es the hospital and disbursed the fund on it’s beha lf due to lack of evidence of any wrong doings. In conclusion thereof, it was recommended by the Legal Consultant, O V Robbin Mason in a report dated 29 th August, 2018 that; a) The Prevention Department be asked to review the Procurement Systems of the K GH ,

36. 35 Failing to sign payment vouchers yet payment effected , implied that recipients never received such monies and also that the transaction was not valid because it ha d not been authorized by the authorities concerned. Recommendation(s) • All payment vouchers have to be signed and authorized before payments are made. • Moreover, recipients have to sign upon receiving DSA s as a means of acknowledgement of receipt. 7.8 Area of focus: No date on receipts Upon verification of documents and/or payment vouchers, it was observed that receipts attached to most of the payment vouchers inspected were not dated. Some in fact, ha d not got any amount written to support the transaction. The following are samples of transactions. Description Issuer Amount (Le) Accommodation of C ouncil guests for Audit Service Sierra Leone Red Cross 3,560,000 Radio discussion for Council Ordinary meeting Kono radio 300,000 No details A.I. Kallon Investment 9,024,750 Inscription of sanitary tools No information 486,000

12. 11 4.3 Area of Focus: Goods Delivered /Service s rendered in the Absence of the I nternal Auditor and the verification Team Findings • It was observed that no internal audits were conducted to verify drugs (goods) services and works procured by C ouncil on behalf of the hospital. • It was observed that no records or reports exist at the hospital to show that supplies were received and verified and by whom. Verbal acknowledgements were made by the Hospital Secretary and Matron. • It was observed that there was no I nternal Auditor at the K NSCC to ensure that goods , services and works procured were verified upon delive ry in order to confirm completeness and value for money. Implication Goods and Drugs not delivered in the presence of a well constituted verification team makes it difficult to ascertain timeliness of supply, quality, specification and quantity of items delivered. Recommendation • The procurement processes should be sequentially followed and Management should ensure that items procured are

23. 22 A trained S tore K eeper should be employed to ensure the effective man a gement of the stores. 6. INTERNAL AUD IT 6.1 Area of Focus: Audit Unit and / or Internal Auditor 84 (1) of the Local Government Act of 2004 emphasizes that “Every Local Council shall establish an Internal Audit Department”. On the main function of the Head of I nternal Audit, Sec 84 ( 2) of the aforementioned Act states that “The Head of the Internal Audit Department shall, at intervals of three months, prepare a report on the internal audit work carried out by the Department during the three months immediately preceding the preparation of the report, and submit it to the Local Council. The law, as provided by Section 84(4) of the said Act, directs that “A copy of the report shall be sent to the Minister”. Findings The team observed that the I nternal A udit U nit and / or Auditor has not been created for over two year. The absence of this importan t U nit has shown the vulnerability in the entire system of K NSCC . Th is had a ripple effect on: • The A nnual Audit plan • The Audit Committee

11. 10 procurement activities were not made available to them by the Council. Implication The lack of records on procurement hi n ders accountability and transparency as procurement processes could not be properly audited. There is high indication of corruption in the procurement processes. Poor filing system of the few records makes it difficult for the retrieval of information . Recommendation • Keeping records of all procurement activities should be mandatory. Records should reflect the entire transaction from its initiation to its completion. Failure by the P rocurement O fficer to keep proper records should result to investig ation of the transaction and his/her removal from office. • Similarly, the Hospital Management should maintain records of all procurement activities conducted by them or on their behalf with particular emphasis on D elivery N otes. Failure by the responsible officer to keep proper records should result in investigation of the transaction and his/her removal from office. • The P rocurement O fficer should adopt a filing system that ensure s easy reference and retrieval of information such as categorizing suppliers and Good s , works and S ervices into appropriate categories.

19. 18 • There were strong indications that these companies only exist ed in name “briefcase” businesses and that they were set up by persons working within the Council or the ir relatives specifically for procurement transactions. There were strong suspicions of conflict of interest. Implication These are strong indications that the suppliers do not exist and frau du lent activities were been conducted in the procurement processes. Recommendations • The P rocurement Unit should verify the existence of suppliers to ensure that they are not bogus entities and detect an y conflict of interest. • Instances of conflict of interest should be avoided at all cost and perpetrators investigated. Integrity Pacts must be attached to all procurement contracts which are to be signed by all supplies. 4.6.4 Hospital Management/Pharmacist not involved in the procurement of drugs and other supplies . Findings It was observed that the Council procure d drugs and other supplies for the Hospital with no consultation with and

5. 4 b) Review the process of handling funds between the Council and the devolved KGH . The r ecommendations are in line with the mandate of the Preven tion Department of the Commission as set out in the Anti - Corruption Commission Act 2008, section 7 (2)(f) as follows : “To examine practices and procedures of public bodies .... ” (h) “to issue instructions to public bodies of changes in practices and procedures.......” T he K NSCC and the K GH are public bodies as defined in the Anti - C orruption Act 2008 . The fund in question was public fund under the same Act. Consequently a thematic review of both entities was initiated in line with the recommendations contained in the Investigation Report. The KGH is devolved to the KNSCC . It provides funds allocated by the Central G overnment through the Local Government Finance Department (LGFD) to the KGH . These funds are provided to enable the Hospital in its general administrative functions, procurement management, stores management , in providing an enduring quality, effective and efficient health care to the people of Koidu and its environs. It was quite apparent that a huge percentage of the n ational budget was allocated to the City and District Councils on Health C are D elivery and a huge portion of this percentage goes to the procurement of essential goods and services.

35. 34 It was obser v ed by the review team that payments were made which were not authorized and /or signed by the initiator of the payment vouchers and /or approved by the authority in charge. Furthermore , there were no signature s of recipients of Daily Sustenance Allowances (DSAs) . The documents were never approved or authorized by the authority concerned. See table below (sample of data) Date Description Amount (Le) Comments No date DSA for various Staff 3,490,000 None of the recipients signed 23 May 2018 Request for the release of funds 650,000 Document was not signed by the Accountant 4 July 2018 Request for the release of funds 2,000,000 Document was not signed by the Finance Clerk 24 July 2018 Request for the release of funds 1,000,000 Document was not signed by the Finance Clerk 12 August 2018 Request for the release of funds 2,500,000 Document was not signed by the Finance Clerk 2 October 2018 DSA for Mayor 1,000,000 No signature of mayor to acknowledge receipt 11 October 2018 DSA for CA 1,000,000 No signature of CA to acknowledge receipt The above table showed that, no evidence of receipt of payments w ere made and /signed by the initiator, yet the documents were authorized. Implication(s)

14. 13 Finding(s) • The team observed that identified the P rocurement U nit of the C ouncil comprise d of one staff only; that is, the Procurement Officer. He undertakes procurements for both the C ouncil and the K GH . • Taking into consideration the quantum of work of the U nit, this clearly show ed that the P rocurement U nit was understaffed to effectively carry out it s functions. Implication(s) Without adequate staff with the appropriate skills, the Unit will not function effectively and efficiently to ensure that its objectives are achieved. This w ould create lapses and gaps which w ould undermine accountability. Recommendation • It is recommended that Management should ensure employing additional staff with the requisite skills. • Personnel should be assig ned to the Hospital to guide them on any internal procurement activity the y may want to conduct. • The U nit should be equipped with the necessary tools to carry out its mandate .

32. 31 From the table above shows the outstanding amount with respect to minimum wage bill. It is evident that, 62 staff were being underpaid for a period of 5years (2015 - 2019 inclusive), amounting to si xty eight million two hundred and eighty five thousand, and seventy five Leones (Le 68,285,075). It was also revealed that an accumulated monthly total of thirteen million six hundred and fifty seven thousand and fifteen Leones (Le 13,657,015) have accrued . Implication(s) Payment below minimum wage contravenes the statutory instrument of 2015 and might s erve as a disincentive to staff . Recommendation(s) 55 500,000 328,500 171,500 857,500 56 500,000 275,420 224,580 1,122,900 57 500,000 285,870 214,130 1,070,650 58 500,000 275,420 224,580 1,122,900 59 500,000 266,760 233,240 1,166,200 60 500,000 266,760 233,240 1,166,200 61 500,000 266,760 233,240 1,166,200 62 500,000 266,760 233,240 1,166,200 TOTAL 13,657,015 68,285,075

15. 14 4.5 Area of Focus: Procurement Office doubles as the S tore K eep er Findings The team observed that the P rocurement O fficer also doubled as the S tore K eeper at the C ouncil. All procurement s made for both the Council and the K GH were distributed directly to end users by the P rocurement O fficer. Implication Without separation of duties the P rocurement O fficer w ould have complete control over all buying activities. This w ould lead to corruption as the P rocurement O fficer w ould be tempted to make fraudulent purchases resulting to misappropriation of fund s. Without a n independent S tore K eeper , he will not verify that the goods and drugs purchased have been received. This is in contravention of the NPPA P rocurement R egulations 2006 . Recommendation • The team recommends that Management should ensure that storage facilities are provided for the Council and the Hospital for drugs and other items . • A trained and qualified S tore Keeper should be employed to manage the store .

30. 29 2015 to date. The table below shows the outstanding amounts owed by C ouncil with regard to breach of the minimum wage payment. No Minimum Wage Net Salary per month Differences (backlog) in monthly Salary Backlog in Salary over the 5 YEAERS (2015 - 2019) 1 500,000 306,800 193,200 966,000 2 500,000 306,800 193,200 966,000 3 500,000 288,600 211,400 1,057,000 4 500,000 350,025 149,975 749,875 5 500,000 400,500 99,500 497,500 6 500,000 350,025 149,975 749,875 7 500,000 266,760 233,240 1,166,200 8 500,000 266,760 233,240 1,166,200 9 500,000 288,600 211,400 1,057,000 10 500,000 266,760 233,240 1,166,200 11 500,000 266,760 233,240 1,166,200 12 500,000 266,760 233,240 1,166,200 13 500,000 266,760 233,240 1,166,200 14 500,000 350,025 149,975 749,875 15 500,000 266,760 233,240 1,166,200 16 500,000 266,760 233,240 1,166,200 17 500,000 266,760 233,240 1,166,200 18 500,000 266,760 233,240 1,166,200 19 500,000 266,760 233,240 1,166,200 20 500,000 288,600 211,400 1,057,000 21 500,000 266,760 233,240 1,166,200 22 500,000 266,760 233,240 1,166,200 23 500,000 266,760 233,240 1,166,200

3. 2 1. INTRODUCTION ................................ ................................ ................................ ................................ ................ 3 2. OBJECTIVES OF THE REVIEW ................................ ................................ ................................ .......................... 5 3. REVIEW METHODOLOGY AND SCOPE ................................ ................................ ................................ ......... 6 4. PROCUREMENT MANAGEMENT ................................ ................................ ................................ .................... 7 4.1 Area of Focus: Procurement Plan ................................ ................................ ................................ ................ 7 4.2 Area of Focus: Records and filing system ................................ ................................ ................................ ..... 9 4.3 Area of Focus: Goods Delivered/Services rendered in the ................................ ................................ ............ 11 Absence of the Internal Auditor and the verification Team ................................ ................................ ................... 11 4.4 Area of Focus: Staffing Capacity ................................ ................................ ................................ ................. 12 4.5 Area of Focus: Procurement Office doubles as the Store Keeper ................................ ............................. 14 4.6.1 Area of Focus: Irregularity in Procurement Procedures and Documentation ................................ ............ 15 5. STORES MANAGEMENT ................................ ................................ ................................ ................................ 19 5.1 Area of Focus: Storage and Distribution ................................ ................................ ................................ ..... 20 5.2 Area of Focus: Storekeeper ................................ ................................ ................................ ........................ 21 6. INTERNAL AUDIT ................................ ................................ ................................ ................................ ........ 22 6.1 Area of Focus: Audit Unit and / or Internal Auditor ................................ ................................ ...................... 22 7. FINANCIAL MANAGEMENT ................................ ................................ ................................ ...................... 23 7.1 Area of Focus: Receipt /Supporting Documents ................................ ................................ ......................... 23 7.2 Area of Focus: Withholding Tax, PAYE and NASSIT ................................ ................................ ................... 24 7.3 Area of Focus: Fixed Assets Register ................................ ................................ ................................ ........... 27 7.4 Area of focus: Minimum Wage ................................ ................................ ................................ .................. 28 7.5 Area of focus: Cash Handling ................................ ................................ ................................ ..................... 32 7.6 Area of focus: Cheques written in the names of staff members ................................ .............................. 33 7.7 Area of focus: Failure to Authorize and / or sign Documents ................................ ................................ ...... 33 7.8 Area of focus: No date on receipts ................................ ................................ ................................ ............ 35 8. CONCLUSION ........................................................................................................................................................39

31. 30 24 500,000 266,760 233,240 1,166,200 25 500,000 266,760 233,240 1,166,200 26 500,000 266,760 233,240 1,166,200 27 500,000 266,760 233,240 1,166,200 28 500,000 266,760 233,240 1,166,200 29 500,000 266,760 233,240 1,166,200 30 500,000 266,760 233,240 1,166,200 31 500,000 266,760 233,240 1,166,200 32 500,000 266,760 233,240 1,166,200 33 500,000 266,760 233,240 1,166,200 34 500,000 266,760 233,240 1,166,200 35 500,000 266,760 233,240 1,166,200 36 500,000 266,760 233,240 1,166,200 37 500,000 266,760 233,240 1,166,200 38 500,000 266,760 233,240 1,166,200 39 500,000 266,760 233,240 1,166,200 40 500,000 266,760 233,240 1,166,200 41 500,000 266,760 233,240 1,166,200 42 500,000 266,760 233,240 1,166,200 43 500,000 266,760 233,240 1,166,200 44 500,000 315,000 185,000 925,000 45 500,000 306,800 193,200 966,000 46 500,000 266,760 233,240 1,166,200 47 500,000 266,760 233,240 1,166,200 48 500,000 306,800 193,200 966,000 49 500,000 266,760 233,240 1,166,200 50 500,000 266,760 233,240 1,166,200 51 500,000 266,760 233,240 1,166,200 52 500,000 315,000 185,000 925,000 53 500,000 266,760 233,240 1,166,200 54 500,000 266,760 233,240 1,166,200

Views

- 2257 Total Views

- 1795 Website Views

- 462 Embeded Views

Actions

- 0 Social Shares

- 0 Likes

- 0 Dislikes

- 0 Comments

Share count

- 0 Facebook

- 0 Twitter

- 0 LinkedIn

- 0 Google+

Embeds 7

- 16 www.anticorruption.gov.sl

- 14 anticorruption.gov.sl

- 9 35.176.107.124

- 7 35.176.107.124:8072

- 1 m.baidu.com

- 1 35.176.107.124:8069

- 2 anticorruption.gov.sl:8069

-

SYSTEMS AND PROCESSES REVIEW REPORT - SLAJ

2322 Views . -

OFFICE OF THE ADMINISTRATOR AND REGISTRAR GENERAL

3310 Views . -

MINISTRY OF WATER RESOURCES

2442 Views . -

GUMA VALLEY WATER COMPANY

2325 Views . -

-

-

-

-

Ministry of Lands, Country Planning and Environment

2594 Views .

-

-

IACAlumnus_Jul_2018_online

30618 Views . -

Commissioner's Profile

25222 Views . -

NACS ACTION PLAN

21669 Views . -

-

National Anti-Corruption Strategy 2019-2023

20519 Views . -

ANNUAL REPORT FOR 2016 (2017) FINAL

19106 Views . -

ACC ANNUAL REPORT FOR 2017

18072 Views . -

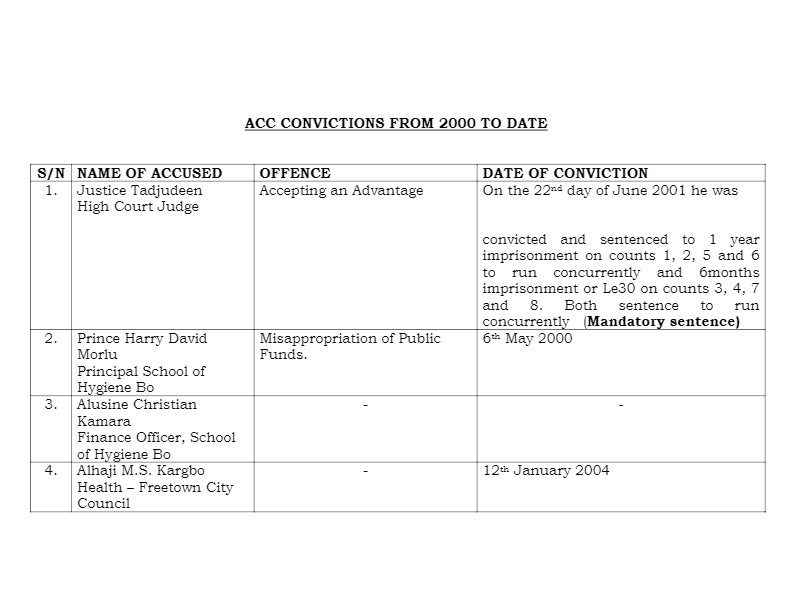

CURRENT ACC CONVICTIONS FROM 2000 TO 2018

17948 Views . -

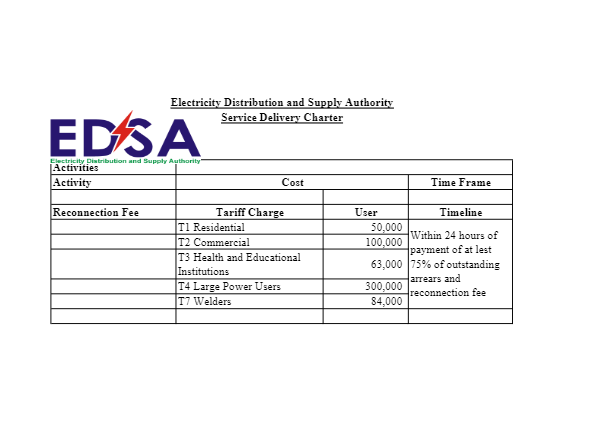

ELECTRICITY service_delivery_charter_EDSA

17877 Views . -

ANNUAL REPORT FOR 2014

17764 Views . -

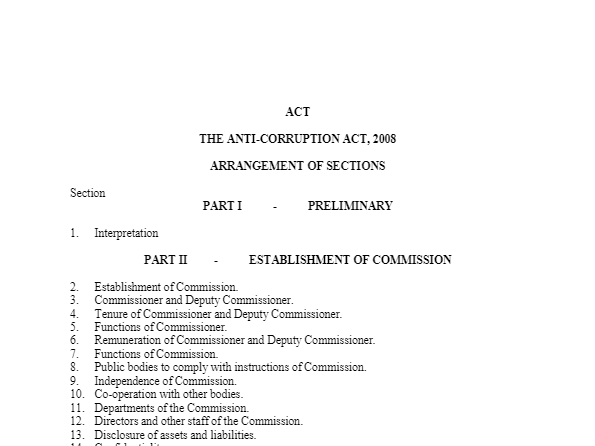

ACC Act 2008

17563 Views . -

NACS NATIONAL ANTI-CORRUPTION STRATEGY 2018-2020

17432 Views . -

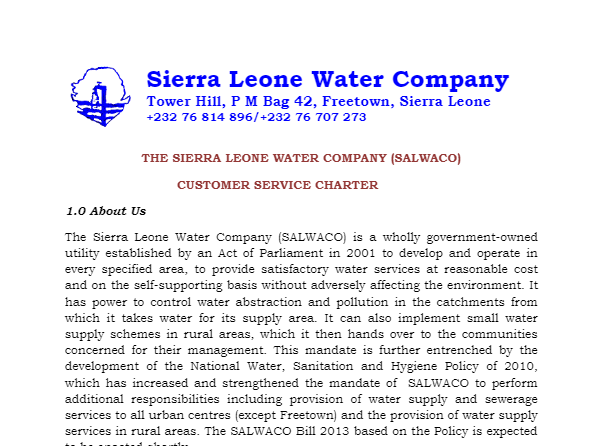

-Draft-SALWACO-SERVICE-CHARTER

16841 Views . -

Reports Curbing Salary Double Dipping in MDAs

16758 Views . -

Police Service-Delivery-Charter-2015-final-2

16187 Views . -

Press Release - ACC Head Office

14896 Views . -

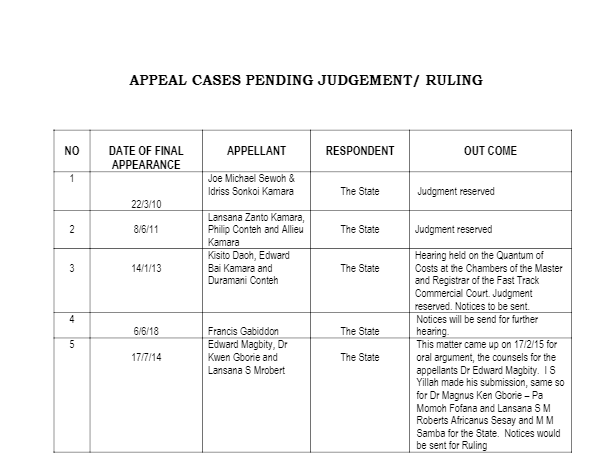

APPEAL CASES

14049 Views . -

2019 Comms Strategy_FINAL

13992 Views . -

Behavioural analysis of Bribery in Sierra Leone

13688 Views .